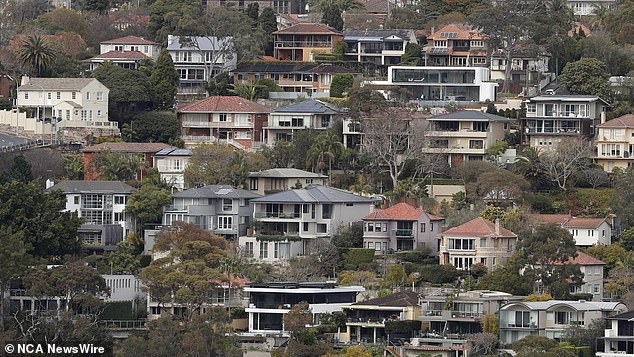

Latest figures show huge change to Australia’s property market compared with a year ago

Homeowners are becoming increasingly confident in marketing their properties. The latest figures show that there are 40 percent more homes available than twelve months ago.

The latest PropTrack listing report showed that the Australian property market saw the strongest new listings for the month of April since 2021.

The number of new listings increased by 40.4 percent year-on-year in all capitals.

Cameron Kusher, director of economic research at PropTrack, said while new quotes are higher in every capital city, Sydney and Melbourne are still the strongest markets.

The latest PropTrack listing report found the Australian property market saw the strongest new listings for the month of April since 2021

“Looking at Sydney and Melbourne, the number of listings has been higher every month since July last year,” Mr Kusher said.

‘While house prices have remained high in early 2024, the surge in new listings has seen the total number of homes for sale rise, particularly in Sydney, Melbourne and Canberra.

“Despite the increase in the number of homes for sale, other indicators suggest buyer demand remains strong, including a decrease in average time on market and an increase in inquiries compared to a year ago.”

New offers for April year-on-year:

- Sydney 44.9 percent

- Melbourne 52.7 percent

- Brisbane 34.4 percent

- Adelaide 26.6 percent

- Perth 23.5 percent

- Hobart 11.1 percent

- Darwin 2.7 percent

- Canberra 49.1 percent

Mr Kusher said the spike in new listings did not come as a complete surprise as property owners considered how interest rates were impacting their budgeting and continued pressure on the cost of living.

“I think a lot of that has to do with the number of new listings that came to market before that, which was very low before that, when interest rates were changing every month in 2022 and then changing regularly in 2023,” Mr. Kusher said.

Cameron Kusher, director of economic research at PropTrack, says many factors have been examined as to why people are deciding to sell their properties now, compared to 12 months ago. Image: supplied

“I think people realized it wasn’t an ideal situation to sell at that time.

“Now that interest rates have become more stable, while we’ve had a few more increases, but (they’ve been) more stable for almost a year, that’s given people more confidence to put their properties on the market.

‘The next few months will be telling as, of course, many people who own or want to buy a home expect interest rate cuts later this year, but it seems more likely that rates will fall in the first half of next year.

“It will be very interesting to see how the market responds to the expectations expressed so far.”

But Kusher said there was a “combination of things” that had prompted people to sell their properties.

“Certainly there are cost-of-living pressures that are forcing some people to sell, but I think there are other factors as well,” he said.

‘Real estate prices have risen sharply in a short time.

“Some people look at the equity they have in their property and use that to get into the market.

‘I think there are also other factors that have caused people to postpone selling and now find themselves in a house that no longer suits them.

‘It’s very expensive to do a major renovation of a property because material and trade costs have risen so much, so that’s encouraging people to move.’

Sydney, Melbourne, Hobart and Canberra also saw an increase in the total number of listings for sale in April 2024, compared to a year earlier, by 16.1 per cent, 21.4 per cent, 1.1 per cent and 29.7 respectively per cent

However, Mr Kusher warned that the latest year-on-year figures could be “worsened” around March and April, depending on when Easter fell.

Sydney, Melbourne, Hobart and Canberra also saw an increase in the total number of listings for sale in April 2024, compared to a year earlier, by 16.1 per cent, 21.4 per cent, 1.1 per cent and 29.7 respectively per cent.

But in Brisbane, Adelaide, Perth and Darwin, business has not been as strong as it was 12 months ago.

Compared to a year ago, the total number of listings in those capitals decreased by 6.3 percent, 9.4 percent, 23.2 percent and 0.5 percent, respectively.

Mr Kusher said there has been less new construction built in these capitals, reducing the amount of choice on the market.

“There’s just a lot more choice for someone looking to buy in Sydney and Melbourne than there was,” he said.

Listings in Brisbane, Adelaide, Perth and Darwin have not been as strong as they were 12 months ago

Meanwhile, Mr Kusher said that while the property market continued to strengthen, the rental market remained tense due to a lack of available rental stock.

“In Sydney and Melbourne, demand (for rental properties) is down slightly compared to 12 months ago,” Kusher said.

‘In most capitals you still have very low inventory and rental competition.

“We know the number of people migrating to Australia is starting to decline, but there isn’t much construction going on in these cities for the rental market, so there won’t be a significant increase in supply.

“We’re getting to the point where people are going to rise to the challenge of having the capacity to pay the prices that people are looking for.

‘What that means is that people will move to smaller properties, move to less desirable locations or move into shared housing to save on rental properties.

‘I think the rental market is likely to remain tight for years to come, but we probably won’t see rents rise as quickly as they are now because people’s wages aren’t keeping pace with rental growth.’