A quarter of Americans still have holiday debt from 2022 – as experts warn shoppers that soaring interest rates mean it could take 40 MONTHS to pay off a $1,000 credit card bill

As shoppers head to stores or look for Black Friday deals online, experts warn that a quarter of Americans are still in debt from last year’s holiday spending.

This is evident from a study by the personal finance site WalletHub24 percent of Americans will still pay off their remaining credit card balance as of 2022.

Nearly a fifth of Americans admitted they would get a new credit card this year to pay for holiday groceries, the survey found.

It comes as credit card balances rose by $48 billion to $1.08 trillion in the third quarter of this year, as Americans continue to grapple with the impact of persistent inflation on household budgets.

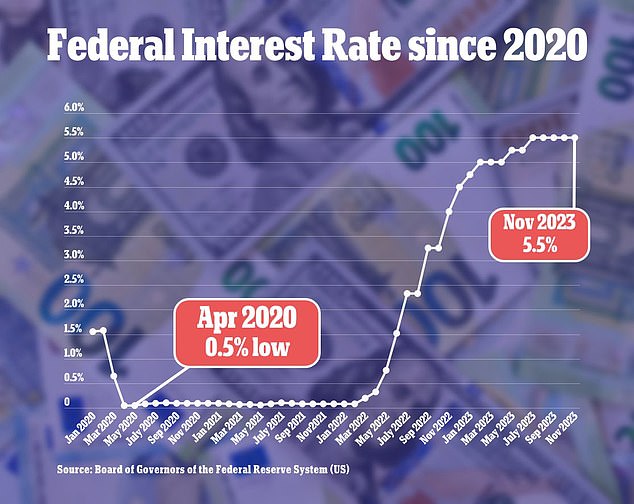

Benchmark borrowing costs are now at their highest levels in decades, between 5.25 and 5.5 percent, following an aggressive campaign of rate hikes by the Federal Reserve.

Combined US household debt rose by $228 billion to $17.3 trillion in the third quarter of this year

Higher interest rates mean it could become more expensive and take longer to pay off outstanding debt, experts warn.

According to Bankrate, the interest rate on an average credit card is approaching 21 percent this month.

Ted Rossman, senior industry analyst at Bankrate, said CNBC: ‘Even a more modest balance of $1,000 (perhaps from last year’s holiday gifts) would keep someone in debt for forty months and cost them $390 in interest if they made only minimum payments at the current average rate of 20.72 percent .’

“If you’re in a hole, stop digging,” he said.

Rossman recommends using a credit card such as a debit card by paying the full amount to avoid interest.

Americans should also take advantage of credit card rewards programs and buyer protections, he told the newspaper.

If you’ve already collected rewards, Rossman says, the holidays can be an optimal time to use them to your advantage by redeeming points for gift cards or getting cash back.

But he cautioned against taking on more debt just to get rewards on a credit card.

If you’re carrying a balance, high interest charges can eat up any money you can save by using points, Rossman added.

Ted Rossman, senior industry analyst at Bankrate, recommends using a credit card as a debit card by paying in full to avoid interest

The Federal Reserve announced earlier this month that interest rates would remain between 5.25 and 5.5 percent

A record 130.7 million people in the U.S. are expected to shop on Black Friday this year, according to estimates from the National Retail Federation (NRF).

Shoppers plan to spend an average of $875 on holiday purchases — $42 more than last year — with clothes, gift cards and toys at the top of most shopping lists, according to a survey of 8,424 adults conducted early this month by the NRF.

According to Adobe Analytics, online spending on Thanksgiving Day increased 5.5 percent from a year ago, with shoppers spending $5.6 billion on that day alone.

According to the company – which tracks holiday spending habits – that’s almost double the $2.87 billion Americans spent in 2017.