Apple shutting down popular feature just a year after launching in major blow for iPhone users

Apple discontinued a popular feature just a year after launch, which was a major blow to iPhone users.

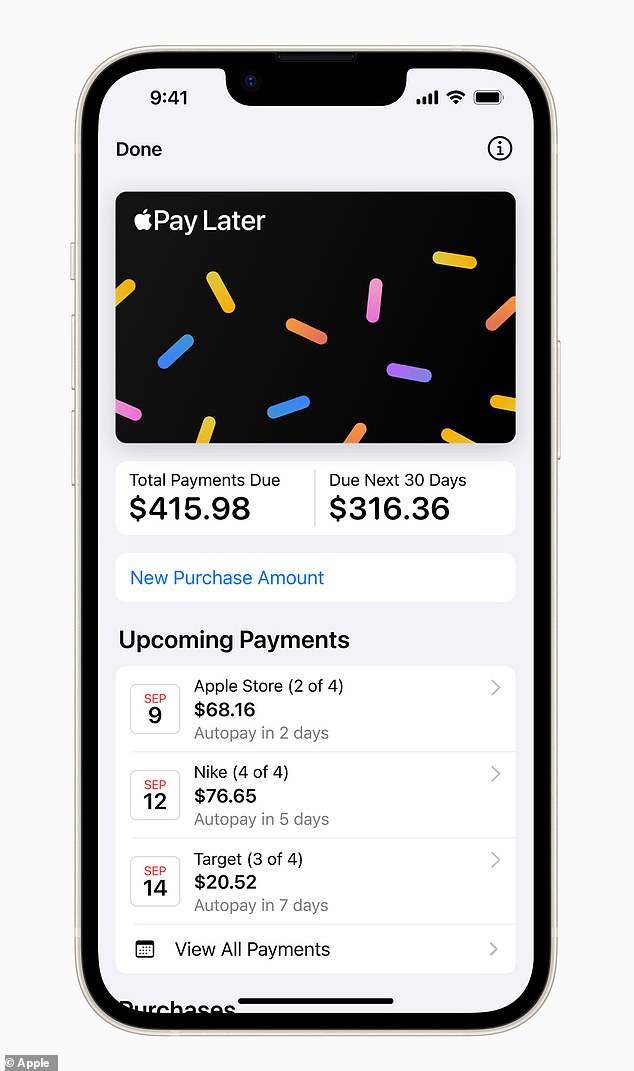

The tech giant has removed the ‘buy now, pay later’ feature from Apple Pay, which allowed users to take out loans for purchases of up to $1,000 and pay them off in four installments over six weeks.

Although this option is no longer available, consumers with existing loans will not be affected.

Apple’s decision to cancel its buy now, pay later service comes as Apple plans to introduce a similar program in the fall that will allow users to access loans made by eligible credit and debit card companies.

Apple announced on Tuesday that it is canceling the ‘pay later’ option, but made it clear that people who have taken out existing loans will not be affected.

“Starting later this year, users around the world will be able to access installment loans offered through credit cards, debit cards and lenders at checkout with Apple Pay,” Apple said. 9to5Mac.

Rather than working as a lender itself, Apple will focus on helping users secure other lending options that “will allow us to bring flexible payments to more users, in more places around the world, in partnership with banks and lenders that support Apple Pay’. the company added.

This option will be available in the US through Discover credit card and retail lenders Synchrony Financial and Fiserv Solutions, accessible directly through Apple Pay.

The new feature also allows users to apply for a loan with Affirm – a buy now, pay later lender that offers short-term loans for both online and in-store purchases.

Users can add the loan option during checkout, which allows them to apply for the loan through a credit card and loan service or directly through Affirm.

The new loan feature still omits hidden fees, offers zero percent interest and allows users to split payments into four installments due over six weeks.

According to a June questionnaire According to LendingTree, about 13 percent of 889 respondents said they had used Apple’s buy now, pay later feature, while one in three Americans said they had considered applying for an installment loan.

Users in Australia, Spain and the United Kingdom – who previously didn’t have access to Apple’s buy now, pay later feature – will also have access to installment options starting this fall.

The ‘buy now, pay later’ feature (pictured) allowed users to split payments of up to $1,000 into four installments that would be paid off within six weeks

Apple introduced early access to the feature in March 2023, providing the loans themselves, but it didn’t officially launch until October.

The partnership with its former rival Affirm could help the company expand its loan program and offer longer-term repayment options, JPMorgan analyst Reginald Smith said.

“Affirm does not expect any meaningful impact on FY25 revenue. . . but it’s hard to imagine that adding a platform of this magnitude wouldn’t move the needle,” Smith wrote last week, according to the Financial times.

The shift to partnering with Affirm and other credit and debit card companies to replace the buy now, pay later option was introduced last week at the Worldwide Developers Conference in California.

DailyMail.com has contacted Apple for comment.