Amex, Chase and Bank of America face backlash after quietly making change to credit cards

A powerful consumer watchdog is taking aim at credit card companies over a major complaint for millions of Americans: the devaluation of reward points and airline miles.

For years, consumers have diligently collected credit card points, eager to redeem them for flights, hotel stays or even cash.

But since the Covid-19 pandemic, the value of those points has steadily declined as inflation has eroded their purchasing power, leaving many cardholders feeling shortchanged.

The Consumer Financial Protection Bureau (CFPB) has warned that major credit card companies, including American Express, could be breaking the law because of this practice.

It accuses these issuers of luring customers with promises of enticing benefits and rewards but failing to deliver on those promises.

Credit card companies that obscure the terms and conditions for earning or keeping rewards in fine print may be engaging in illegal practices, the report said.

The agency has already taken action against companies like American Express and Bank of America for unlawful conduct related to their rewards programs, as outlined in a circular sent to other law enforcement agencies.

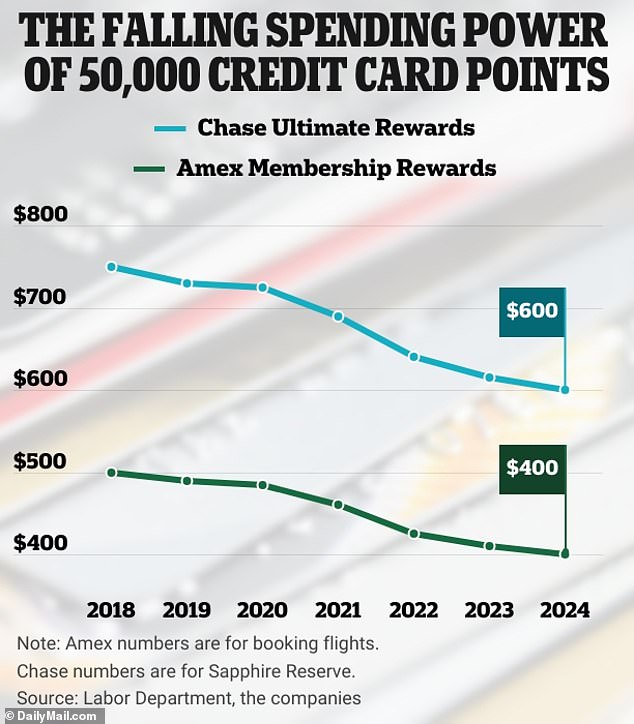

Companies like American Express and JPMorgan Chase have come under fire as the value of points continued to decline in the years since the COVID-19 pandemic as inflation has taken hold.

The Consumer Financial Protection Bureau (CFPB) warned that major credit card issuers are guilty of luring customers with the promise of perks and rewards and then failing to deliver

A point redeemed through online banking has long been worth about one cent. But according to the Bureau of Labor Statistics, one penny has lost about 20 percent of its purchasing power since 2018.

This means that a point has also decreased in value by approximately the same amount, according to The Wall Street Journal.

According to the outlet, the 50,000 points collected from a major credit card company in 2020 were worth about 41,300 as of October this year.

By 2022, three-quarters of all general-use credit cards were rewards cards Reuters.

Many consumers choose which card to apply for based on the rewards offered, the CFPB said.

Issuers often promise cash, points and miles as sign-up bonuses to consumers, as well as rewards for certain types of spending.

But consumers have reported to the watchdog that the rewards are difficult to pay out or are sometimes devalued by the companies.

It was also discovered how some companies hide the conditions for earning or keeping rewards.

“Disclaimers in fine print or vague terms hidden in a contract may unlawfully conflict with prominent advertising language advertising the rewards consumers can earn,” the CFPB said.

“Companies can also illegally rely on fine print to cancel valuable rewards that consumers have already earned.”

Rohit Chopra, director of the CFPB, said: “Too often, major credit card issuers play a game to lure people to expensive cards, increasing their own profits while depriving consumers of the rewards they have earned.

“If credit card issuers promise cashback bonuses or free return flights, they should actually deliver.”

In 2012, the CFPB ordered Bank of America to pay $85 million to about 250,000 customers for “illegal card practices.”

Bank of America, meanwhile, paid more than $100 million to customers last year.

Inflation begins to erode the value of points as users redeem them directly through a bank’s portal or online app

The CFPB has had to take action against issuers such as American Express and Bank of America for illegal practices related to credit card rewards programs, the CFPB said in a circular to other law enforcement agencies.

Issuers often promise cash, points and miles as sign-up bonuses to consumers, as well as rewards for certain types of spending. But consumers have reported to the watchdog that the rewards are difficult to redeem or sometimes devalued by the companies

Industry groups pushed back on the report, accusing the CFPB of chasing headlines and tarnishing a popular product.

Rob Nichols, president of the American Bankers Association, said in a statement that complaints about credit card rewards were “extremely unusual” and accused the CFPB of putting political pressure on card issuers, Reuters reported.

President-elect Donald Trump has yet to appoint someone to lead the watchdog next year, but experts say the industry is likely to take a very different approach to regulation under the next administration.

Trump ally Elon Musk, meanwhile, has spoken about abolishing the agency entirely.

Cardholders amassed a stockpile of points worth more than $34 billion in 2023, according to annual reports from major card companies American Express, Capital One and JPMorgan Chase.

Inflation is starting to erode the value of points as users redeem them directly through a bank’s portal or online app.

However, the exchange rate for points changes when you transfer them from the bank’s portal to a frequent flyer or other points program.

Many airlines have increased the number of points required to book to reflect how prices have risen due to inflation.

Other airlines now price fares for point users more similarly to how they determine cash value for flights.

For example, in 2015, Delta switched its points rates from a fixed pricing model to dynamic pricing based on timing and customer demand.

Other airlines, such as American and United, have since done the same.

Credit card issuers have generally offered points more liberally in recent years since the pandemic, Tiffany Funk, president and co-founder of Point.Me, which tracks credit card reward values, told The Wall Street Journal.

That’s instead of increasing the value of rewards to keep up with inflation.