Anthony Albanese’s disastrous gaffe about the US economy comes under withering attack from a top White House advisor – after PM got his basic facts horribly wrong

A former economic adviser to Barack Obama has criticized Anthony Albanese for completely misrepresenting the facts about the US economy.

Australia’s Prime Minister was asked about the US Federal Reserve’s massive 50 basis point rate cut, but he got basic facts about the economy wrong.

“Because the economy is so slow, they (the US) are cutting rates,” he told ABC Radio National announcer Patricia Karvelas on Thursday.

However, the US economy is booming compared to Australia, with gross domestic product growing at 3 percent in the year to June 2024.

In contrast, the Australian economy grew by a meagre 1 percent in the last fiscal year, taking the economy to levels not seen since a recession.

This was the lowest annual growth since 1991, barring a pandemic, thanks to the Reserve Bank of Australia’s 13 rate hikes.

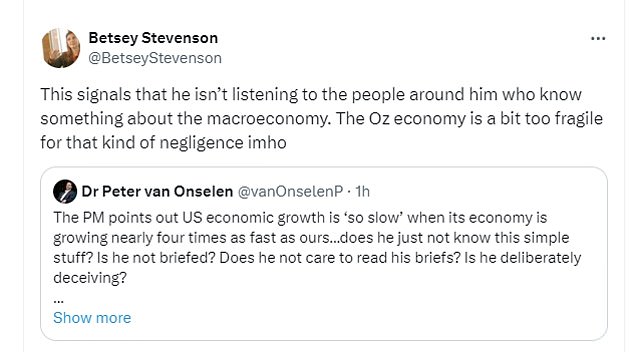

Betsey Stevenson, who served in the Obama administration The Council of Economic Advisers criticised Mr Albanese on X for putting the wrong spin on the US Federal Reserve’s first rate cut in four years.

“This is a sign that he is not listening to the people around him who understand macroeconomics,” she said, referring to a story by Peter van Onselen, political editor at Daily Mail Australia.

Betsey Stevenson, who served on the Obama administration’s Council of Economic Advisers, criticized Anthony Albanese for misrepresenting the facts about the U.S. economy

“Australia’s economy is a bit too vulnerable to that kind of negligence (in my humble opinion).”

Mr Albanese ignored Karvelas when she pointed out that the US economy is growing much faster than Australia’s.

The US Federal Reserve has cut the federal interest rate by 50 basis points to 4.75-5 percent, the first cut since March 2020, at the start of the Covid pandemic.

“Recent indicators suggest that economic activity continues to expand at a robust pace,” the US Fed’s accompanying statement said, but added that “employment growth has slowed.”

The US Federal Reserve has joined the European Union, Canada, the United Kingdom and New Zealand in cutting interest rates this year.

John J. Hardy, chief macro strategist at Saxo, said financial markets viewed a 50 basis point rate cut by the US Fed as only a 60 percent chance.

“So it remains a bit of a pigeon-like surprise,” he said.

Finance Minister Jim Chalmers also made a candid statement on Thursday when he wrongly suggested that financial markets had expected the huge US rate cut.

Prime Minister Anthony Albanese has wrongly suggested that US economic growth was much slower than Australia’s.

Barack Obama’s former economic adviser tweeted a link to the story by Peter van Onselen, political editor of Daily Mail Australia

“I think what we saw last night in the US was to be expected,” he told Nine’s Today show.

Although a rate cut in the US was expected, a 50 basis point easing failed to materialise.

Reserve Bank of Australia Governor Michele Bullock this month ruled out a local rate cut before Christmas.

That’s because Australia’s inflation rate of 3.8 percent is much higher than the US level of 2.5 percent and well above the Reserve Bank of Australia’s target of 2 to 3 percent.

But Australia’s cash rate of 4.35 per cent, while at a 12-year high, is still lower than the corresponding policy rates in the US, UK, EU, Canada and New Zealand. Dr Chalmers was right.

“It’s very important to remember that interest rates in the US have risen more than in Australia,” he said.

‘Even after this overnight rate cut in the US, interest rates in the US are still higher than here.’

Although economic growth in Australia is weak, the labour market is still strong. Unemployment was still at 4.2 per cent in August and 47,500 jobs were created.

The Commonwealth Bank, Australia’s largest mortgage lender, now expects the RBA to cut rates by 25 basis points in December instead of November.

However, Gareth Aird, head of Australian economics at the bank, said the Reserve Bank wanted more detail on inflation and the labour market before taking action.

“We now believe the RBA board needs to see and assess this broader dataset before it is prepared to join many other central banks in cutting rates in 2024,” he said.