Amex, Chase and Capital One have quietly made changes to credit cards

Millions of Americans are religious about accumulating credit card points to spend on flights and hotel stays — or simply convert them to cash.

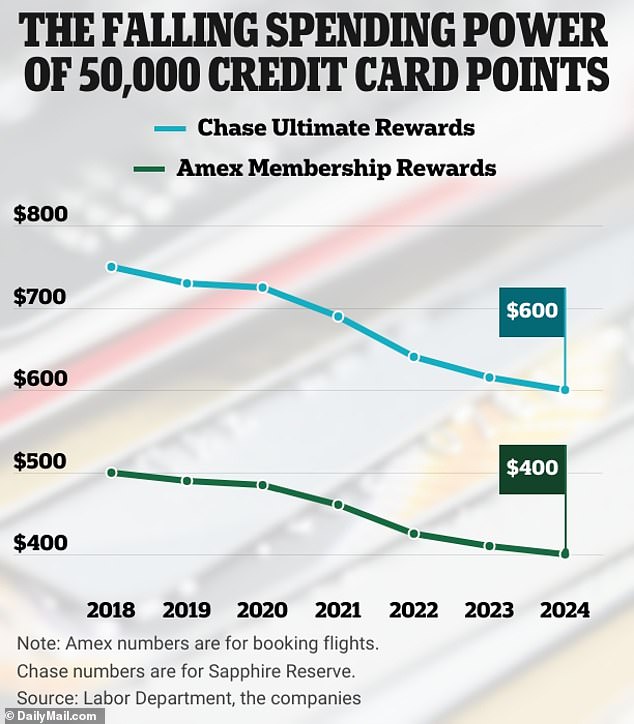

But the spend value of credit card points has fallen in the years since the Covid-19 pandemic as inflation has taken over.

A point redeemed through online banking has long been worth about one cent. But according to the Bureau of Labor Statistics, one penny has lost about 20 percent of its purchasing power since 2018.

This means that a point has also decreased in value by approximately the same amount, according to The Wall Street Journal.

If you collected 50,000 points from a major credit card company in 2020 and still haven’t spent them, they’re now worth about 41,300, according to the outlet.

The spend value of credit card points has fallen in the years since the Covid-19 pandemic as inflation has taken over

Cardholders amassed a stockpile of points worth more than $34 billion in 2023, according to annual reports from major card companies American Express, Capital One and JPMorgan Chase.

Inflation is starting to erode the value of points as users redeem them directly through a bank’s portal or online app.

But the exchange rate for points changes when you transfer them from the banking portal to a frequent flyer or other points program.

Different airlines and hotels have their own points rating systems. And many of them are increasing the number of points needed to book, to reflect how prices have risen due to inflation.

While annual inflation fell to 2.5 percent in August, higher inflation has pushed up prices in recent years.

This has resulted in the average price for an economy flight purchased with points increasing by about 19 percent since 2019, according to aviation consultant Idea Works.

Michael Faulkner, who works in the insurance industry, told The Wall Street Journal that transferred points don’t go as far as they used to.

He said the same flight from his home in Chicago to France has gone from 60,000 United Airlines points last year to between 80,000 and 90,000 this year.

Many airlines now price point user fares more similarly to how they set cash value for flights.

In 2015, Delta switched its points rates from a fixed pricing model to dynamic pricing based on timing and customer demand, the outlet reported.

Other airlines, such as American and United, have since done the same.

Inflation begins to erode the value of points as users redeem them directly through a bank’s portal or online app

The exchange rate for points changes when you transfer them from the bank’s portal to a frequent flyer or other points program

Millions of Americans are religious about accumulating credit card points to spend on flights and hotel stays – or simply convert them to cash

Credit card issuers have generally offered points more liberally in recent years since the pandemic, Tiffany Funk, president and co-founder of Point.Me, which tracks credit card reward values, told The Wall Street Journal.

That’s instead of increasing the value of rewards to keep pace with rising inflation.

She recommends that Americans can find the best deals by sticking to cards with easily transferable points.

If you create multiple accounts with different partner companies, Funk says, you can shop around to see which one offers the best deal.

Spending points soon after they land in your account can also be a good way to avoid “points inflation,” says Nick Ewen, analyst at The Points Guy.