AIM turns thirty: the junior market is mature

Fast fashion retailer Asos, luxury tonic water maker Fever-Tree, budget airline Jet2 and pizza franchise Domino’s may sound like a handful of household names, but they have one thing in common.

They all started life as listed firms on London’s junior AIM share market, which celebrates its 30th anniversary this year.

The Alternative Investment Market was launched in June 1995 to provide small and medium growth companies with access to capital. Since then, it has admitted more than 4,000 companies, raising a total of more than £135 billion.

According to the latest statistics, AIM-listed companies will have contributed £68 billion to the UK economy and supported 770,000 jobs by 2023.

According to analysis by accountant Grant Thornton, the direct economic contribution of AIM companies has grown by 6.6 percent over the past four years.

But as AIM enters its thirtieth year, it faces an existential threat.

High flyers: Jet2, Domino’s Pizza and Asos are success stories

Experts have warned that the market is shrinking, with one in three AIM-listed companies vulnerable to a takeover.

Loungers, the owner of casual dining chain Cozy Club, agreed in November to be bought by a US private equity firm for £338m.

And last week retailer Quiz said it would go private, saying AIM was “unlikely to provide significant additional or more cost-effective financing options” than can be achieved privately.

This came after a series of high-profile exits in previous years.

Online estate agent Purplebricks folded in 2023 after shareholders voted to sell the company for just £1 following a series of profit warnings.

Luxury confectionery chain Hotel Chocolat exited the market when it was sold to Mars for £534 million last year.

Over the past thirty years, AIM has also built up something of a ‘Wild West’ reputation.

Collapses can be sudden and unexpected, while the stock market’s reputation has been clouded by accounting scandals at Healthcare Locums and Patisserie Valerie.

As a result of the ‘light touch’ regulations, some say it is a home for speculative, flashy, high-risk companies.

And in a further blow to the stock market, Labor Chancellor Rachel Reeves announced in the Budget that all AIM-listed shares would be subject to 50 per cent inheritance tax from April 2026.

Currently, there is a 100 percent tax credit on shares held for two years at the time of the owner’s death, with some exceptions.

Susannah Streeter of investment platform Hargreaves Lansdown said: ‘This small change could have a big impact when it comes to creating a nurturing environment for entrepreneurial businesses.’

Caroline Simmons, chief investment officer at asset manager Quilter Cheviot, added: ‘Depressed valuations are likely to see foreign buyers circling AIM-listed companies in 2025. This could drive investors towards less transparent and potentially riskier unlisted portfolios.”

But there are also success stories in the growth market: companies have moved to the main market and become household names after sinking their teeth on AIM. Dan Coatsworth, investment analyst at investment platform AJ Bell, said: ‘AIM has been a good place to support small and medium-sized businesses as they grow. Many companies have been able to tap investors on a regular basis for money to support their growth plans, and many have done great things.”

Asos started life as a PLC on AIM before moving to the main market in 2022. Domino’s Pizza UK discontinued Aim in 2008 as it entered the key market.

Other household names still listed on AIM include Vimto maker Nichols and fashion retailer Boohoo.

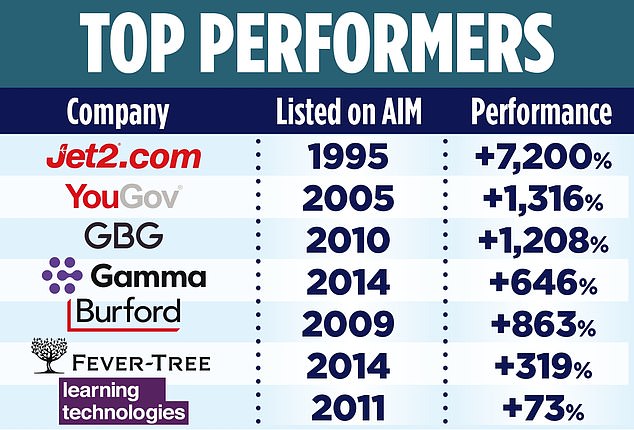

Only ten companies that joined the exchange at the opening are still trading on Aim. Of these, Jet2 is by far the best performing. An investor who bought £1,000 worth of Jet2 shares on the first day of trading in 1995 and held on to them would be sitting on £73,000 today. Coatsworth said: ‘Starting as a flower transport business, it morphed into a wider air and road freight business, but the turning point was the launch in 2003 of a scheduled passenger airline.

‘It is now a serious competitor for easyJet and Ryanair. It has also minted investors.”

In a quiet year for UK listings, there were ten IPOs on AIM, including restructuring specialist Rosebank Industries, games developer Winking Studios and salt substitute Microsalt.

Half of the new visitors came from US companies and the average year-to-date price performance has increased by 44.4 percent, according to data from the London Stock Exchange Group.

In AIM’s 30th year, city experts called on the government to recognize its importance to the UK economy. Simmons said: ‘The success of AIM is crucial for Britain as it often serves as an entry point for companies to go public domestically.

‘Without adequate support, companies may seek private funding and choose to list on international markets, weakening Britain’s market position. At the very least, we would urge the government to commit to maintaining the tax position on AIM for at least ten years to provide stability and increase its attractiveness.”

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.