Aussies claim Optus’ outage proves why Australia shouldn’t go completely cashless

Australians have warned of a completely cashless society after a major outage at telecoms giant Optus.

Optus is experiencing one of the largest outages in Australia’s history, affecting millions of customers, hospitals and businesses.

The outage was first reported at 4am on Wednesday, with Optus mobile users saying they were unable to make calls or send texts as the internet network and home broadband were also down.

Optus users in Brisbane, Perth, Sydney, Melbourne, the ACT, Tasmania and Adelaide have all reported blackouts with the network.

Australians have flooded the internet with comments warning of a cashless society as the outage affects online activities such as internet banking.

Optus is experiencing one of the biggest outages in Australian history

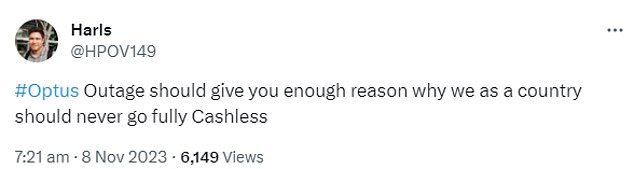

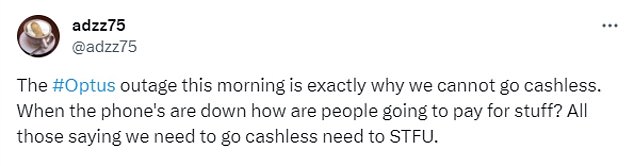

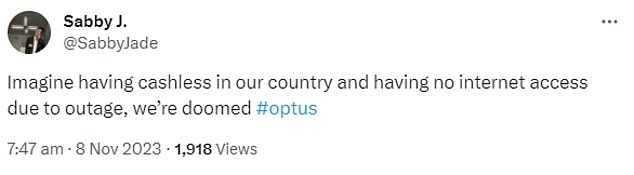

Australians have taken to the internet to express their concerns about a cashless society

“#Optus Outage should give you plenty of reason why we as a country should never go completely Cashless,” read one post on X.

“Imagine in our country we have no cash and no internet access due to outage, we are doomed #optus,” said another.

“The #Optus outage this morning is exactly why we can’t operate without cash,” a third message read.

“If the phone goes out, how are people going to pay for things? Anyone who says we should go cashless needs to STFU’.

While another warned: ‘With Optus going under this morning and the stupid people want a cashless society… think about that, no phone, no purchases.’

Businesses across the country were forced to offer cash-only sales in their stores as some EFTPOS machines malfunctioned.

Other carriers using Optus’ mobile network, such as Amaysim, Vaya, Aussie Broadband, Moose Mobile, Coles Mobile, Spintel, Southern Phone and Dodo Mobile, are also offline.

The telco said it is aware of issues affecting some customers, but has not yet provided an explanation for the system outage.

“Optus is aware of an issue that may be impacting some of our mobile and internet customers,” a spokesperson said.

‘We are currently working to determine the cause and apologize for any inconvenience caused.

‘In case of emergency, customers can still call 000.’

Businesses across the country were forced to offer cash-only sales in their stores

A post on X expressing concern about the implications of a completely cashless society

Another post raising concerns about Australia’s transition to a cashless society

Melbourne’s train network was also closed earlier on Wednesday, leaving many commuters stranded.

It is believed this was a result of the Optus outage.

Metro Trains has since confirmed services have resumed, but major delays are expected.

The outage follows recent warnings that Australia could become a cashless society sooner than expected, with large bank orders for banknotes falling to a new low.

The Reserve Bank, a banknote wholesaler, announced last month that orders from commercial banks for cash in the past financial year were just a third of the usual annual level.

“The use of physical cash for everyday transactions has been declining for years as consumers switch to digital payment alternatives,” the report said.

An Adelaide cafe was only able to offer cash sales to customers on Wednesday as its EFTPOS machine was unavailable due to the outage

The Reserve Bank announced last month that orders from commercial banks for cash during the past financial year were just a third of the usual annual level