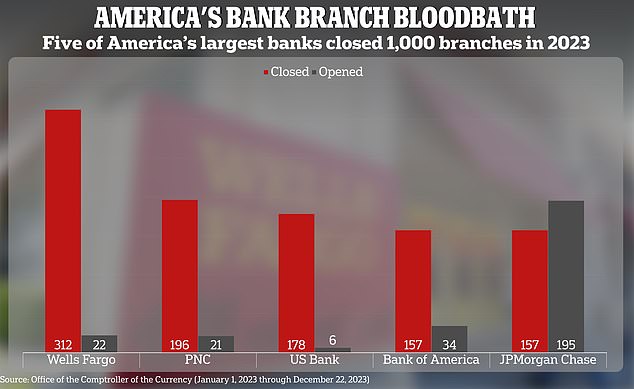

America’s bank branch bloodbath laid bare: More than 1,500 banks were shut in 2023 – with Wells Fargo, PNC, US Bank and Bank of America closing the most

Banks closed branches in California and the Midwest at a higher rate than elsewhere this year, as the continued elimination of expensive brick-and-mortar locations leaves a growing number of Americans without access to basic financial services.

Dozens of banks have filed notices to close a total of 1,566 branches between January 1 and December 22, according to data from their regulator, the Office of the Comptroller of the currency (OCC). In contrast, they only informed the regulator of plans to open 472.

And the closures are palpable. DailyMail.com has received emails from concerned readers that they now have to travel further to access a bank.

California had by far the largest net closures, losing an average of 300 branches. The Seattle area also lost more than a dozen locations, while gaining just two.

Dozens of banks filed notices to close a total of 1,566 branches between Jan. 1 and Dec. 22, according to data from the Office of the Comptroller of the currency

But the rapid withdrawal of banks from some regions has been perhaps most pronounced in the Midwest. Michigan lost 36 locations during the year, but gained none. Illinois lost 60 branches and gained 18.

One reader said they now had to cross state lines to get to the bank.

“PNC closed our local branch which was three miles away, and now I indicated going to a neighboring town or across the river to Ohio to make deposits or other banking needs,” they wrote. “It's totally inconvenient and as a senior, the extra mile is a waste of gas.”

Another older reader from the early 1980s pointed out that driving long distances is not always feasible.

“This is all very disturbing for both my husband and me,” they said. 'We have already had several closures of our banks and have to drive further and further to find our banks. What happens if we can't drive anymore?'

A banking desert is a neighborhood with no bank branches or within 10 miles of downtown.

Only a handful of states – Arkansas, Mississippi, Nebraska, Oklahoma, South Carolina, Tennessee, West Virginia and Wyoming – experienced a net gain in establishments.

West Virginia was the only state not to lose a single bank branch all year.

The majority of Americans are concerned about widespread bank branch closures, which are hitting lower-income households the hardest.

Wells Fargo led the charge, filing to close 312 branches. Wells Fargo filed in November to close 15 branches in one week.

It was followed by PNC and US Bank, which reported 196 and 178 closures, respectively. Bank of America and Chase have both filed to close exactly 157 branches.

Citibank was a notable outlier among major national banks, filing only eight banks for closure during the entire year. Meanwhile, certain smaller banks also closed a significant number of branches.

Santander, headquartered in Boston, said it would close 61 of its roughly 500 locations. About 38 of those closures were planned in Massachusetts.

Wells Fargo led the charge, filing to close 312 branches. JPMorgan Chase opened more than 40 percent of the total 472 banks reported during the year

Citizens Bank said it would close 85 branches — nearly 10 percent of the roughly 1,000 nationwide.

JPMorgan Chase stood out because it was one of the few banks that filed to open more banks than it said it would close. It reported to the OCC that there were 195 openings – that's more than 40 percent of the total 472 reported by all banks during the year.

Similarly, TD Bank said it would close just one branch in Maine but open 24.

A spokesperson for Bank of America told DailyMail.com that it was closing branches in response to declining customer traffic.

“What we're seeing across the industry is our customers using digital banking for more of their everyday needs. “They only come to our financial centers when they want to have a conversation about their finances or something a little more complex,” they said.

As consumer habits change, the way banks are structured will also change, the spokesperson said.

In the past, Bank of America branches were arranged so that the counter was at the front. That line is now often located at the back of the branch to make room for customers to meet private bank employees closer to the entrance.

Although the majority of consumer banks have closed branches in recent years, the scale of the reduction may be leveling off, the spokesperson suggested.

Another Wells Fargo spokesperson, Amy Amirault, also told DailyMail.com that the bank is evolving with its customers.

“As customer preferences and transaction patterns change, so will our locations,” she wrote in a statement. 'For example, we can open new branches by merging two older existing branches into one better located location.'

Despite closing more than 300 U.S. locations, Wells Fargo has only notified the regulator of 22 openings in 2023. The photo shows a Wells Fargo Bank in Aspen, Colorado.

But an exclusive DailyMail.com poll earlier this year found that 51 percent of consumers said they were very or somewhat concerned about the declining number of bank branches.

It also found that physical services were less accessible to Black Americans. While 14 percent of black Americans said they don't have a local chapter, only 8 percent of white Americans did.

When a bank closes a branch, it must submit an application to the supervisory authority.

In a statement to DailyMail.com, an OCC spokesperson said, “The OCC understands the importance of bank branches and is committed to supporting access to banking services in all communities.”

The watchdog also said that while banks and credit unions must notify the “primary regulator of closures,” the law requiring them to do so does not allow them to object.

The majority of Americans are concerned about widespread bank branch closures, which are hitting lower-income households the hardest.