America’s inheritance crisis: Only 46% of over 55s have a will in place – and experts warn it could be catastrophic for their heirs

Fewer than half of people over 55 have an estate plan – and experts warn it could have disastrous consequences for their families.

Only 46 percent of Americans over the age of 55 have a will study by healthcare provider site Caring.com.

The number of households that plan to divide their assets after death is also steadily decreasing. In 2020, 48 percent of people over 55 had a will, the research shows.

Younger Americans are even less prepared; only 26 percent of 18-34 year olds and 27 percent of 35-54 year olds have an estate plan.

When someone dies without a will in place, families are faced with the difficult and often costly task of untangling their affairs – which can become increasingly painful depending on state laws.

Fewer than half of people over 55 have an estate plan – and experts warn it could have disastrous consequences for their families

When someone dies without a will or trust, the local court takes over the administration of the estate – a process known as probate.

Experts warn that problems may then arise within the family left behind.

The family home is often the most valuable asset, and this is usually passed on to the children when the last living parent dies.

“It’s not easy to divide a house,” says Gal Wettstein, a senior research economist at Boston College. USA today.

Survivors may disagree about whether to keep or sell the home, and what to do about property taxes. If things go wrong, a legal battle between siblings could result in expensive costs or the property could be sold at a loss.

“You can end up wasting a lot of the asset,” he said.

Similar problems can arise with a family business or other valuable or valuable asset.

Wettstein also warned of problems facing non-traditional families – which are becoming increasingly common in the US.

State laws may not apply to single-parent families or cohabiting partners who are not married.

For example, if an unmarried partner dies, Wettstein warned, “the state does not necessarily recognize that the other is an heir.”

Only 46 percent of Americans over the age of 55 have a will, according to a survey by healthcare provider site Caring.com

Wettstein added that the decline in wills reflects the growing diversity of America’s senior population.

A Boston College analysis found that black and Hispanic families are less likely to have a will than non-Hispanic white families.

Between 1992 and 2018, Hispanic Americans were found to be 23 percent less likely to have an inheritance than non-Hispanic white people with similar socioeconomic profiles.

According to Caring.com, 39 percent of white people reported having a will, compared to 29 percent of black people and 23 percent of Hispanics.

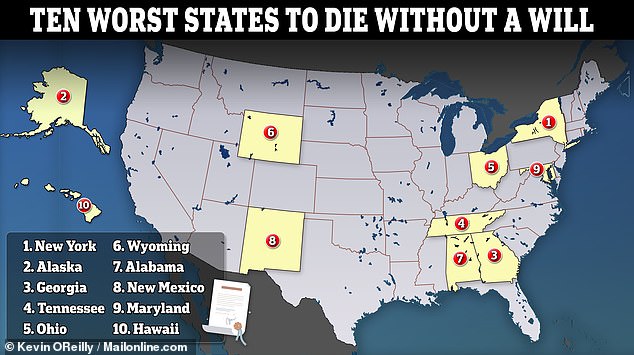

A separate study by Caring.com found that New York is the worst place to die without a will, followed by Alaska, Georgia and Tennessee.

This is due to complicated guardianship laws in those states, meaning a child of the deceased is forced to live with a court-appointed guardian instead of their preferred choice unless there is a will.

New Jersey is the worst state for probate, the study found, because families can wait more than a year to complete the process.

Researchers ranked New York as the worst place to die without a will, followed by Alaska, Georgia and Tennessee

It comes as financial planners warn that estate planning is becoming increasingly complicated due to the sheer number of accounts Americans now own that have beneficiary forms attached to them.

These include life insurance policies, pension pots and even some bank and broker accounts.

If these accounts name the wrong beneficiary, their entire value could be transferred to that person, regardless of what your will or other estate plans say.

Florida financial planner Paxton Driscoll told DailyMail.com: ‘The most important thing for older people to make sure is that their affairs are all in line.

‘Lawyers love to charge money wherever they can, so families need to be crystal clear about who the beneficiaries of their estates are.

“People come to me all the time and find out that their ex-wife is actually listed as a beneficiary on some financial account.

‘Most assume that the bank will let you know if something is wrong, but it is up to you to stay on top of it.’