Vince Cable urges Labor to block Royal Mail takeover bid

- Cable said ministers should be cautious about Daniel Kretinsky’s bid

- Former Lib Dem minister Cable was responsible for the privatization of Royal Mail in 2013

- He sold it for £3.3 billion, or £3.30 per share

Labor was warned this weekend not to abandon the debt-fuelled £3.6 billion bid for Royal Mail from former business secretary Vince Cable, the architect of the postal service’s privatization a decade ago.

Cable said ministers should be cautious about Czech tycoon Daniel Kretinsky’s bid because of his high debt burden and ties to the Kremlin.

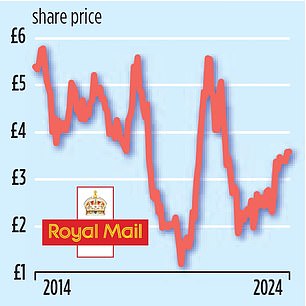

The former Lib Dem minister’s intervention carries weight because Cable led the privatization of Royal Mail in 2013 under the coalition government. He sold it for £3.3 billion, or £3.30 per share, in a deal that saw it listed on the London stock market.

“It is very sensible to be concerned about Kretinsky’s bid,” Cable told The Mail on Sunday. “The debt-fueled offer and its Russian connections should give ministers pause for thought.”

Cable, 81, faced fierce criticism 11 years ago when he was accused of agreeing to an initial public offering that undervalued the company. Shares rose in the wake of the privatization, reaching an all-time high of almost £6.07.

Chuka Umunna, then Shadow Business Secretary, said the group had been sold ‘cheaply’. The former Labor MP has since acted as an advisor to Kretinsky.

Criticism: Vince Cable

The shares closed at £3.59 this weekend, valuing the company at £3.43 billion, a fraction above the original sale price agreed by Cable more than a decade ago.

Cable indicated he did not think Kretinsky’s £3.6 billion offer for the company was too low, saying: ‘This offer is fractionally higher than the original sale price of £3.3 billion. If it’s undervalued, where are the other bids?’

However, when asked whether he expected a takeover like Kretinsky’s when he sold Royal Mail, Cable said: “We had long-term institutional shareholders in mind.”

Cable has repeatedly defended Royal Mail’s sales price, which is facing increasing problems. It posted a loss of £138 million for the six months to September 29.

In January last year, the former minister said the decision to sell the shares at £3.30 was “justified a long time ago” and that the coalition government “got as good a deal as we could get”.

Kretinsky, who is called the Czech Sphinx because of his inscrutability, made his fortune in the energy sector. He is the largest investor in Royal Mail’s parent company International Distribution Services (IDS) with a 28 percent stake.

He made a bold attack on Royal Mail earlier this year with a £3.6 billion bid.

If he succeeds, the company will fall into foreign hands for the first time in its 508-year history.

But the offer has been highly controversial as Kretinsky has already made concessions to the Labor government.

He has agreed to maintain the company’s universal service commitment, which requires the company to deliver letters six days a week.

Other obligations include not touching the surplus in the Royal Mail staff pension scheme.

Although the bid still must pass a government investigation under the National Security and Investment Act, ministers are expected to approve the takeover in the coming weeks.

Last month, Business Secretary Jonathan Reynolds appeared to shrug off concerns about the tycoon’s impending takeover, saying Kretinsky was a “legitimate business figure.”

But concerns remain about the billionaire’s plans and his international business ties.

In 2021, EP Group, the holding company of Kretinsky’s business empire, signed an £823 million financing deal with a syndicate of banks including the Beijing-owned Bank of China.

EP’s accounts also revealed that one of its commodities trading firms is in a £174 million dispute with a Russian company after it defaulted on a coal contract when the war in Ukraine began.

EP Resources refused to buy coal from the Russian company, in accordance with international sanctions.

The dispute is subject to arbitration and the EP has warned that the outcome is impossible to predict.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.