A court forced Realtors to cut fees for sellers – guess what they did next?

House hunters will have to sign an agreement with their agents before viewing homes under major regulatory changes.

The homebuying process has been forced to overhaul following a $418 million ruling that found home sellers have historically been overcharged by real estate agents.

The National Association of Realtors (NAR) – which has 1.5 million members – has ended the practice of the seller’s agent offering commissions to the buyer’s agent. The concern was that buyers were being steered toward homes that earned their agent a higher fee.

The new rules mean homebuyers and their agents will have to sit down together to agree on money before looking at houses. They come into effect on August 17.

However, experts speculate that the changes will likely cost buyers. Until now, buyers did not have to pay their real estate agent a fee, but that is now changing.

The National Association of Realtors (NAR) – which has 1.5 million members – has also agreed to ban the practice of seller’s agents offering commissions to buyers through Multiple Listing Services (MLSs). Pictured: NAR President: Kevin Sears

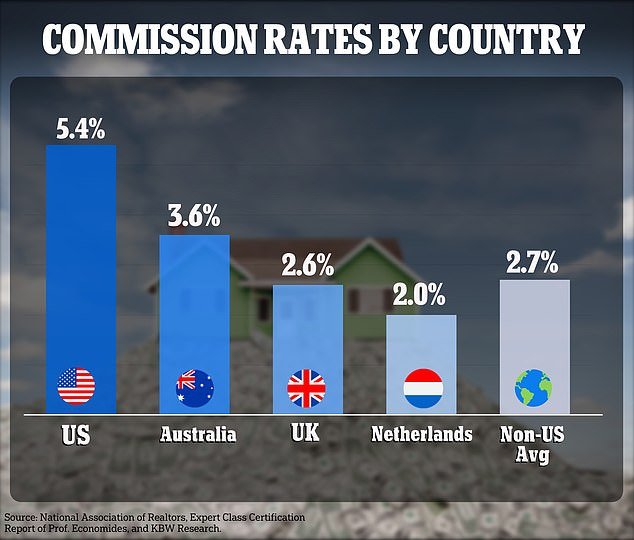

Agents in the US charge home sellers an average commission of between 5 and 6 percent of the sales price of their property. That’s more than double the average fee charged in Britain, according to investment bank Keefe, Bruyette & Woods

Under the old system, the commission was paid entirely by the seller, but split between the two brokers on both sides according to NAR standards.

But the new rules mean a seller cannot be required to pay the commission to the buyer’s agent.

Instead, the buyer will enter into a separate agreement with his agent regarding his commission.

Laura Ellis, president of home sales at Chicago-based Baird & Warner, said Crain’s Detroit Company

said one expert buyers are probably thinking, “Wait a minute, I’m saving for the 10 percent down payment, 20 percent down payment, and now you’re telling me I have to pay you 2.5 percent, 3 percent on top of that?”

That’s the view of Laura Ellis, president of home sales at Chicago-based Baird & Warner.

Speaking to the Crain’s Detroit Company, she added: ‘All the research we’ve seen says buyers are not opposed to the agent being paid.

“They just want to know what they’re paying for.”

Missouri home sellers sued the NAR in a landmark case that paved the way for multiple copycat lawsuits.

The case revolved around a common practice where seller’s agents quote the commission their client is willing to pay for a Multiple Listing Service (MLS).

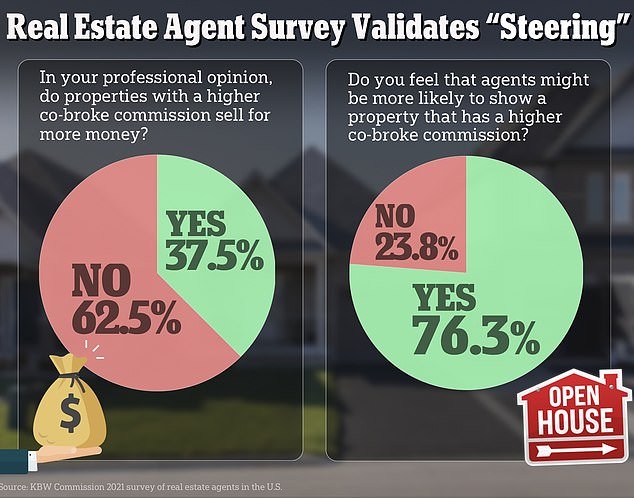

In theory, the old system allowed agents to “steer” buyers to homes where commissions are higher so they can benefit more from a sale.

Estate agents in the US charge home sellers an average commission of between 5 and 6 percent of the sale price of their property – more than twice the average fee charged in Britain, for example.

According to a survey by consulting firm 1000watt, more than 76 percent of 640 real estate agents in the U.S. said buyer’s agents would be more likely to show a home if they knew the seller was paying a higher commission.

But after a settlement of the Missouri case was tentatively approved by U.S. District Judge Stephen R. Bough, the NAR made several changes.

On its website, the trade body says agents should ‘work with buyers’ to secure a signed agreement before ‘touring’ a home.

The agreements should specify the services of both agents and their expected compensation.

An offer prepared by a seller’s agent cannot specify the amount of commission payable to the buyer’s agent and cannot require the buyer’s agent’s commission to be paid by the seller.

On its website, the NAR says agents should “work with buyers” to secure a signed agreement before “touring a home.”

The buyer’s agent can see which properties have the best sales commission and ‘steer’ buyers there. More than 76 percent of agents said buyer agents would be more likely to show a home if the seller offered a higher commission

The buyer’s agent may still – but is not required to – receive a portion of the commission paid by the seller to the seller’s agent as part of his compensation.

But this can only happen if that arrangement is freely negotiated on the basis of one individual transaction, and with the buyer’s consent.

A driving factor behind the settlement was the theory that by removing the burden of the total commission from the seller, the price would be reduced.

However, it remains to be seen whether these price reductions will materialize in practice.

It comes as the final details of the NAR compensation are still being finalized.

Homeowners who have sold property in the last seven years are now eligible for a payout, although they must file a claim by May 9, 2025.

Qualifying sellers must have listed the home on a Multiple Listing Service (MLS) and paid a commission to a real estate agent.