Are YOU on target to save a £630k pension pot for a comfortable old age

Savers need a pot of £630,000 to invest or £643,000 to buy an annuity at retirement to fund a comfortable old age, according to a new study.

That assumes a person is also eligible for a full new state pension, currently worth £10,600 a year, to reach a total income of £37,300 a year.

The annual cost of a financially secure old age is based on the industry standard measure of what people need for a minimal, moderate or comfortable retirement.

Pension Plan: Are YOU on track to save a £630,000 pension pot and qualify for a full state pension?

Incomes of £12,800 and £23,300 a year are needed for a basic life and a decent lifestyle in retirement respectively.

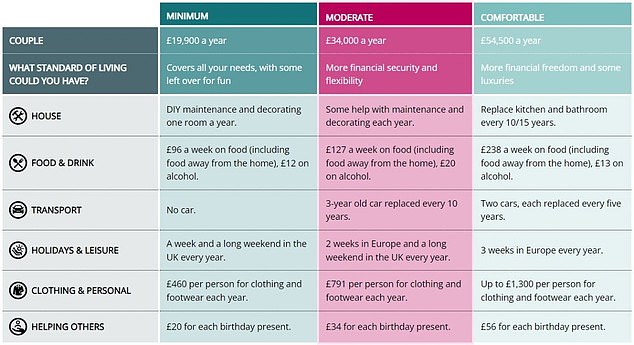

This is based on various baskets of goods and services such as food and drink, transportation, vacations, clothing and social outings, compiled in the Pensions and Lifetime Savings Association’s annual Retirement Living Standards report.

The numbers are, of course, higher for couples at all three income levels, but getting two state pensions means they can save less for work and other private retirements.

Inflation means you need to save more than you did last year, although the biggest jump is for those trying to get basic income because of the rising cost of food and energy.

RBC Brewin Dolphin calculated what an individual aiming for the comfortable annual income of £37,300 would currently need to save on top of a full state pension.

Pot to invest at age 67 – £630,000: Assuming an average return of 5 percent, after costs, over 33 years.

Annuity purchased at age 67 – £643,000: Buys an income of £26,700, guaranteed until you die, increased by 3 per cent each year, single life means nothing to a surviving spouse.

Need for retirement income for single people. Scroll down to find out what couples need for a decent old age (Source PLSA)

Carla Morris, financial planner at RBC Brewin Dolphin, says, “What constitutes a comfortable retirement is highly subjective. For some, an annual income of £37,300 will be enough, but for others it won’t cover all their expenses.

‘Retirement may seem a long way off, but starting to save earlier means you benefit from compounded returns; earning a return on your return.’

Adds Morris, “The combination of stock market volatility and rising inflation make this a particularly challenging time for those approaching retirement.”

But she notes that for those looking for a guaranteed income, annuities have seen a resurgence in rates. This is because rising interest rates have made them worth more again.

“Annuity rates did go up last year, so it might be a good idea for some people to use part of your retirement savings to purchase an annuity, which gives you guaranteed income for life.

> Do you want investment growth AND a guaranteed pension? How to combine withdrawal and annuities to maximize retirement income

Retirement Income Needs for Couples (Source PLSA)

“Knowing that a large portion of your bills are covered can give you some comfort, while keeping an invested portion to cover further expenses,” says Morris.

“Although passing on pension pots is now a popular choice, it is important to first ensure that your income needs are met.”

RBC Brewin Dolphin says that starting to save for retirement as early as possible really helps because investing for the long term gives your money the greatest chance to grow in value.

It’s calculated what you’ll need to put away if you’re middle-aged and already have some retirement savings to reach the £630,000 target to invest into old age.

– A 40-year-old with a pension pot of £120,000 would need to put about £980 a month into his pension today, assuming 4 per cent growth and 2 per cent inflation. However, if you manage to achieve 5 per cent growth after costs, you should be putting in around £720 a month.

– A 50-year-old with a £180,000 pension pot would need to put about £1,5004 a month into his pension to retire with a £630,000 pot, assuming 4 per cent growth and 2 per cent inflation. With a 5 per cent growth after costs, you should be putting in around £1,200 a month.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.