According to the latest Rics survey, the property market will recover this year

Estate agents and surveyors predict the property market will recover in the coming months, according to the latest research from the Royal Institution of Chartered Surveyors (Rics).

It said its members were seeing an increasing number of inquiries from buyers, with more sellers entering the market.

The closely watched monthly survey takes the temperature of Rics members and provides a snapshot of what’s happening in the property market across the country.

Demand is rising: A total net balance of +8 percent of agents surveyed saw an increase in new buyer inquiries in March – the most positive result since February 2022

According to the survey, buyer demand continued to rise last month and was the most positive in more than two years.

This means that more and more Rics members reported more buyer inquiries in March.

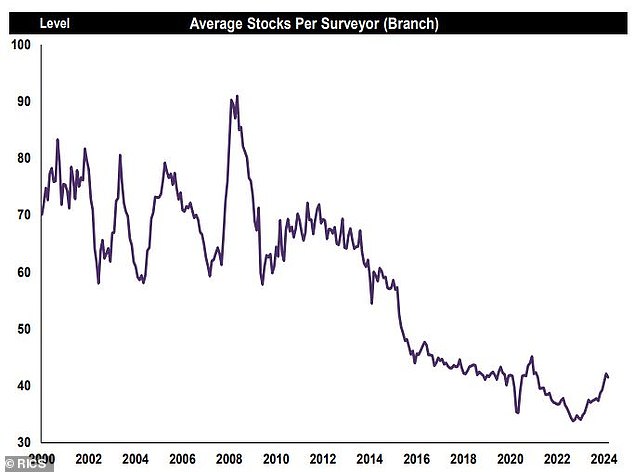

Rics members also report that more houses are coming up for sale. According to the research, the flow of new listings has increased for the fourth month in a row.

Looking ahead, more and more estate agents and surveyors are predicting a further improvement in activity in the coming months.

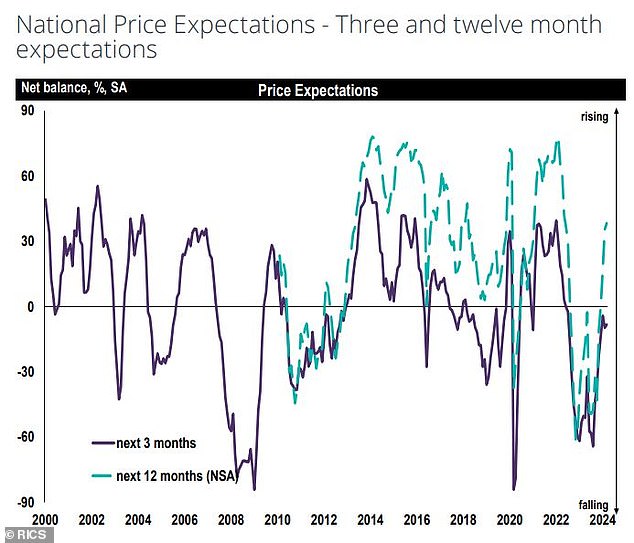

When it comes to house prices, Rics members have become much less gloomy than at the end of last year.

In September 2023, the vast majority of estate agents and surveyors expected house prices to fall.

Fast forward to March this year and the sentiment is more or less neutral, suggesting that there is now a more stable picture for house prices.

In fact, more real estate agents than not think house prices will rise over the next twelve months.

More supply: The flow of new properties coming onto the sales market has increased for the fourth consecutive report, according to Rics

Tarrant Parsons, senior economist at Rics, said: ‘Demand continues to gradually recover in the UK housing market, with the number of new buyers rising for the third month in a row according to the latest survey feedback.

‘Now that inflation has become somewhat less difficult recently, this has led to expectations that the Bank of England may cut interest rates later this year.

“This should continue to support the market to some extent going forward.

‘Consistent with this, near-term sales expectations point to an improving outlook, although the scope for an acceleration in activity will still be relatively limited as mortgage rates are expected to remain much higher than in 2020/21.’

What happens to house prices? Rics brokers currently have a neutral view, while 12-month forecasts point to an upward trend

What are Rics members across Britain saying?

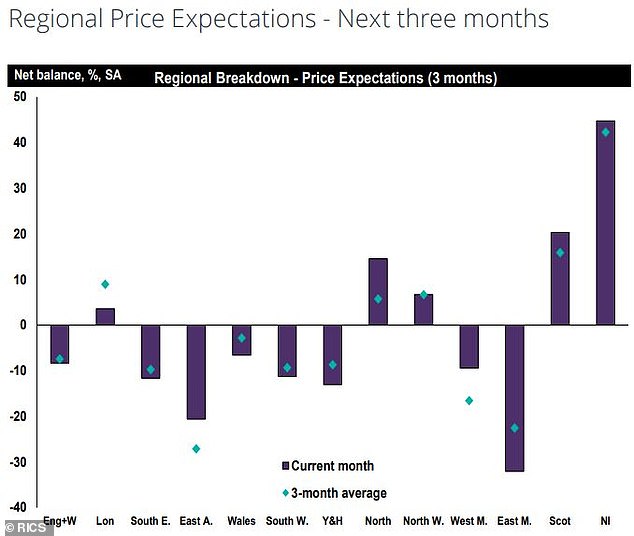

House prices are expected to rise in all parts of Britain over the coming year, with sentiment particularly robust in Northern Ireland, London and Scotland.

Nicola Kirkpatrick, member of Rics in Belfast, said: ‘Prices remain high thanks to demand in the area, and new listings are quickly turning into sales.’

Joe Arnold, a Rics member based in London, said: ‘London is very busy (with) good levels of supply and demand. We have had our best start to the year since Brexit.

‘Some sealed bids are back and customers are paying the asking price for some prime properties. Good foreign interest too.’

Chris Hall, a Rics member from Edinburgh, added: ‘The market has been busier and more active in the first three months of 2024 than in the last three months of 2023.

“There has been encouraging sales activity, especially in urban areas, where supply is greater than in rural areas.”

All rising: Rics members believe all parts of Britain will see house prices rise over the next year, with sentiment particularly robust in Northern Ireland, London and Scotland

Meanwhile, Rics members in the East Midlands and East Anglia appear to be the most gloomy about the outlook for house prices.

Some real estate agents report a shortage of homes to sell, while others suggest homes are struggling to find buyers.

Peter Buckingham, a Rics member based in Market Harborough in Leicestershire, said: ‘Activity levels are showing signs of recovery as we head towards the traditionally busy Spring market. There is still a shortage of available inventory, which is holding the market back.”

Stephen Gadsby, a Rics member based in Derby, added: ‘It’s still a fragile market, although (there are) early signs of more market activity. Realistically priced properties will sell.”

Mark Wood, a Rics member based in Cambridge, said: ‘After a busier than expected February, March disappointed as overall activity did not increase as hoped.

“Perhaps after Easter, with better weather and increasing expectations of rate cuts, there will be more activity.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.