America’s retirement savings bounce back! Average 401(K) balance shot up 15% in 2023 thanks to booming stock market

The average 401(K) balance shot up 15 percent in 2023 thanks to a booming stock market and an increase in the number of employees contributing to their plans.

New data from Bank of America (BofA) shows that savers had an average of $86,820 in their accounts at the end of 2023, compared to $75,045 in the same period in 2022.

And gains were boosted by a booming stock market, with the S&P 500 up 24.2 percent for the year.

The findings come after a turbulent few years for American retirement savings, as rising costs of living forced many to take out loans and cut hardships out of their plans to make ends meet.

But the latest data from BofA suggests the tide is starting to turn. The percentage of savers borrowing through their plans fell from 2.5 percent to 2.3 percent between the third and final quarters of 2023.

The average 401(K) balance shot up 15 percent in 2023 thanks to a booming stock market and an increase in the number of employees contributing to their plans

Similarly, the hardship withdrawal rate fell from 0.59 percent to 0.57 percent.

Lorna Sabbia, head of retirement and personal wealth solutions at BofA, said: “We were encouraged to see more plan participants taking positive actions on their accounts in the fourth quarter.

“These insights indicate that people are prioritizing their retirement savings, with more workers increasing their contributions and receiving fewer benefits.”

BofAs Participant Pulse The report uses data from 4 million people enrolled in its clients’ employee benefits programs.

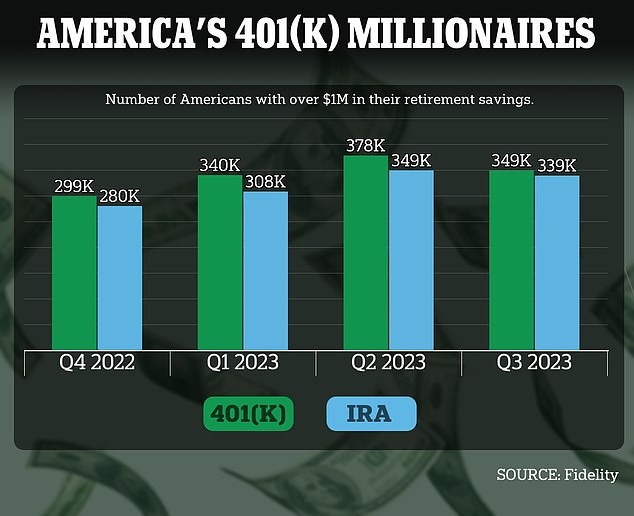

It comes after a separate report from Fidelity Investments showed the number of savers with $1 million in their retirement accounts had risen by around 100,000 people by 2023.

According to Fidelity Investments, some 349,000 401(K) owners and 339,000 workers with an individual retirement account (IRA) ended the year with a seven-figure balance.

Although there is a slight decrease from earlier this year, the number is still well above 2022 levels, when the figures were 299,000 and 280,000 respectively.

A 401(K) is an employer-sponsored plan to which employees often contribute directly from their paychecks. An employee’s contributions are often matched by the employer.

By comparison, IRAs can be opened by anyone, including freelancers.

Those who have managed to store a comfortable savings egg claim that it is not as difficult as it seems.

Caroline Eby told DailyMail.com that she is getting closer to the $1 million mark, despite never making more than $80,000 in her life.

The number of savers with $1 million in their retirement accounts will increase by about 100,000 people by 2023, thanks to the booming stock market

Caroline Eby, 57, pictured, told DailyMail.com she is closing in on the $1 million mark despite never making more than $80,000 in her life

The Washington, DC-based finance worker said, “I started saving at age 25, when I was making $22,000 a year in manufacturing.

‘Every year I increased my contribution by 2 percent if I could afford it. I have maximized my contribution at about 12 percent.”

She added: “I have never married and have always been completely self-sufficient. I am so happy and proud of myself for the sacrifices I made 30 years ago.

“Like everyone told me, slow and steady wins the race.”

Eby had $990,000 in her account two years ago, but then lost $100,000, something she blamed on the broader economy. Now her account is “on its way back up,” she said.