D-Day for property investors as experts warn of imminent house price collapse: Shocking new figures reveal the suburbs where owners will feel the pain first – and how the dominos will fall…

Homeowners in Sydney’s wealthy suburbs are looking at a 15 per cent price drop as their postcodes predict a looming property crash that will spread to most of the city.

Australia’s most expensive property market has been resilient despite the most dramatic Interest rates are rising in a generation as immigration reaches record levels during a rental crisis.

House prices in Sydney rose by double digits year-on-year in early 2024, despite interest rate hikes – a situation that continues in Brisbane, Adelaide and Perth.

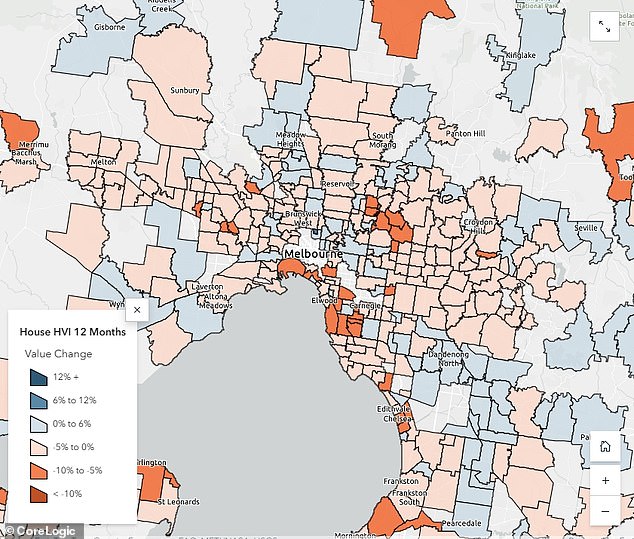

Among major cities, Melbourne was the exception, with house prices falling almost every month in 2024 due to a state investor tax.

But Sydney is now losing momentum as house prices fall across the city in October and November.

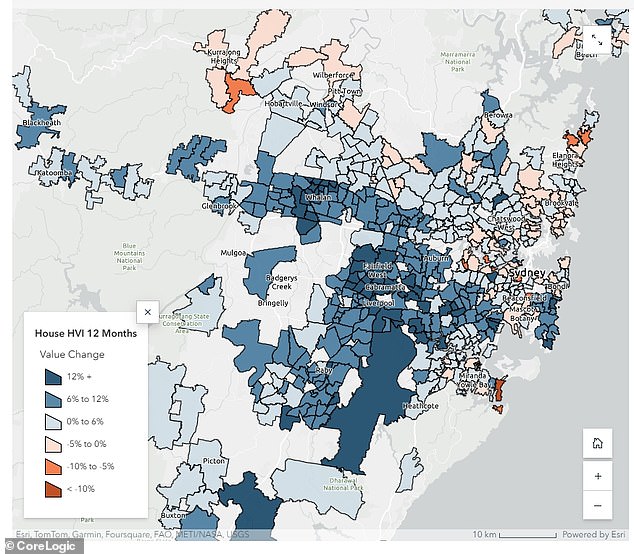

The decline has well and truly begun in wealthier postcode areas, with mid-market house prices falling by double digits over the past year, our closer look at CoreLogic data shows.

Beachside Cronulla, in the Sutherland Shire, has seen an 11.4 per cent drop in prices, but the midpoint house price is still expensive at $2.705 million.

On the other side of Sydney, the northern beaches have also seen some dramatic annual declines.

Wealthy postcodes are the first to suffer big price drops, a key sign of what’s to come in Australia’s most expensive property market (pictured is Cronulla in Sydney’s south)

The decline is well and truly underway in Sydney’s wealthier postcode areas, with mid-year house prices down double digits over the past year, a closer look at CoreLogic data showed

The Pittwater postcode Bayview is down 9.7 per cent to $2.824 million.

Neighboring Newport has seen an eight percent drop to $2.655 million in a suburb where former Miss Universe Jennifer Hawkins and her husband Jake Wall previously had a waterfront home.

AMP chief economist Shane Oliver predicts Sydney’s wealthiest suburbs will see an annual decline of as much as 15 per cent by 2025 if there is no rate cut from the Reserve Bank.

‘Affordability is much worse in those areas, so what’s actually happening is that demand is being forced into the cheaper suburbs and away from the posher areas, leading to price falls in the north and east, even though the south west is still holding stand. ‘ he tells me.

‘Some of the people who bought houses in prosperous areas are struggling with their mortgages and therefore have to sell them.’

The suburbs with the biggest price drops have prices almost double that of central Sydney ($1.483 million), with the western suburbs reflecting a typical house with a backyard.

Across Sydney, house prices fell a further 0.4 per cent in November, although unit values still grew.

On an annual basis, house prices are still rising at 3.5 percent, but recently in March house prices grew at an annual rate of 10.7 percent.

Newport on Sydney’s Northern Beaches has seen an eight per cent drop to $2.655 million in a suburb where former Miss Universe Jennifer Hawkins and her husband Jake Wall previously had a waterfront home

Affordable parts of Western Sydney are still growing strongly, with St Marys values rising 12.3 per cent over the year to $992,089.

In Brisbane, average house prices rose 11 per cent annually to $974,396 in November.

But in pricier Hamilton on the Brisbane River, average house prices fell 6.4 per cent to $2.181 million.

Across Melbourne, house prices have fallen 2.3 per cent in the past year to $923,422.

However, the more expensive suburbs on Port Phillip Bay have seen bigger falls, with house prices in central Brighton falling 5.5 per cent to $3.348 million, while Albert Park values fell 7.4 per cent to $2.171 million.

As in previous real estate market downturns, prices in wealthy suburbs fall first before the dominoes begin to fall in other suburbs.

Dr. Oliver says the suburbs with the worst affordability have historically been the first to experience the sharpest declines during a recession.

‘It’s a pretty common pattern. When you see it [the market] It’s the wealthier suburbs first, then the less affluent suburbs start to rise,” he says.

However, the more expensive suburbs on Port Phillip Bay have seen bigger falls, with Albert Park values falling 7.4 per cent over the year to $2.171 million.

Across Melbourne, house prices have fallen 2.3 per cent to $923,422 in the past year, but prices have fallen more in the more expensive suburbs

“Once the market reaches its peak, it starts to fall again. It is the areas that have risen the most and are initially the most vulnerable as people move to more affordable housing.”

This happened in 2017 after the Australian Prudential Regulation Authority restricted interest-only loans for investors.

House prices in Australia fell by 8.38 percent between October 2017 and June 2019.

Dr. Oliver predicts house prices in the capital will fall by eight per cent in early 2025, from peaks in mid-to-late 2024, until the RBA cuts rates again.

‘It is conceivable that you will see another eight percent decline. “It could get a lot worse if we go into a recession,” he says.

This would be much steeper than the 4.9 percent fall in 2022 after the Reserve Bank began raising interest rates in May that year, pushing them eight times higher.

Interest rates rose another five times in 2023, with the thirteen increases in eighteen months marking the most severe monetary policy tightening since the late 1980s.

Despite this, property values were up last year and into 2024, while net overseas migration levels climbed to record highs above 500,000.

AMP chief economist Shane Oliver predicts Sydney’s wealthiest suburbs will see an annual decline of as much as 15 per cent by 2025 if there is no rate cut from the Reserve Bank.

But if there is no interest rate cut in sight, potential buyers will no longer be able to borrow.

The futures market does not see any relaxation of the existing cash rate of 4.35 percent until May next year. Economists from ANZ, Westpac and NAB agree with that prediction.

As a result, sellers are struggling to get the prices they want, with Sydney’s auction clearance rate falling to 59 per cent on the last Saturday of November – down from 78 per cent in early May.

In the past three months alone, Sydney house prices have fallen in the upscale eastern suburbs, the North Coast, the Northern Beaches, the Inland and the Sutherland Shire.

In Sydney Harbour, prices at Bellevue Hill have fallen 8.4 per cent since August, leaving the price just below the $10 million mark.

But they have continued to rise in the more affordable postcodes in Sydney’s west and far south west, with Wetherill Park values rising 4.6 per cent to $1.216 million in the past three months.

A year ago, financial markets and economists had expected the Reserve Bank to cut interest rates by the end of 2024.

However, underlying inflation of 3.5 percent is still well above the RBA’s target of 2 to 3 percent.

The lack of rate cuts has slowed monthly price growth in Adelaide, Brisbane and Perth and caused prices to fall on a monthly basis in Sydney, Melbourne and Hobart.

“That’s contributing to the downturn in the real estate market,” says Dr. Oliver.

“I tend to think that once rates start to fall, prices will start to rise again from the middle of next year.”

Dr. Oliver adds that higher immigration will continue to put a floor on prices.

“It’s still a source of support for the real estate market,” he says. “That doesn’t mean they can’t fall; it’s just unlikely they’ll fall that often.”

A net of 449,060 migrants moved to Australia in the year to September.

This was significantly higher than government forecasts of 260,000 for the 2024-2025 financial year in the May budget.