A typical house is worth £10,000 more than it was a year ago, but are house prices starting to fall again?

- Average house prices rose 3.4% to £292,000 in the 12 months to October

The price of the average house rose by around £10,000 in the year to October, according to the latest figures from the Office for National Statistics.

The average home in Britain now sells for an estimated £292,000, which is an increase of 3.4 percent on the same period last year when the average property sold for £282,000.

Although house prices have risen slightly for most of the year, they have fallen by £1,000 since August and prices in four of the nine English regions have fallen compared to September.

According to the ONS, all recorded prices fall between September and October in the North East, the Inland West and the South East.

In London, the average property fell by £7,000 between September and October, while prices fell £11,000 in two months.

According to the ONS, the average property in the capital cost £520,000 in October, down from £531,000 in August.

London falls: Prices in the capital have fallen an average of £11,000 in the past two months

Jonathan Hopper, CEO of estate agents Garrington Property Finders, said: ‘Year-on-year, every part of Britain saw average prices rise in October. But dig deeper into today’s official data and the momentum seems less certain.

‘While there is no shortage of buyers, those planning a move are becoming increasingly pragmatic and price sensitive.

‘This sense of caution is likely to increase following the sharp rise in consumer inflation in November, which is eroding people’s disposable income and could delay next year’s long-awaited interest rate cut.

‘As a result, we’re seeing some buyers reassess what they can afford. The abundance of homes for sale often leaves them spoiled for choice, giving them the confidence and leverage they need to negotiate hard on price.”

Why have house prices risen in the past year?

The general upward trend over the past twelve months is believed to have been caused by declining mortgage rates in recent months. But concerns about higher inflation and rising interest rates again could dampen future growth, experts say.

The ONS figures are lagged compared to other house price indexes, but are considered more accurate because they are based on completed sales.

In September, mortgage rates fell to lows not seen before the Liz Truss mini-Budget at the end of 2022, sending markets reeling.

The lowest five-year fix reached 3.68 percent, while the lowest two-year fix fell to 3.82 percent – although these averages have risen again since October and are now back above 4 percent.

Where have house prices risen the most this year?

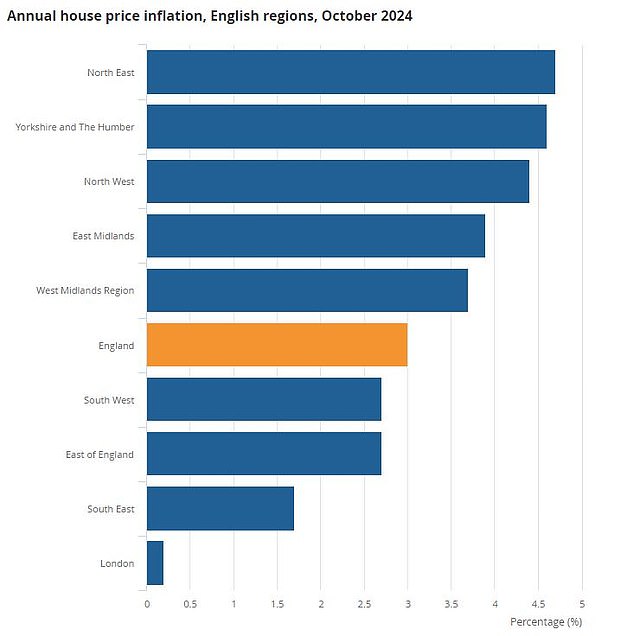

That said, the pace of house price growth varies from country to country.

House prices rose the least in London at 0.2 percent, while in Scotland average house prices rose by 5.1 percent.

According to the latest data from the ONS, prices in Northern Ireland have been even higher, up 6.2 percent this year.

In England, the north is where prices have risen the most.

In the North East, Yorkshire and The Humber, average prices have risen by 4.7 and 4.6 per cent year-on-year respectively.

In contrast, prices in the South East have only increased by 1.7 percent year-on-year, while the South West has seen below-average growth of 2.7 percent.