America’s homebuyers are older than ever – with the median age now 49 – as rising college costs and shaky job security make it more difficult for younger people to enter the market

- Research from the National Association of Realtors shows that the average age of American homebuyers is now 18 years older than it was in 1981

- BankRate senior economic analyst Mark Hamrick blamed the rising costs of higher education, job insecurity and the burden of retirement savings.

The average American homebuyer is now 49 years old – 18 years older than in 1981 – as inflation, college costs and home prices make it harder for young people to get a foot on the ladder.

Research from the National Association of Realtors has shown that the average age of all homebuyers has risen steadily over the past four decades.

The most shocking contrast applies to first-time buyers: the average age is now 35, compared to 31 in 2013 and 29 in 1981.

The NAR attributes this to ‘both the tightened credit conditions and the lack of inventory on the market, which caused home sales prices to rise’.

The median home price this year was $410,200, the second highest since NAR started keeping the data.

The average age of homebuyers has risen steadily over the past forty years

This year, only 3 percent of all buyers were between 18 and 24 years old.

According to Jessica Lautz of the NAR, the number of starters on the housing market is at a ‘historical low’, but has increased slightly compared to last year.

She said: “First-time buyers tiptoed back into the market this year, with less competition and fewer multi-offer scenarios.

‘Although the share of starters is still at a historic low, it is higher than last year.’

In addition to getting older, starters also become richer.

Ms Lautz said: ‘In particular, current first-time buyers had household incomes almost $25,000 higher than last year and are more likely to use financial assets to enter the market.’

She told Axios: “We’re talking about a different homebuyer profile today. We are displacing anyone looking for affordable housing.”

BankRate senior economic analyst Mark Hamrick said the rising costs of higher education, job insecurity and the burden of retirement savings “have made it harder for younger people to gain a foothold with their personal finances.”

House prices this year were the second highest on record, making it harder for young people to get a foot on the ladder

It comes after analyst Meredith Whitney warned that younger people are missing out on $21 trillion in equity that older generations have built through home ownership.

Whitney, once dubbed the “Oracle of Wall Street” for accurately predicting the 2008 financial crisis, said young people have been priced out of the housing market due to high mortgage rates and rising prices.

The average age of repeat buyers has also risen from 36 in 1981 to 58 this year.

The numbers are part of an overall shift in the demographics of average American homebuyers.

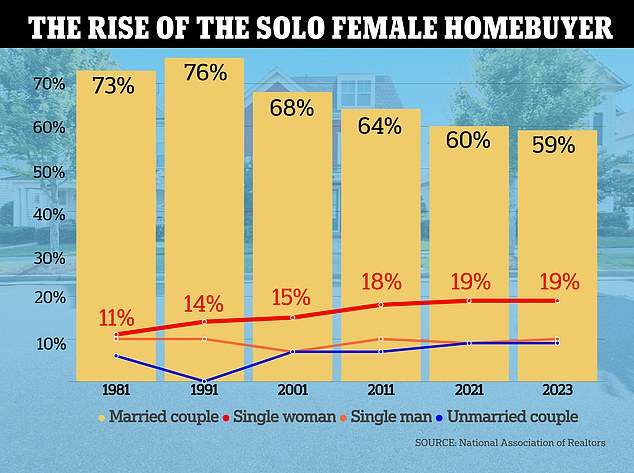

While home buying has traditionally been the preserve of married couples, homeowners in the U.S. are now increasingly single women.

Female real estate buyers alone now make up 19 percent of U.S. homebuyers – nearly double that of single men

Female buyers alone now make up 19 percent of U.S. homebuyers — nearly double that of single men — according to the latest figures. facts of the National Association of Real Estate Agents (NAR).

This is in stark contrast to forty years ago, when the share of single women and men buying a house was about the same: 11 percent and 10 percent respectively. As of 2023, the share of single men buying property has remained stable at 10 percent.

According to the NAR, the share of recent buyers who are married has also fallen to 59 percent – the lowest level since 2010.

In 1981, when the organization began analyzing the profiles of buyers and sellers, married couples made up 73 percent of homeowners.