Are WH Smith shares poised for a recovery? Retailer sets up investor payouts as travel industry booms

Shares in WH Smith received a rare boost on Wednesday after the retailer arranged shareholder distributions as the lucrative travel sector continues to boom.

The group announced a £50m share buyback programme in response to 7% annual sales growth in the year to 31 August, driven by a 12% expansion in its UK travel business, which offset a 4% decline in the high street.

Investor confidence was also boosted by an £85m boost from the acquisition of WH Smith’s pension fund and assurances that debt levels were back to the company’s desired level.

Can long-suffering WH Smith investors finally expect a significant increase in the value of their shares?

Different pies: WH Smith has been strengthened by its travel division, while its high street division is in decline

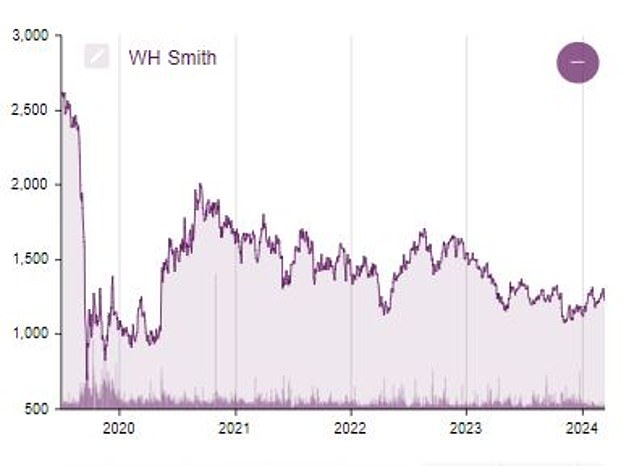

WH Smith shares closed up 10.5 per cent today at 1,360p. They are up just under 4 per cent this year but are down 2 per cent in the past year, having fallen from their recent peak above 1,700p in 2023.

WH Smith shares are now worth around half their December 2019 peak, reflecting the tough years the company has endured since the start of the Covid pandemic.

WH Smith’s profitability has been driven by the expansion of its travel offering, which has seen the retailer tap into a captive audience at airports, bus stations and other transport hubs.

In the UK, travel sales grew 9 per cent in the fourth quarter, with trading peaking. This was supported by the new food-to-go offering – Smith’s Family Kitchen – which WH Smith said was performing better than expected.

Meanwhile, the rest of the world and the US are expected to show full-year revenue growth of 15 percent and 6 percent respectively.

This offsets the continued decline in high street sales, which continue to struggle despite management efforts such as the launch of Toys “R” Us ‘shop-in-shops’.

WH Smith expects to open another 37 Toys “R” Us shop-in-shops before Christmas 2024, taking the total to 76.

John Moore, senior investment manager at RBC Brewin Dolphin, said: ‘The travel sector continues to experience strong growth, while high street performance, while declining, is in line with expectations.

‘The revenue growth, profitability and the steps taken by the management team all point in the right direction after the difficult years of the pandemic and its immediate aftermath.

‘With a share price less than half its pre-Covid peak, WH Smith is effectively one of the poster children for UK SMEs that remain cheap.

‘But given that a reasonable dividend has been paid, a number of measures have been taken to help the company and a share buyback programme is planned for later this year, that could change in the not too distant future.’

Big drops: WH Smith shares are now worth about half their December 2019 peak

In addition to the tills, WH Smith has also received an £85m boost from the acquisition of its defined benefit pension scheme.

This enabled the buyback of own shares and ensured that the group remained committed to a capital allocation policy, including returning excess cash to shareholders.

The company also expects the acquisition to have significantly reduced leverage, which is in line with its strategy.

Analysts at Peel Hunt, which has a price target of 1,500p for WH Smith, said: ‘The pension relief changes gearing ratios and WH Smith is confident enough to buy back £50m of shares.

‘Has the story changed? No doubt. The buyback is a pleasant surprise, but we think the stock will live and die on the underlying forecast momentum.

‘It’s a decent growth story with a not-too-high price/earnings ratio, but a positive surprise from the US is needed to really push the shares higher.’

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.