Anthony Albanese reveals his single reason for breaking his election promise on Stage Three tax cuts

Anthony Albanese has defended breaking a major election promise by overhauling the stage three tax cuts, arguing changed economic conditions forced his hand in his bid to reclaim central Australia.

The Prime Minister addressed the National Press Club on Thursday to unveil his plan to cut tax cuts for higher earners in favor of bigger benefits for those earning less than $150,000.

‘For me, our responsibility is clear. This is the right decision, not the easy decision,” he said.

Prime Minister Anthony Albanese (seen above on Wednesday with partner Jodie Haydon) told the National Press Club he was backing down due to changing economic conditions

Over the summer, senior officials from the Treasury and Treasury were tasked with exploring options for easing the cost of living for Australians.

READ MORE: Daily Mail Australian politics live blog – Dutton explodes

The Treasury advice, released at the same time the Prime Minister began his speech, said that when phase three was first legislated by the Coalition in 2019, the Australian economy was expected to be supported by ‘ positive global outlook, with strong, broad-based global growth’. .

“Inflation, and therefore interest rates, are expected to remain low,” the advice said.

However, the pandemic, damaged supply chains, conflict in the Middle East and Europe and rapid increases in food and energy prices have meant that economic forecasts have not materialized.

Mr Albanese said if he continued with the old plan, central Australia would miss out on the “help they need and deserve”.

“Because when I see the pressures Australians are under right now, it’s crystal clear to me that every taxpayer needs and deserves a meaningful tax cut,” he said.

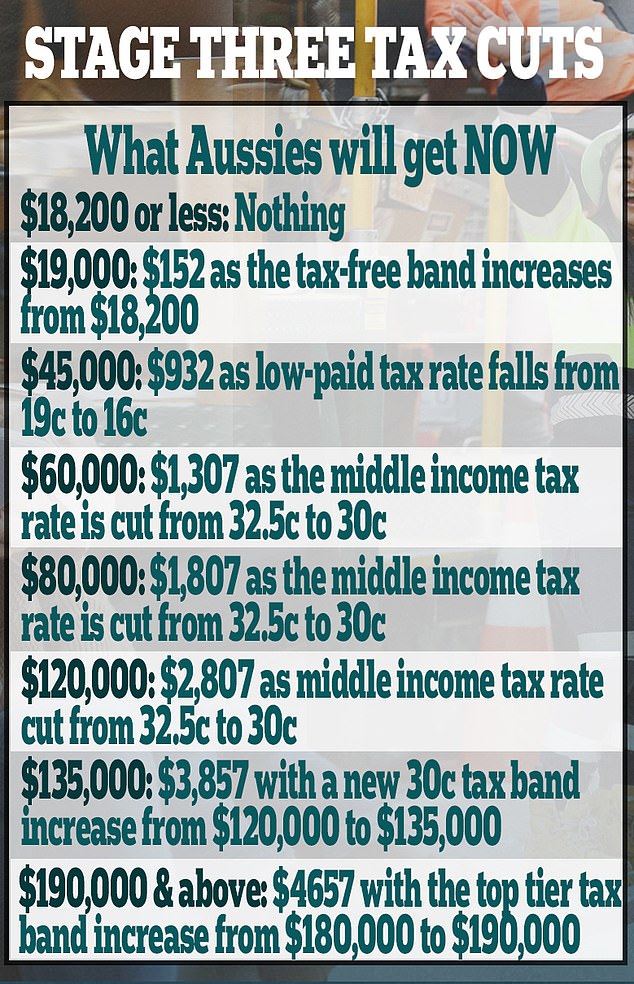

Among the changes pushed through by the caucus on Wednesday, the revised cuts will lower the tax rate on incomes up to $45,000 to 16 percent – from 19 percent – and lower the tax bracket to 30 percent – from 32 percent – from $45,000 to $135,000. .5 percent. per cent.

In addition, the 37 percent tax bracket remains between $135,000 and $190,000, above which the top marginal tax rate then kicks in at a rate of 45 percent.

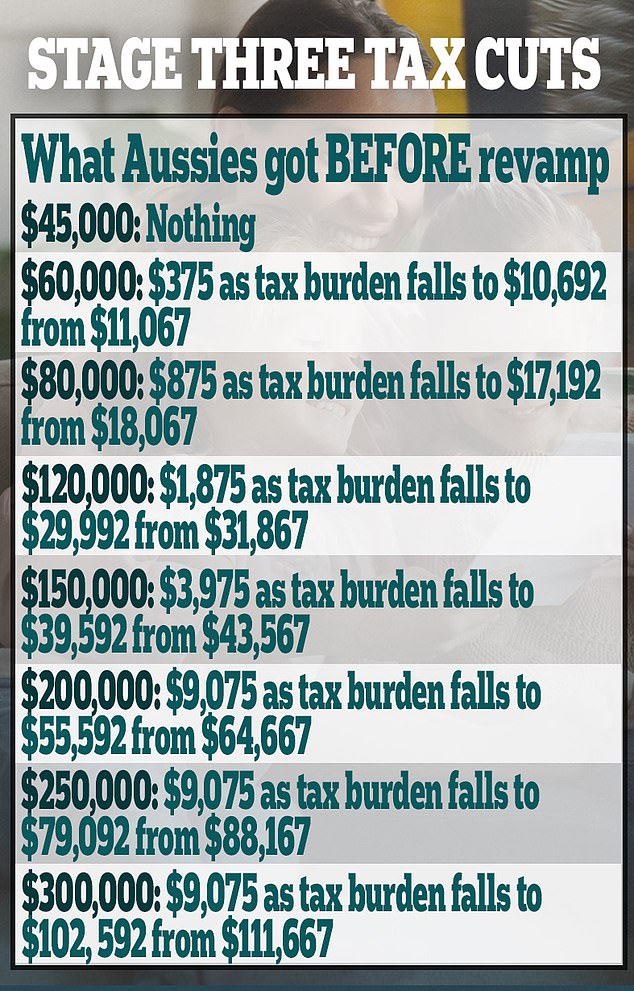

The changes will undo the third phase of the Morrison government’s tax package – designed to tackle the tax bracket – which would have abolished the 37 per cent tax band on income earned between $120,000 and $180,000.

Instead, a 30 percent tax rate would have applied to all income between $45,000 and $200,000, with a 45 percent tax rate on all income above this level.

As a result of Labour’s tax package, around a million taxpayers earning more than $150,000 a year will be up to $4,546 worse off than they would otherwise have been.

However, the vast majority of taxpayers will be better off, as all incomes between $45,000 and $135,000 will receive an additional $840 under the Albanian government’s policy.

Mr Albanese argued that by making the tough choices in the government’s past two budgets and achieving the first budget surplus in 15 years, there was now room to reform tax breaks.

The coalition – which passed tax cuts in government in 2019 with Labor’s support – has used days of speculation in the run-up to the speech to accuse Mr Albanese of breaking a promise.

Deputy Liberal leader Sussan Ley initially suggested the coalition would withdraw cuts if it won the next election, but pushed back on Thursday morning.

Mr Albanese said the reaction was “predictable” and nothing more than “manufactured outrage”.

“That’s how far down the rabbit hole they went. They would rather organize a political struggle than help people with low and middle incomes,” he said.

The government also announced an increase in the low income threshold to which the Medicare levy applies, meaning that 1.2 million low-income people will either remain exempt from paying the levy or pay less tax.