The very surprising group of Aussies who are most likely to be the victim of an online scam – and it’s not boomers

New data shows that millennials are more likely than older baby boomers to fall victim to financial scams.

Last financial year, 514,300 people fell victim to scams in which a criminal tricked them into sending money or providing personal information.

William Milne, the federal government’s head of crime and justice statistics, said more than a third of Australian scam victims had been duped through online shopping – with more than 200,000 people duped.

“Buying or selling fraud, including things like fake invoices and online shopping scams, was the most common,” he said.

OOnline shopping fraud was far more common than a text or email phishing message, a request for advance payment, questionable financial advice, a pretend love interest on a dating app or a threat.

Contrary to popular belief that tech-disabled baby boomers are the main victims of scams, millennials were in fact more likely to be the victims of a fake financial transaction.

Millennials rather than older baby boomers are more likely to fall victim to financial scams, new data shows (pictured is a stock photo)

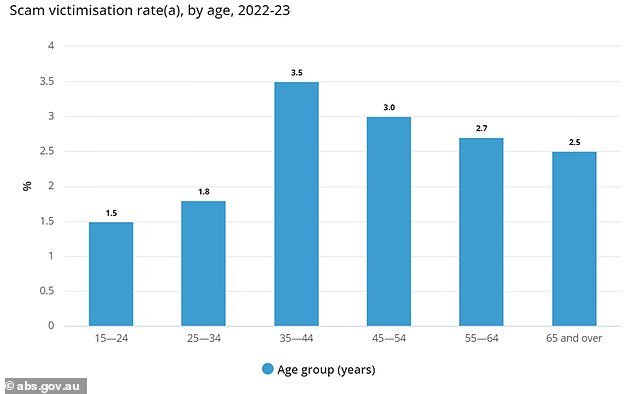

Those aged 35 to 44 were more likely to be duped, with 3.5 per cent of them losing money to scams in the 2022-2023 financial year, new data from the Australian Bureau of Statistics shows.

By comparison, only 2.5 percent of baby boomers, or those aged 65 and older, were victims of fraud.

They were even less likely to be ripped off than Australians in Generation

That compared to 2.7 percent for the 55 to 64 age group, including Generation X and baby boomers.

Younger Gen Z consumers, born since 1997, were among the least risky consumers because they grew up with the internet and smartphones, with only 1.8 percent of people aged 25 to 34 falling victim to scams.

Children over 15 and young adults under 25 had the lowest scam victimization rate, at 1.5 percent, perhaps because they had less money to spend on online shopping.

When it came to personal finance victims, card fraud was the most common, affecting 1.8 million people or 8.7 percent of the population.

Only 2.5 percent of baby boomers, or those age 65 and older, were victims of fraud (stock image)

Younger Gen Z consumers, born since 1997, were among the least likely to be scammed because they grew up with the internet and smartphones, with only 1.8 percent of people aged 25 to 34 falling victim to scams

That paled in comparison to the 2.5 percent of the population who were victims of fraud.

Among the Australian population, 1 percent have been scammed through online shopping, compared to phishing (0.6 percent), advance payment (0.4 percent), financial advice (0.3 percent), romance (0.1 percent) and threats or extortion (0.1 percent).

This was more common than the 1 percent of the population, or 199,100, who experienced identity theft, and the 2.1 percent, or 434,300, who were victims of online impersonation.