America’s insurance crisis: How the average family’s home and car cover ballooned to $3,700 a year following series of painful premium hikes

The skyrocketing costs of car and home insurance are increasingly weighing on cash-strapped Americans.

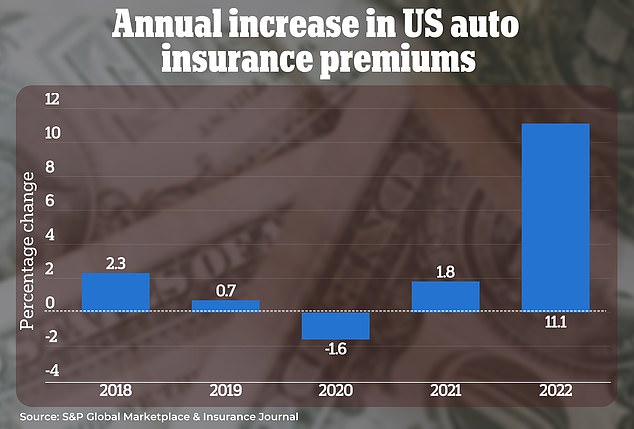

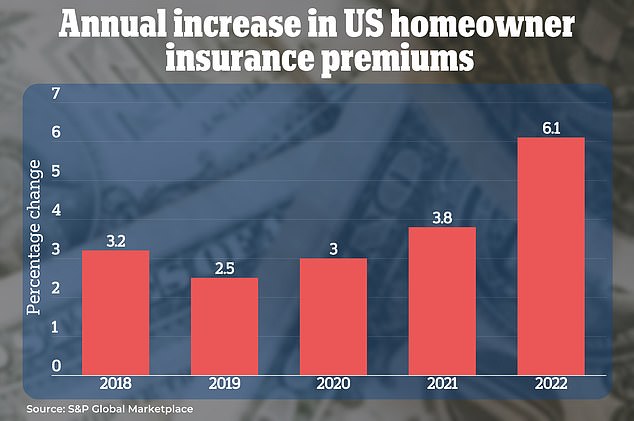

In 2022, the average price of both types of insurance saw the biggest spike in more than five years.

And according to analysis from S&P Global Market Intelligence, interest rates are expected to rise by an even greater amount this year. Within the first seven months, both were up double digits.

Higher premiums are caused by a number of factors, such as the increasing number of extreme weather events and costly car accidents. Partly due to inflation, insurance companies are faced with higher costs to settle claims.

US auto insurers are rapidly increasing premiums in their attempt to offset historically poor performance, data from S&P Global shows

Rising premiums are driven by a number of factors, including more frequent devastating weather events and costly car accidents. Pictured is a flooded house in Florida in November

According to the latest analysis from Forbes Advisor, the average cost of home insurance is the same $1,582 per year for a policy with $350,000 coverage. And the typical motorist pays $2,150 per year for full coverage car insurance.

That means a household could spend more than $3,700 a year on auto and home insurance alone.

These costs are so high that some people cut back where they can: they opt for home insurance with a higher deductible, or no policy at all.

Adam Katz, 40, from New Jersey, personal finance author and founder of Money for Dads, told DailyMail.com that his car insurance nearly doubled in just three years.

The most recent increase in his premium came in April, when insurer Geico said it would increase the monthly insurance payment for his two cars from about $230 to $270.

Adam Katz, 40, is a personal finance author and founder of Money for Dads. His Geico car insurance nearly doubled in three years

In just over a year, its rates have increased 23 percent — about the same as Geico's average national rate change, according to data from S&P.

'I called them and said, 'We don't use insurance much. We don't drive the cars that much. Why are you increasing it?'' he shared. “They said our costs have gone up, we have to pass that on to you.”

Katz pointed out that he could handle the higher costs, but noted that such a significant change in monthly expenses could be critical.

“For people who say it fluctuates, say $30 or $50, who have an hourly job and make minimum wage, that's a problem,” he said.

The walk he experienced was not abnormal. According to data from S&Paverage insurance costs increased by 11 percent last year. They had already increased by the same amount in the first seven months of 2023 alone.

Texas had seen the highest cumulative interest rate increase of 37.6 percent in the past 20 months. Illinois, Ohio, Tennessee, Nevada, Arizona, Illinois and Utah also saw rate increases of 30 percent or more.

According to Lynne McChristian, director of the Office of Risk Management and Insurance Research at the University of Illinois at Urbana-Champaign, there has been an increase in the frequency and severity of accidents.

“There is a spike in accidents,” she told DailyMail.com. “There has been an increase in fatalities and accidents, and data shows people are driving more recklessly.”

Homeowners insurance premiums rose 6.1 percent last year. And in the first nine months of this year, through September 1, interest rates had already risen 8.8 percent, according to S&P data.

Within its first six months, Geico had already raised the average national interest rate by nearly 8 percent, according to S&P data

Similarly, says Charles Nyce, associate professor of Risk Management and Insurance at Florida State University's College of Business told DailyMail.com that bad weather, coupled with increasing amounts of fraud, was driving up the cost of home insurance.

“In Florida we have a huge exposure to hurricanes, number one and number two, we also had some fraud issues in the market. So insurance companies suffered significant losses,” Nyce said.

According to separate homeowners insurance data from S&P, premiums rose 6.1 percent last year. And in the first nine months of this year, through September 1, interest rates had already risen by 8.8 percent.

The highest increase in the US occurred in Arizona, where insurers collectively increased their rates by an average of 18.4 percent. A 16.4 percent change in Texas was the second largest increase, followed by a 16.3 percent change in Illinois.

Another twelve states had seen double-digit increases. According to Nyce, these rising costs are a significant burden for most households.

'There are studies in the United States that say that 50 percent of households cannot afford an unexpected loss of $500. They just don't have that rainy day fund to cover this,” he said.