Florida man issues stern warning to homeowners as he is fined $1 MILLION for previous resident’s code violations

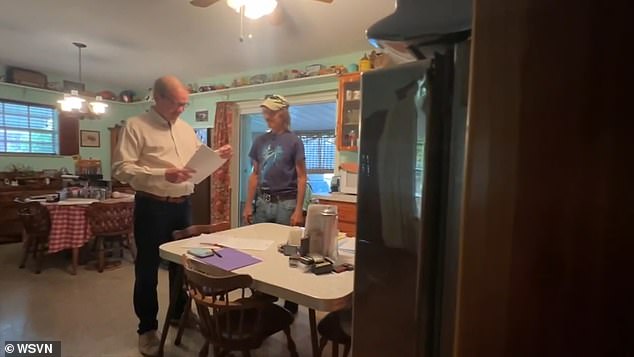

A handyman was left shocked when he was handed a bill for more than $1 million by the previous residents for code violations on his Florida home.

Denny Dorcey bought his house 10 years ago when it was about to be sold and has completely overhauled the space. He added custom cabinets, restored old televisions and an oven and made other modifications.

“I’m holding on to a part of the 1970s that I enjoyed as a child,” he said WSVN.

However, Dorcey was in shock when he was hit with a whopping $1,097,400 bill for code violations in his home.

“The letter stated that I owe the city over $1 million for code violation fines from the time before I purchased the house,” he said.

The letter describes four minor violations committed by former residents.

“Little things like overgrown weeds destroying the carport,” he added.

Yet no fines or liens had been recorded when Dorcey purchased the house, and he was none the wiser until he received the letter ten years later.

Denny Dorcey bought the house, was foreclosed on and rebuilt, but was left in shock after receiving a whopping $1,097,400 bill for code violations on his house.

The letter describes four minor violations committed by former residents. “Little things, like overgrown weeds destroying the carport,” Dorcey said

When Dorcey told them he would not be able to pay such a large fine, he was told to call the collection agency and negotiate a settlement. The enormous price was out of Dorcey’s reach, but even though the fines aren’t his fault, the bill is still his responsibility

Oakland Park only notified Dorcey after he reportedly deleted old files and happened to come across his.

“That’s how it all started,” he added.

When Dorcey told them he would not be able to pay such a large fine, he was told to call the collection agency and negotiate a settlement.

The enormous price was beyond Dorcey’s reach, but even though the fines aren’t his fault, the bill is still his responsibility.

A 7News legal expert, Howard Finkelstein, said it’s perfectly legal for government agencies to, for example, wait 10 years before notifying a new homeowner about the fines, allowing them to grow.

“But in this case, the city cannot do this to Denny because he purchased the property under foreclosure, wiping out any existing liens and fines the city had,” he added.

The outlet notified Oakland Park, which checked the 2010 case and found the property had not been brought into compliance before it was foreclosed. The municipality was not informed of the execution, WSVN reports.

Dorcey’s $1 million fine was therefore rescinded and the lien was dropped.

A 7News legal expert, Howard Finkelstein, said it is perfectly legal for government agencies to wait to notify the buyer of such a bill, but in this case it was not legal because of the exclusion.

‘Without you they would have completely destroyed my life. I have no doubt about it,” Dorcey said

‘Without you they would have completely destroyed my life. There is no doubt in my mind,” he said.

Dorcey’s shocking near-bankruptcy situation underscored the importance for new homeowners to check for liens on a home before purchasing a home.

Dorcey’s story comes not long after another couple planned for their dream home in Florida, but quickly left $17,500 behind while paying taxes on unusable land.

Donna Hartl and her husband purchased the $17,500 property with plans to move from North Dakota to Brooksville, Florida.

Their dreams were quickly crushed after a neighbor alerted them to a decades-old easement on the land with Duke Energy.

The easement prohibited any building within three feet of the utility pole, but the couple still had to pay taxes on the unusable land. However, Hartl said they had done their homework on the land and saw no red flags throughout the process.

Donna Hartl and her husband bought the $17,500 property with plans to move from North Dakota to Brooksville, Florida, but their dreams were crushed after a neighbor told them they would never be able to build there

‘I got the green light for everything. My property was placed on the county GIS map, I was given my setbacks, what I could and could not do. I could put in a modular home, a mobile home, or I could put in a single-family home,” Hartl said

![Florida man issues stern warning to homeowners as he is fined $1 MILLION for previous resident's code violations 7 When they later came to visit the property, they found a row of huge concrete utility poles, one of which was on their property. '[We] came to our building on Monday November 11th and saw that pole behind us and left "Wow, wow, wow"Hartl said](https://nybreaking.com/wp-content/uploads/2024/12/1734658484_691_Florida-man-issues-stern-warning-to-homeowners-as-he-is.jpeg)

When they later came to visit the property, they found a row of huge concrete utility poles, one of which was on their property. ‘[We] came to our property on Monday, November 11th and saw that pole behind us and said, “Whoa, whoa, whoa,” said Hartl

The couple hired a contractor to draw up plans for their home and had county records confirm the property was zoned for residential or agricultural use.

‘I got the green light for everything. My property was placed on the county GIS map, I was given my setbacks, what I could and could not do. “I could put in a modular home, a mobile home, or I could put in a single-family home,” Hartl shared WFLA.

While provincial workers insisted she could still build, they were later corrected by an uncovered 1955 document.

The document stipulated decades-old utility provisions that prohibited development within 100 feet of the pole in any direction, leaving almost the entire tract unusable for their new home.

What remained was a 600 square meter corner that was not suitable for a house due to septic and water well requirements.

“So then there’s nothing left,” she said.

Hartl said she has filed complaints with the Florida Attorney General’s office and several state regulators.

She added that Nexgen representatives told her they are taking note of the information provided to them by the property seller.