Aussie couple reveal how they turned $60,000 into a $153million property empire

A young Australian couple has revealed the investment strategy that helped them turn their student savings into a massive property portfolio worth more than $150 million.

Scott, 37, and Mina O’Neill, 36, bought their first investment property in Sydney’s Sutherland Shire 14 years ago with $60,000 they had saved since they were teenagers.

By investing keenly in both residential and commercial real estate, the couple now has a vast real estate empire worth more than $153 million.

Their real estate investments generate gross returns of $6.2 million annually, a significant portion of which comes from their commercial properties.

The O’Neills managed to nearly double their property investments from $53 million in 2022 to $105 million at a time when Australians were struggling to find a bargain on the market.

They owe their recent great success to not overlooking commercial properties and entering the market with a simple set of rules.

The couple first began buying offices for recession-proof businesses such as doctors’ offices and dentists, while also targeting businesses that rarely move.

They then diversified their portfolio by buying warehouses – which were among the best performing properties in the country – before moving into small business complexes.

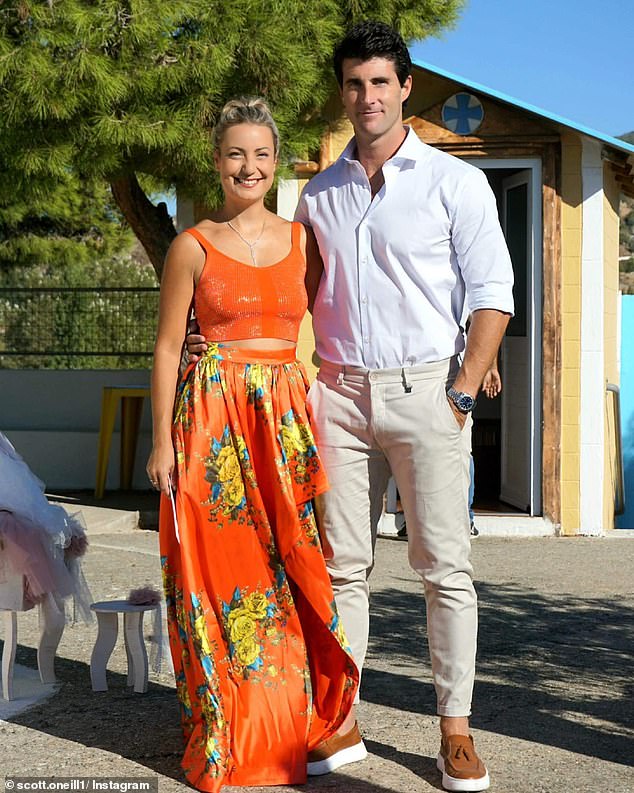

Scott, 37, and Mina O’Neill, 36, (both pictured) have revealed how opting for overlooked commercial properties has almost tripled their already huge property portfolio

Mr O’Neill said the couple made the jump to certified wealth management after having enough capital to invest in complexes that attract competitive rates from banks because of the high returns.

He added that their turn into the commercial market made “a lot of money for our family” and “it changed our lives.”

“Choosing properties such as mid-market shopping centers has taken us to the next level of prosperity,” Mr O’Neill told the newspaper Daily Telegraph.

“People have strong opinions about residential real estate, but no one talks about commercial real estate and it’s the commercial real estate properties that can actually make you more money.”

The father of one of the well-known commercial properties is often invested in by pension funds and great opportunities are often overlooked.

‘The chance of making a big return is much greater than with residential property, the risks are greater, but you can take that into account if you know what you are doing,’ Mr O’Neill said.

Mrs O’Neill said the couple have never had an “emotional attachment” to their properties and are always willing to part with an investment for better opportunities.

The family could live happily on the $6.2 million in gross annual returns, but have started an investment company Rethink Investing to continue their ‘passion’.

The couple started a $60,000 investment property in Sydney’s Sutherland Shire 14 years ago, with a huge $153 million portfolio, giving them a gross annual return of $6.2 million

They owe the portfolio growth in recent years to investments in the commercial real estate market and the acquisition of sufficient capital to purchase small to medium-sized complexes with high returns (photo)

For Australians looking to invest in the housing market, Mr O’Neill previously said one of his key tactics for their first purchase was to generate equity.

Equity is the difference between how much a borrower owes on a property and what it is worth, or, in other words, how much profit he would make if it were sold.

“I did this by renovating homes, often with my own hands,” O’Neill told Daily Mail Australia last December.

Mortgage holders can use the equity in their home as collateral with the banks to borrow more, which can be used to finance renovations or expand to another investment property.

Mr O’Neill said that ‘saving that initial deposit took a lot of time and effort’, but that once he was in the market he was able to see consistent growth by doing his research and choosing the right properties to to buy.

He added that his wealth snowballed during his first decade of real estate investing by taking advantage of the bullish real estate market.