Asos and Boohoo fail to keep up as online-only shopping falls out of fashion

Tie-up: Model Elle Macpherson for Boohoo brand Karen Millen

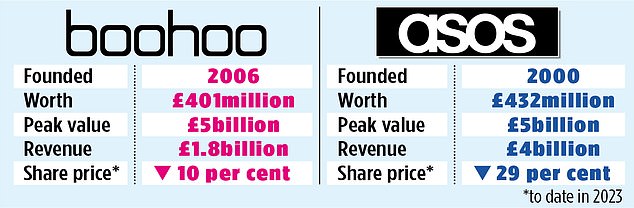

Hedge funds betting on Asos and Boohoo are worth their weight in gold as shares of the beleaguered online retailers hit new lows.

The two e-commerce groups, which pioneered the fast fashion trend among younger shoppers, are currently the most shorted stocks on the stock market, meaning traders expect them to fall in value even further, new figures show.

More than 7 percent of Asos’s shares – and more than 6 percent of Boohoo’s – have been lent. Boohoo owns brands including Karen Millen.

It comes amid increasing signals that sales at online-only businesses may have peaked as customers return to the high street. Online shopping boomed during the pandemic as lockdowns closed non-essential stores and working from home sent demand for new clothes, especially dresses and suits, falling off a cliff.

But the end of the corona crisis has led to a turnaround in the situation, with big names such as Next and Marks & Spencer experiencing a significant rebound.

These companies have been more successful at balancing online sales through apps and websites with physical stores.

Last week, Next raised its full-year profit forecast – its fourth increase in six months – while Asos said it was mothballing a massive warehouse as sales fell and losses edged towards £300 million.

Experts say clothing retailers must adapt to changing customer behavior.

“The way people shop has changed,” says Tamara Sender, fashion and retail director at research group Mintel. ‘While there has been a shift towards visiting stores to buy clothes and shoes over the past year, the increased engagement online continues.

“People use smartphones to check stock availability and compare prices while browsing a physical store,” she added. ‘As a result, more and more retailers are switching to a hybrid approach.’

Last month, online women’s clothing retailer Sosandar unveiled plans to open physical stores for the first time. The Aim-listed company noted that around 60 percent of sales in the £55 billion clothing market are still in-store, with the rest online.

“Our customers like to shop online and go to the stores, so we need to do both,” says co-founder Ali Hall.

Investors are still not convinced that the hybrid model will deliver returns.

Co-founder Julie Lavington said: ‘Our share price is the same as when we turned over £1 million – except we now turn over £40 million. It’s frustrating.’

Analysts say established retailers are well-placed to benefit from changing shopping habits. Next’s latest update noted that online sales in the three months to October were up 6.5 percent on last year, while in-store sales fell 0.6 percent due to unseasonably warm weather.

Experts say it’s too early to write off fast fashion. They point to the success of Shein, the controversial e-commerce retailer that last week acquired fashion group Missguided from Mike Ashley’s Frasers Group.

Shein, which has been criticized for the treatment of workers in its Chinese factories, now has a turnover in Britain of more than £1 billion. “It’s a phenomenon,” Lavington added.