Apple's stock price falls again after another analyst goes sour on its stock – and it could lose its status as the world's most valuable company

- Concerns about a slowdown in iPhone sales this year are causing analysts to turn away from the company

- The $1,599 iPhone 15 has had 'lackluster' sales – prompting Barclays to downgrade the stock on Tuesday and now Piper Sandler downgraded its rating

- Microsoft is close to Apple in terms of market capitalization

<!–

<!–

<!–

<!–

<!–

<!–

Growing concerns about iPhone sales prompted a second analyst this week to cut Apple's stock price.

The tech giant's value has now fallen by $155 billion this week – more than THREE times the value of Ford.

Apple is still worth $2.83 trillion, making it the most valuable company in the world.

But at No. 2 is Microsoft – seen as a leader in AI – and is worth $2.73 trillion, and could overtake it this month if Apple's share price continues to fall.

The gap has now fallen by $100 billion – the smallest since November 2021.

Piper Sandler and Co cut Apple's rating on Thursday, the second major bank to do so after Barclays' downgrade on Tuesday.

Apple's stock price has fallen this week – Microsoft could take its place as the world's largest company

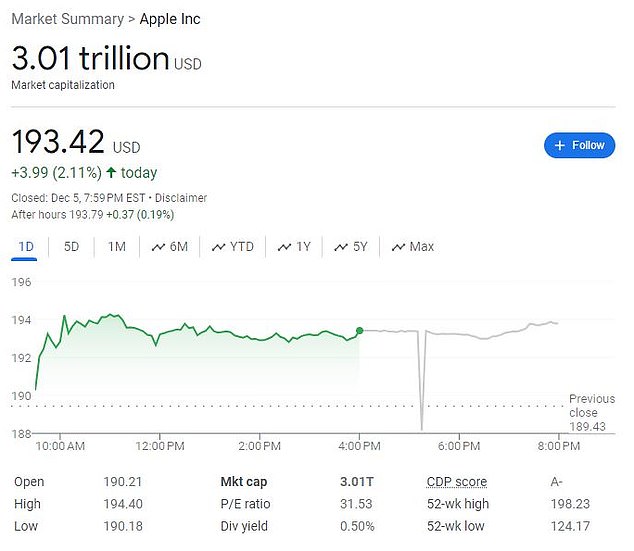

Apple's stock price fell again on Thursday after Piper Sandler downgraded its rating on the stock price, meaning Apple's value has fallen more than 6 percent this week

Microsoft's stock price also fell this week, but by less. It is now on the verge of taking over the status of the world's most valuable company

An analyst at Barclays downgraded Apple shares, causing them to fall in value. Barclays said sales of the iPhone 15 – held up by Apple CEO Tim Cook – were “lackluster”.

Piper Sandler analyst Harsh Kumar said he was concerned that the iPhone might not sell as much as expected in the first half of this year.

“Unit sales growth rates have peaked,” he said.

Earlier this week, on Tuesday, Barclays' Tim Long said sales of Apple's iPhone 15 smartphones were “lackluster” and that the upcoming iPhone 16 “should be the same.” He set a target of $160 per share.

Then the stock price – which was above $192 at the end of December – immediately fell four percent, and by Wednesday afternoon it was hovering around $184.

Today (Thursday), the price fell again below $182 – down 6.3 percent this year – after Piper Sandler's note.

Microsoft's stock price is also down this year, but only 2 percent to just under $368.

In addition to Microsoft's stock having smaller losses so far in 2024, the Windows maker has had a slightly stronger year than Apple's. Shares of Microsoft rose 57 percent in 2023, compared to 48 percent for Apple.

Apple depends on iPhones for just over half of its revenue. Microsoft once depended on its Windows software, but now it also makes money from cloud computing and devices like its Surface computers.

Apple was the first company ever to achieve a $1 trillion valuation in 2018. Since then, it has remained the largest company in the world, with the exception of brief periods when Microsoft stole the title.

The next largest company is Saudia Arabian Oil with about $2.13 trillion, then Google owner Alphabet with $1.73 trillion and then Amazon with $1.51 trillion.

Apple had another problem on Thursday: it had to withdraw an update to its operating system after just two hours, because it caused iPhones to freeze. It was a beta update – for those keen to test out the latest features – so most users weren't affected.

Apple shares rose 50 percent to hit a record high last year, making it the first company with a market value of more than $3 trillion. It reached the milestone first in June and then again in early December, when shares were above $193.

The sales slowdown in China is the biggest problem for Apple, according to analysts. This happens for two main reasons.

Chinese rivals such as Huawei are gaining market share there, and Beijing has placed restrictions on the use of iPhones by government workers.

According to BloombergSmartphone data company IDC has lowered its 2024 forecast for Apple's Chinese sales.

“Huawei's success has the biggest impact on Apple's growth in China,” said IDC research director Nabila Popal.

Huawei's share of high-end smartphones rose to 24 percent in the third quarter of 2023, compared to 11 percent the year before.