Amex copies Capital One with change on airport lounge access

Frequent flyers will all have experienced a common frustration.

They pay hundreds of dollars a year for a credit card that promises lounge access, but when you arrive they face long lines.

But American Express has a solution: a new online waitlist feature now available at all Centurion Lounges in the US.

Similar to Capital One’s system introduced earlier this year, Amex’s new digital waitlist allows cardholders to join the line remotely through their app.

You can register while you are still on your way to the airport and you will be notified when it is your turn to enter. You then have 15 minutes to check in.

This means that you no longer have to queue; you just show up when your spot is ready.

Amex recently expanded this feature after successful testing in select locations. While it doesn’t guarantee immediate access, it can save you valuable time.

American Express has a solution to long lines at Centurion Lounges: a new online waitlist feature now available in the app

Experts say this digital waiting list won’t solve the core problem of overcrowding, but it should make the experience less frustrating.

After all, the promise of luxury travel usually doesn’t include waiting in a long line.

Here’s how to use the new Amex feature:

- Use the Amex app if you are approximately 10 minutes away from the lounge.

- Log in and select your eligible card – usually the Platinum Card or Business Platinum Card.

- Tap the “Membership” tab and choose the Centurion Lounge for your airport.

- If space is available, click ‘Get Eligibility Code’ for immediate access. If full, sign up for the “Waiting List” and receive a notification when it is your turn.

- After you have been notified, you have 10 minutes to enter using a QR code. No physical card is required.

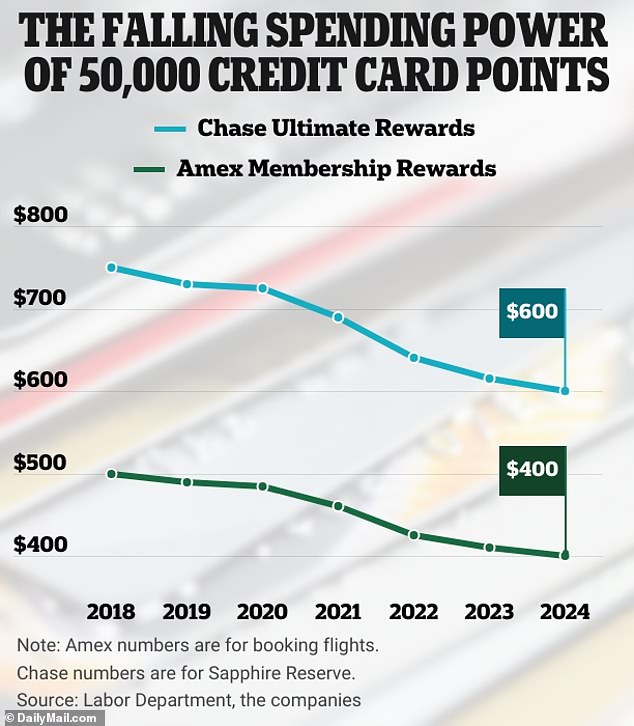

Meanwhile, a recent report showed how the value of credit card reward points has gradually declined as inflation has taken hold.

A rewards point has long been worth about one cent when used to cover other purchases.

But according to the Bureau of Labor Statistics, one penny has lost about 20 percent of its purchasing power since 2018.

This means that a point has also decreased in value by approximately the same amount, according to The Wall Street Journal.

If you accrued 50,000 points with a major credit card issuer in 2020 and still haven’t spent them, they are now worth about 41,300.

Inflation begins to erode the value of points as users redeem them directly through a bank’s portal or online app

Cardholders amassed a stockpile of points worth more than $34 billion in 2023, according to annual reports from major card companies American Express, Capital One and JPMorgan Chase.

But the value of points has also dropped when users transfer them from the bank’s portal to a frequent flyer or other points program.

Different airlines and hotels have their own points rating systems. And many of them are increasing the number of points needed to book, to reflect how prices have risen due to inflation.

Michael Faulkner, who works in the insurance industry, told The Wall Street Journal that transferred points don’t go as far as they used to.

He said the same flight from his home in Chicago to France has gone from 60,000 United Airlines points last year to between 80,000 and 90,000 this year.