A few key words in Fed boss Jerome Powell’s speech signals when interest rates are coming down

The Federal Reserve left interest rates unchanged for the sixth consecutive year but has signaled that cuts are closer.

Fed Chairman Jerome Powell said a rate cut was possible next month and the central bank made notable changes to its policy statement, suggesting inflation is moving closer to its 2 percent target.

Stocks rose after the announcement, which is good news for U.S. 401(K) accounts.

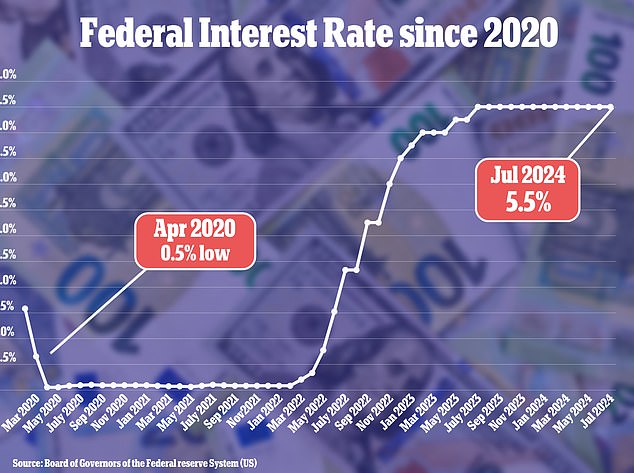

The central bank has kept interest rates between 5.25 percent and 5.5 percent over the past year, a range that guides rates on credit cards, mortgages and other consumer debt products that affect household budgets.

Markets were looking for signs that the Fed will cut rates next month for the first time in more than four years.

The Federal Reserve has kept interest rates unchanged for the sixth year in a row but has signaled it is moving closer to cutting (pictured: Chair Jerome Powell at a news conference after the announcement)

The Federal Reserve kept interest rates between 5.25 and 5.5 percent at its last meeting

Powell said at a press conference after the announcement: “We have not made any decisions about future meetings, including the September meeting.

‘The Committee believes that the economy is moving closer to the point where it is appropriate to cut our policy rate.’

He said this decision would depend on the data, not on a specific response to one or two data releases.

‘The question is whether the totality of the data, the changing outlook and the balance of risks are consistent with increasing confidence in inflation and the maintenance of a solid labour market.

‘If that test is successful, a cut in our policy rate could be on the table as early as the next meeting in September.’

The central bank also significantly revised its policy statement, but did not explicitly commit to a rate cut in September.

The policy statement described inflation as “somewhat elevated,” down from previous months, and said “further progress had been made towards the Committee’s 2 percent inflation target.”

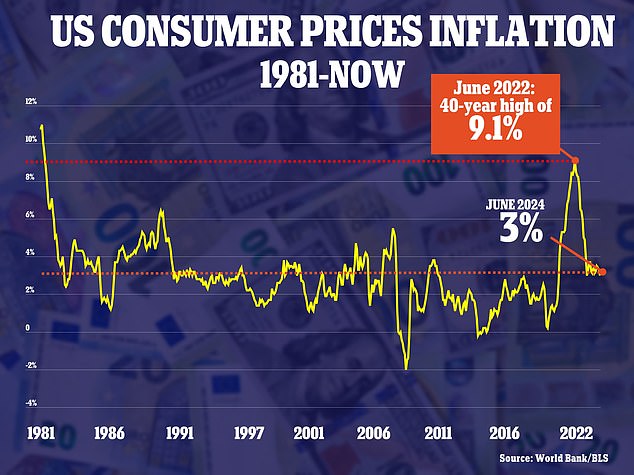

In June, the Fed said only “modest” progress had been made in curbing inflation, which hit a 40-year high two years ago.

“The Committee is of the view that the risks to the achievement of the employment and inflation objectives are increasingly well balanced,” the policy statement said.

This is an improvement on the previous formulation, which placed commitments to reduce inflation and maintain a healthy labour market on a more equal footing.

This shift is important because it suggests that inflation may no longer be a barrier to cutting interest rates, especially if the labor market continues to cool.

At the press conference, Powell added: ‘We’ve had this really significant fall in inflation and unemployment has remained low. And this is a historically unusual and such a welcome outcome for the people we serve.

‘What we’re thinking about all the time is how do we keep this going, and this is part of it. We don’t have to be 100 percent focused on inflation because of the progress we’ve made.

‘The work on inflation is not yet finished, but we can still afford to ease the constraints on our policy rate.’

This follows a series of encouraging data sets on inflation and the health of the US economy.

The annual inflation rate was 3 percent in June, down 0.1 percent from May.

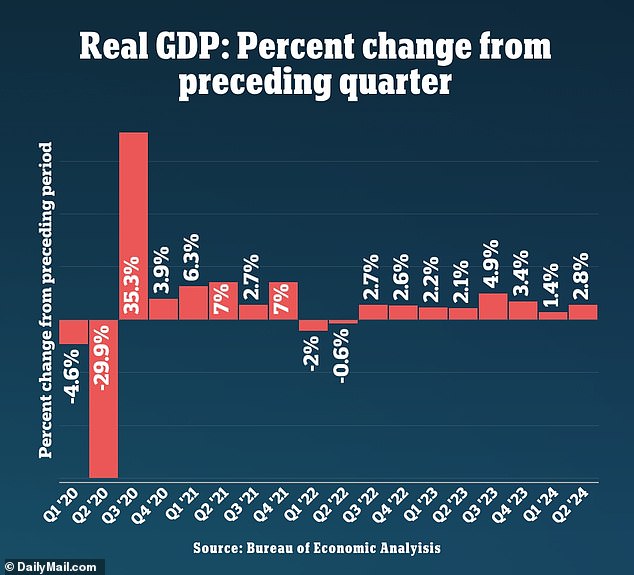

The American economy too accelerated last quarter as consumers and businesses increased spending despite continued pressure from high interest rates.

Economists say this could mean the economy is headed for a so-called ‘soft landing’, which is good news for the stock market.

This rare slowdown occurs when inflation returns to the Federal Reserve’s 2 percent target without triggering a recession.

“There is a change in tone from the Fed,” said Bret Kenwell, U.S. investment analyst at eToro.

“The Fed has focused primarily on bringing inflation back to its 2 percent target, but its attention is now shifting – rightly – to the labor market, which has weakened in recent months.”

Stocks rose after the announcement, good news for 401(K) accounts

The annual inflation rate was 3 percent in June, above the Fed’s 2 percent target.

GDP grew at an annual rate of 2.8 percent for the April-June quarter of 2024

Stocks rose after the announcement, with the S&P 500 up 1.9 percent, the Nasdaq up 2.9 percent and the Dow Jones Industrial Average up 422 points, or about 1 percent.

A strong stock market is good for 401(k) pension funds and other retirement accounts, which are largely invested in these major indices or in stocks of individual U.S. companies such as Apple.

A rate cut would be good news for consumers, as high interest rates keep borrowing costs high and put pressure on household budgets.

For example, credit card interest rates move in line with the Fed’s benchmark numbers, so that would mean a quick cut and provide some relief to borrowers.

Auto loans, student loans and mortgages are not directly affected by the benchmark rate, but would be affected by it.

For example, interest rates on 30-year fixed-rate mortgages are comparable to the yields on 10-year government bonds.

The bonds are affected by several factors, including inflation forecasts, Fed actions and investor reactions to them.