Activist Gatemore calls for sale of YouGov after ‘missteps’ by management

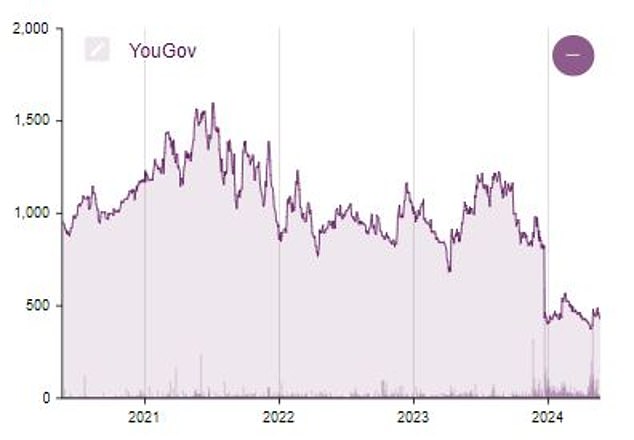

- YouGov shares have lost more than 70% since their December 2021 peak

Gatemore Capital Management disclosed a position in YouGov on Wednesday as it broke cover to demand the company be put up for sale.

The activist investor blamed a series of management ‘missteps’ for a share price fall of more than 70 per cent since the research and data analytics group’s all-time high of 1,600p in December 2021.

Investors in YouGov, which was co-founded by former Chancellor Nadhim Zahawi, have had a torrid year despite a busy global election schedule.

‘Challenges’ in YouGov’s European, Middle East and African markets led to a profit warning in June, while a full-year dividend increase last month was not enough to revive the shares after falling more than 60 percent since early 2024.

Gatemore told the Sohn London Investment Conference that YouGov had eroded investor confidence by failing to provide “sufficient, timely” financial guidance, while a lack of “clarity” has led to a “major gap between the management plan and the market consensus ‘.

YouGov’s intervention follows previous demands from Gatemore made to London-listed companies this year.

YouGov shares have fallen more than 70% since their 2021 peak

The activist last month called on Watches of Switzerland to leave the City for the US, while Gatemore’s long-running campaign for the removal of Elementis boss Paul Waterman finally proved successful early this week.

Gatemore also highlighted YouGov’s membership of AIM as an “obstacle” to a revaluation of its share prices, lashing out at the group’s executive directors who “collectively own less than 0.05 percent of the company’s shares.”

The activist said YouGov is “an attractive company with some fundamental strengths” but the share price does not reflect this.

Gatemore is not a top shareholder in YouGov and his stake in the company is not large enough to be made public.

Gatemore director Liad Meidar

YouGov’s website states that its main shareholders are Liontrust Asset Management, Abrdn and Octopus Investments, which own 7.9, 7.4 and 6.1 percent of the company respectively.

It called on YouGov to undertake a strategic review ‘with a view to unlocking shareholder value’, with a full sale being the ‘most direct route’ to this end.

Gatemore managing director Liad Meidar said: “We have great confidence in YouGov’s fundamental strengths and long-term potential.

“However, urgent actions are now needed to help the company chart a path towards realizing its intrinsic value.

‘YouGov could thrive under new ownership, leaving behind its current governance problems and the malaise of a stock exchange listing on AIM.’

YouGov did not respond to a request for comment.

The YouGov share continued to struggle this year, despite a busy global election schedule

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.