Are coalition governments bad for markets? Not necessary; here’s why

Illustration: Binay Sinha

A coalition government would not necessarily be bad for stock markets, analysts said, suggesting governments should set out a clear, actionable roadmap for its term.

While market sentiment will undoubtedly take a sharp hit in the event of a change of government or a weak coalition, analysts said, it is important to remind ourselves that there are many good things happening for India independent of the government of the day.

“These include good demographics, a well-educated population segment, a large domestic market, the cumulative impact of past reforms, coupled with global push factors such as supply chain diversification and the surge in digitalization. This is not to say that policy shifts will not occur. an impact, but it certainly means that we should not go too far in either direction in longer-term assessments,” said analysts at MUFG, a Japan-based research institute.

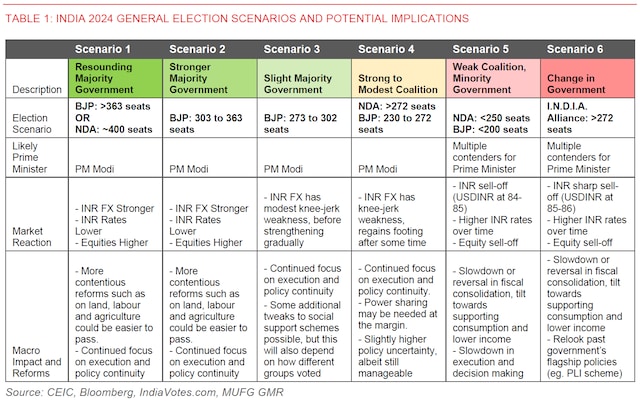

Market scenarios

At UBS too, in the event of a weakened BJP-led coalition, reform momentum is likely to remain broadly unchanged, but some hardline policies may not progress and/or are likely to be suspended (including divestments, a land bill and a uniform Civil Code). However, comfort over fiscal discipline could be less of a concern for investors in this scenario.

On the other hand, in a scenario where the INDIA bloc forms a weak coalition government, the economic policy approach would be broadly aligned, but markets could worry about fiscal discipline and a less decisive government, leading to delays in implementing supply-side reforms.

“There could also be a delay in the recovery of private business investment due to weaker business confidence caused by the surprise political outcome,” they said in a recent note.

What is a coalition government?

A coalition government is formed when several political parties enter into a power-sharing agreement, with an elected representative among them at the helm. Typically, such coalition governments are formed when a single party fails to gain an outright majority to form a government, either at the state level or at the national/country level.

What are the types of coalition governments?

Minority coalitions and surplus majority coalition governments are the two main forms of coalition government. A surplus majority coalition government exists when one political party controls more than the absolute majority of seats in parliament, which is necessary to have a majority in government. On the other hand, minority coalition governments do not hold a majority of legislative seats.

What is the history of coalition governments in India?

The first coalition government in India was formed way back in 1977 with Morarji Desai as Prime Minister. The 1980s and 1990s saw a number of coalition governments in India, with VP Singh, Chandra Shekhar, Inder Kumar Gujaral and HD Deve Gowda assuming the role of Prime Minister of India at different times.

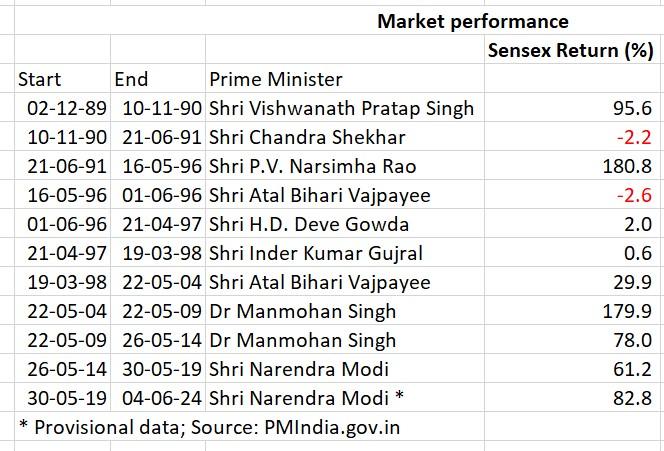

What was the performance of stock markets under coalition governments in India?

A coalition government has not always been bad for stock markets. Data from PMIndia.gov.in shows that the Sensex returned 95.6 percent between December 2, 1989 and October 10, 1990 under the coalition government led by VP Singh as Prime Minister.

Sensex returns

The best performance of the Indian stock market under the rule of a coalition government occurred under the leadership of Prime Minister Manmohan Singh, who led the United Progressive Alliance-1 (UPA-1) between May 22, 2004 and May 22, 2009. The Sensex rose a massive 179.9%. percent during this period, data from PMIndia.gov.in shows.

Under UPA-2, the Sensex registered a gain of 78 per cent, while the Nifty registered a gain of 73.6 per cent.

The National Democratic Alliance (NDA) with Narendra Modi as Prime Minister saw the Sensex rise 61 per cent between 2014 and 2019, data shows.

First print: June 4, 2024 | 3:49 PM IST