Adjustable Mortgage Rates (ARM) gain popularity – but experts warn they can be high-risk

Adjustable rate mortgages (ARMs) are growing in popularity, but experts warn they can be high risk

They earned a bad reputation thanks to their role in the housing market collapse of the early 2000s.

But it appears adjustable-rate mortgage deals are making a comeback as homebuyers try to ease the pain of rising loans.

ARM deals offer a fixed interest rate for a set period of time, usually five, seven or 10 years. It will then be reset in accordance with the current market interest rate.

According to figures from the Mortgage Bankers Association (MBA), 9.2 percent of all loan applications last week were for ARM deals.

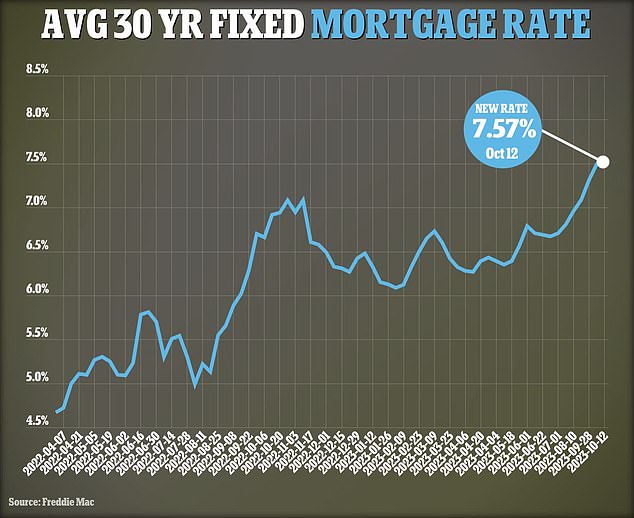

It’s the highest percentage of buyers who have signed up for the deals since November 2022, when rates were also above 7 percent. The interest rate on a 30-year fixed-rate loan is now hovering at a 20-year high of 7.57 percent, according to data from government-backed lender Freddie Mac.

The average 30-year interest rate rose to 7.57 percent on Oct. 12, according to data from government-backed lender Freddie Mac.

But separate figures from the MBA show that interest rates on a 5/1 ARM loan have fallen from 6.49 percent to 6.33 percent, making them more attractive to buyers. Stronger regulation has also made ARMs less risky than they were in the early 2000s.

MBA CEO Bob Broeksmit said: “Mortgage applications increased for the first time in three weeks, thanks to a 15 percent increase in ARM applications.

“With mortgage rates well above 7 percent, some potential homebuyers are turning to ARMs to lower their monthly payments in the short term amid these high mortgage rates.”

However, experts have repeatedly sounded the alarm about these types of deals.

Andrew Lokenauth, founder of TheFinancialNewsletter.compreviously told DailyMail.com that homebuyers should avoid ARMs because if prices rise, they will end up paying more.

‘A fixed rate is best because you can budget for it.’

He added that mortgage rates are likely to remain high for the foreseeable future.

Similarly, Kansas financial planner Kaylin Dillon told CNN, “I only suggest getting an ARM if you can afford to make excess mortgage payments large enough to pay off the loan in full before the fixed interest period of the loan expires.

‘This way you can pay off your home at the lower interest rate, without the risk that the interest will rise significantly at the end of the fixed period.’

Homebuyers are currently facing a perfect storm of rising home prices and rising mortgage rates.

Mortgage rates have been pushed up by the Fed’s aggressive rate hike campaign, taking them from near zero to between 5.25 and 5.5 percent.

Although the Fed’s fund rate does not directly determine mortgage rates, it does influence them.

Instead, lenders track the yield on 10-year U.S. Treasury bonds, which is determined by the Fed’s actions, investor reactions and predictions about what the Fed will do next.

Andrew Lokenauth, founder of TheFinancialNewsletter.com, previously told DailyMail.com that homebuyers should avoid ARMs because if prices rise, they will end up paying more.

As a general rule of thumb, when government bond yields rise, mortgage rates follow suit. The same goes if they refuse.

Last week, the Mortgage Bankers Association, the National Association of Realtors and the National Association of Home Bilders wrote a letter urging the Fed to stop raising interest rates.

Fed officials will next meet on October 31 to discuss the possibility of a rate hike, but experts largely expect rates to remain stable at current levels.