Another sector offering: HDFC MF launches Nifty Realty Index Fund

In addition to a series of thematic launches, HDFC Mutual Fund has also joined the bandwagon and launched a Nifty Realty Index Fund. The new fund offering (NF0) opens on March 7 and closes on March 21, 2024.

The Nifty Realty Index is designed to reflect the performance of real estate companies primarily engaged in construction of residential and commercial properties.

In February, the real estate sector continued its upward trajectory, rising 6.3 percent, making it the leader. The real estate index has risen 131.57 percent in the past year and 63 percent in the past six months. In the past three months alone, the real estate index has increased by 27.6 percent.

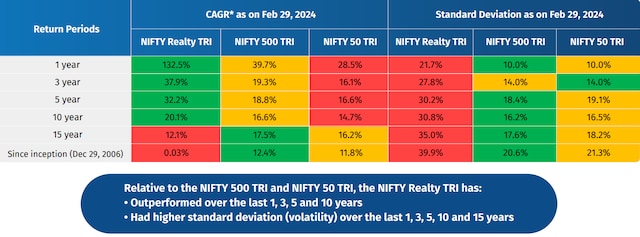

HDFC NIFTY Realty Index Fund provides investors with exposure to a diversified portfolio of real estate stocks through a single instrument, eliminating the need for individual stock selection. It is an open-ended scheme that aims to replicate the NIFTY Realty Index. The fund could be suitable for investors looking for diversified exposure to the growth potential of the real estate sector and who have a high tolerance for volatility.

Why invest in HDFC NIFTY Realty Index Fund?

According to the HDFC mutual fund,

-

The real estate sector is recovering after a decade-long period of consolidation

-

Rising per capita incomes, improving affordability, increased urbanization, government initiatives and RERA^ can drive growth in the coming years

-

Listed real estate companies are poised to benefit from the aforementioned tailwinds.

-

Investors can get exposure to the real estate sector through the passively managed HDFC NIFTY Realty Index Fund

-

Companies have strengthened their balance sheets and improved their profitability figures over the past six to seven years.

-

There is room to also benefit from the ongoing premiumization and formalization of the sector

Snapshot of NIFTY Realty Index

-

Records the performance of the real estate companies. Currently has 10 voters

-

Shares with a maximum of 33% each, the top 3 shares with a maximum of 62% in total

-

The index is rebalanced semi-annually in March and September

Nirman Morakhia and Arun Agarwal are the fund managers of the scheme.

Note: In FY23, home sales in the Indian housing market reached an all-time high of Rs. 3.47 lakh crore, up 48% year-on-year

Thematic or sectoral funds are the highlight of the season, especially for private investors. This particular category of mutual funds has received maximum inflows in the last year or so. According to data from the Association of Mutual Funds in India (Amfi), thematic funds also generated the highest inflows in February 2024 compared to all other categories of equity funds from retail investors. Net inflows into thematic funds increased almost three times to Rs. 11,262.72 crore in February 2024, compared to Rs 3,855.90 crore in a month ago.

The category was helped by the launch of five new schemes during the month (Groww Banking & Financial Services Fund; quant PSU Fund; SBI Energy Opportunities Fund; WhiteOak Capital Banking & Financial Services Fund; WhiteOak Capital Pharma and Health).

First print: March 12, 2024 | 1:06 PM IST