Anthony Albanese’s new tax cuts for everyday working Aussies could keep interest rates higher for longer

Experts have warned that Anthony Albanese’s pushback on stage three tax cuts could add to inflation and keep interest rates high for longer.

There is a general consensus among economists that Australia’s current cash rate of 4.35 percent – after a series of increases by the Reserve Bank – would be cut at least twice in 2024 as inflation is gradually brought under control.

But some now say Labour’s renewed tax cuts, aimed at putting more money into the pockets of middle-income earners, could delay interest rate cuts and keep monthly mortgage repayments eye-wateringly high.

Deloitte Access Economics partner Stephen Smith shared this news.com.au he expected two rate cuts could become “one or none” because the Reserve Bank would expect middle-income earners to spend tax breaks rather than save.

In contrast, the original tax cuts in phase three would have benefited more high-income earners, who would likely save or invest additional money rather than pouring it back into the economy.

Prime Minister Anthony Albanese’s government insisted dozens of times that it would not change the phase three tax cuts before backtracking on Tuesday.

The new tax scheme will benefit middle-income earners, which some experts say could lead the Reserve Bank (pictured, Governor Michele Bullock) to delay interest rate cuts

According to Mr Smith, another $2.6 billion could be injected back into the economy through the new tax cut.

“In the current environment, the government should not be putting extra money into the economy if inflation is already a problem,” he said.

KPMG chief economist Dr Brendan Rynne agreed, saying the government’s claim that the tax cuts would be non-inflationary was likely incorrect.

“The changes are likely to be slightly more inflationary than the original phase three proposals,” he said.

The chief economists of both NAB, Alan Oster, and AMP, Shane Oliver, also agreed, saying that while Labour’s tax system is unlikely to drive up interest rates, it will not help bring them down.

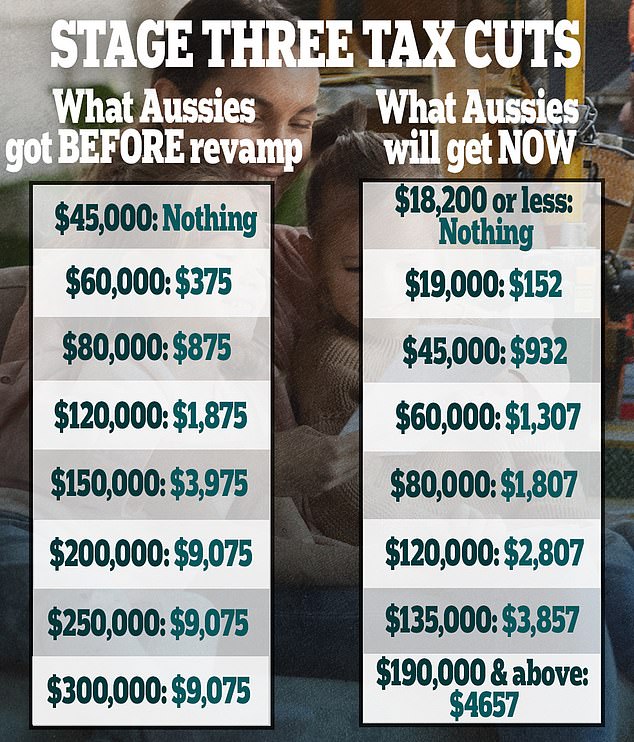

The changes will give someone earning an average wage of $73,000 a tax cut of more than $1,500 per year.

Those earning $50,000 will receive an additional $929 per year, while those earning $100,000 will receive $2,100.

Households with a median income of $130,000 will receive $2,600.

At the high end, phase three tax cuts for those earning $200,000 will be reduced from $9,075 to $4,500.

Mr Albanese will rely on the advice of the Ministry of Finance to advocate for change.

When the third stage tax cuts were introduced by the Coalition in 2018, the Australian economy was expected to be supported by strong global conditions.

Inflation and interest rates were expected to remain low.

He cited the same advice to allay fears of pressure on inflation.

“This option is largely revenue neutral, will not increase inflationary pressures and will support labor supply,” he asserted.

The cost of living has become a major issue for the Labor government, with Mr Albanese also announcing an ACCC review of the Coles-Woolworths supermarket price duopoly

The lowest income tax rate will be reduced from 19 to 16 cents on the dollar, meaning workers will pay less on the first $45,000 they earn.

The low-income threshold at which the Medicare levy kicks in will also be increased.

The second tax rate will be reduced from 32.5 to 30 percent for people earning up to $135,000.

Labor will keep the 37 percent rate for people earning more than $135,000, and the top tax rate of 45 percent will be $190,000 instead of $180,000.

Mr Albanese said the tax cuts were “fairly and clearly targeted at central Australia”.

“Our government understands that middle-income Australians need help meeting their living costs now more than ever,” he said.

Labor MPs approved the tax package at a brief meeting on Wednesday, ahead of Albanese’s speech at the Press Club to open the political year.

The opposition has accused Mr Albanese of breaking his word and taking part in class warfare.

Labor will launch an advertising campaign to explain the changes to Australian workers, with Mr Albanese promising further relief.

“These broader and better tax cuts are not the beginning of our cost-of-living actions — and they won’t be the end,” he said.