What does rising inflation mean for you – and has it offset a rate cut by the Bank of England?

Inflation in Britain rose to 2.6 percent in November, it was revealed today, as the rise in the cost of living accelerated again.

Stubborn inflation is hitting Britons in the pockets and any realistic chance of another key rate cut by the Bank of England this year was crushed this morning as official figures raised fears of a resurgence in inflation.

What happened to inflation?

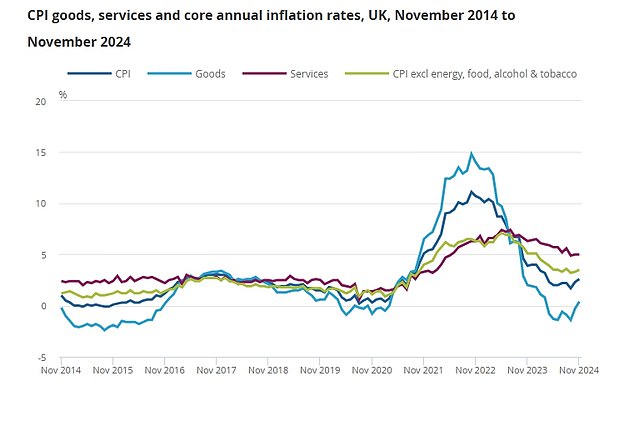

Annual consumer price index inflation rose to 2.6 percent in November from 2.3 percent in October, while closely watched services inflation remained at 5 percent, according to the Office for National Statistics.

The rise in the CPI, which was in line with market forecasts, pushed inflation to an eight-month high. The low point was 1.7 percent in September, when it fell below the Bank’s target of 2 percent.

Price rises were felt broadly across the UK economy in November, with core inflation – excluding energy, food, alcohol and tobacco – rising from 3.3 to 3.5 percent.

Rates puzzle: Bank of England Governor Andrew Bailey must weigh slowing economic growth against persistent inflation

What does this mean for interest rates?

Traders have now all but ruled out any chance of a rate cut by the Bank of England on Thursday, with market rate forecasts showing just two cuts of 25 basis points each next year.

This would take the base rate from its current level of 4.75 percent to 4.25 percent at the end of 2025, in stark contrast to forecasts for the US Federal Reserve and European Central Bank, which investors say will be more aggressive.

Some forecasters are more optimistic about rate cuts, with economists at Capital Economics previously saying the base rate will fall to 3.5 percent in early 2026. These forecasts may be revised in light of higher inflation.

James Smith, developed markets economist, UK, at ING, said: ‘Our base case is that interest rate cuts will be sequential from February, with bank rates falling to 3.25 percent later this year.

‘For now, however, today’s data means the Bank will remain on track at this week’s meeting. It will leave rates unchanged and provide no major hints about what will happen next, other than reaffirming its commitment to gradual cuts.”

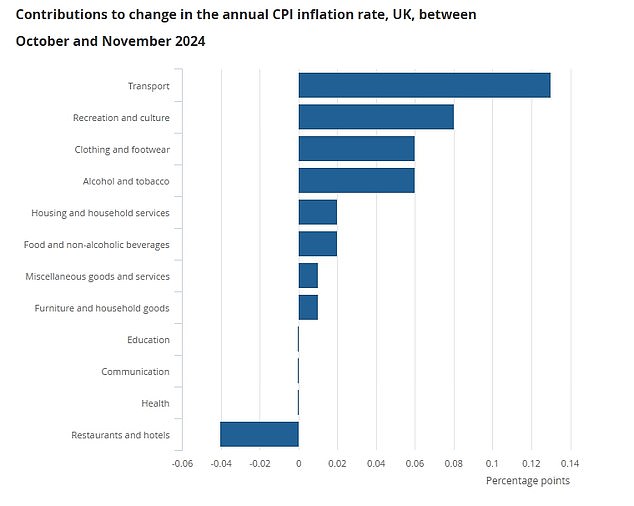

The biggest drivers of rising inflation were transport, recreation and culture, clothing and footwear, alcohol and tobacco, the ONS said

The CPI data follows stronger-than-expected wage growth data published on Tuesday and weakens the case for more aggressive rate cuts to counter slowing UK economic growth.

Michael Field, European equity strategist at Morningstar, said: ‘The explanation for October’s rise in the CPI was due to an increase in the energy price ceiling, but the fact that inflation continued to rise in November means there is likely more to it . the story.’

Jeff Brummette, chief investment officer at Oakglen Wealth, also warned BoE Governor Andrew Bailey to keep a close eye on how the economy responds to changes announced in the autumn budget, which comes into effect from April.

He added: ‘Businesses may increase prices to cover extra national insurance contributions, while the overall increase in government spending could also impact inflation.

“We expect markets to be happy if inflation stays within the 2 to 3 percent range next year, but if inflation were to move higher, the central bank could face another rate hike.”

What will drive future inflation?

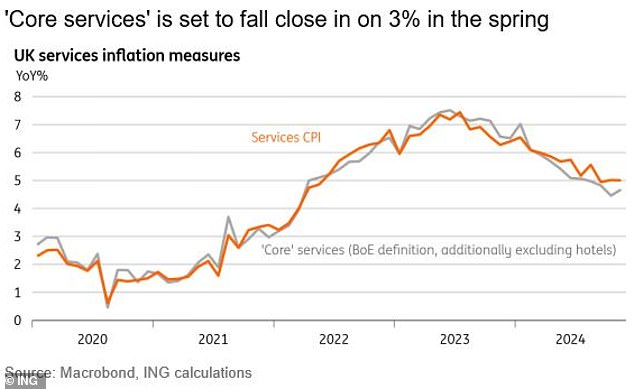

While services inflation of 5 percent disappointed the BoE’s expectations of a decline to 4.9 percent, it was below broader market forecasts of a rise to 5.1 percent.

However, the rate was largely offset by a huge 19.3 percent drop in airfares this month, while Britons saw big jumps in housing and domestic services, restaurants and hotels, and recreation and culture.

Wage inflation is believed to be a major driving force for this.

Lindsay James, investment strategist at Quilter Investors, said there are “reasons to be optimistic” that inflation in the services sector can be “bought under control”, pointing to a decline in job openings and the looming increase in social security benefits from employers as factors that could increase wages. growth under control.

She added: ‘While slower wage growth may be unwelcome news for workers, with wages in a typical service sector business accounting for around 60 per cent of costs, it will keep headline inflation closer to the 2 per cent target. Sofa is coming.’

The ONS data shows that inflation in the services sector is hotter than the rising cost of goods

ING expects services inflation to decline towards 3% in the spring

ING’s Smith said he expects inflation in the services sector to “hover around 5 percent for the next four months,” but to be “quite close” to 3 percent by the spring.

He explained: ‘A large part of the service package is affected by one-off annual changes in indexed prices – think things like telephone and internet bills.

‘These are often linked to past headline inflation rates, which have been quite favorable through 2024.

“Those annual price increases for various services should therefore be less aggressive in April than we saw earlier this year.”

This, he said, would push core inflation “significantly below” 3 percent, and “give the Bank of England some ammunition to cut rates slightly faster than markets are now pricing in.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.