The outrageous loophole at the heart of Anthony Albanese’s superannuation plans – and it will make many Australians VERY angry

Anthony Albanese will be exempt from his own tax hike when he eventually retires and lives in his $4.3 million clifftop mansion – and so will a handful of Australia’s top politicians.

The government wants Australians with more than $3 million in super savings to see their tax rate on their contributions double from 15 to 30 percent.

The proposed change to the country’s retirement savings appeared to be on shaky ground last night as Treasurer Jim Chalmers signaled he would not compromise with the Greens in the Senate.

But if Labour’s bill is passed, a handful of the country’s top politicians will not be affected if they eventually leave politics – a move that has sparked a furious response from the opposition, which says the bill will target politicians and judges treated differently to other working Australians. .

Politicians elected before 2004 are – like the Prime Minister – exempt from Labour’s Better Targeted Superannuation Concessions and Other Measures Bill 2023.

That’s because it only covers Australians whose retirement savings are in an accumulated superannuation savings scheme, where super balances are determined by a fund’s performance.

MPs elected before October 2004 were covered by a defined benefit scheme, whereby after leaving politics they receive a guaranteed payout based on their time in parliament.

This includes Mr Albanese, who was first elected as the Member for Inner West Sydney for Grayndler in 1996.

He would be one of the few MPs to escape the consequences of this bill, which is intended to target the top 0.5 percent of super savers, or 80,000 people.

Opposition Leader Peter Dutton and his Liberal deputy Sussan Ley, Labor Cabinet ministers Catherine King and Penny Wong, and government backbenchers Brendan O’Connor and Maria Vamvakinou would also be exempt because they were first elected in 2001.

Anthony Albanese’s proposed super changes are so hypocritical they won’t affect him personally (he’s pictured here on the right with his fiancée Jodie Haydon)

They can also access their super once they turn 55.

Independent Bob Katter was first elected in 1993 and would also be exempt from Labour’s proposed super changes.

Shadow Treasurer Angus Taylor, who was first elected in 2013, said Labour’s proposed super tax increase would leave people like Mr Albanese untouched.

“Worse still, this regime presents a different approach to a farmer or small business owner than a civil servant, a judge or a politician,” he told Daily Mail Australia.

“Those like the Prime Minister, who are fortunate enough to have a defined benefit plan, will enjoy deferred payments and tax rates determined entirely by regulation, not legislation.

‘This is a wealth tax, very simple. But the Prime Minister has exonerated himself.

“For everyone else, they face a non-indexed annual tax on unrealized capital gains.”

In a radical move, Labor is proposing to tax self-managed super funds on assets above the $3 million threshold before they are sold, without indexation for inflation.

The government wants Australians with more than $3 million in super savings to see their tax rate on contributions double to 30 percent – up from 15 percent (pictured are Gold Coast school students)

That’s a radical departure from the usual tax practice where a person is taxed after he sells his assets and not before.

No other country has applied an unrealized profits tax to retirement savings, while European countries have tried that approach to wealth, but not great.

This policy would affect self-managed super funds that own assets such as farms, which are difficult to sell or split up.

Teal MP Allegra Spender opposed the unrealized profits tax on super, with fellow independent David Pocock hinting he would block the bill on that issue in the Senate.

The Greens are also against the super bill, but only because they want the threshold to be lowered from $3 million to $1.9 million.

Labour’s bill is in danger of being defeated in the Senate, with Dr Chalmers indicating on Tuesday he is unlikely to compromise with the Greens, while key independents and the Coalition are opposed.

“The Greens want to vote against fairer taxes on people with millions in super,” he said.

“They shouldn’t need us to sweeten the deal to do the right thing.”

Shadow Treasurer Angus Taylor, who was first elected in 2013, said Labour’s proposed super tax increase would leave people like Mr Albanese untouched

Liberal Senator Andrew Bragg, first elected in 2019, raised the issue of the Prime Minister being granted an exemption in May.

“One of my favorite super tax exemptions is the one that Labor Ministers have given themselves when applying a new super tax tax,” he told the Senate.

“The new super tax will not apply to Mr O’Connor, not to Mrs King, not to Senator Wong and not to the Prime Minister.

‘It is an astonishing case of hypocrisy that the Australian people hate politicians who are willing to make rules for everyone but themselves.

“It’s a disgusting display of hypocrisy that we shouldn’t be surprised by.”

The coalition raised the issue in a dissenting report on Labour’s proposed super changes, which are now facing defeat in the Senate.

“Shockingly, as it stands, this bill will not apply to Mr Albanese himself,” said a report released in May.

‘This Bill only applies to accumulation scheme legislation, and as Mr Albanese is on the old parliamentary defined benefit scheme, the deeming method for calculating the Prime Minister’s tax liability will be left to delegated legislation.

‘That is why the Prime Minister is asking Parliament to vote on a tax bill that in itself will not apply to him.’

But MPs elected since October 2004 are paid an extra 15.4 percent, which is more than the 11.5 percent employer contributions for everyone else.

Members of Parliament now have a base salary of $233,660.

Those elected before 2004 were covered by the old Parliamentary Contribution Pension Scheme, which was dismantled for new MPs when then-Liberal Prime Minister John Howard succumbed to pressure from then-Labor leader Mark Latham.

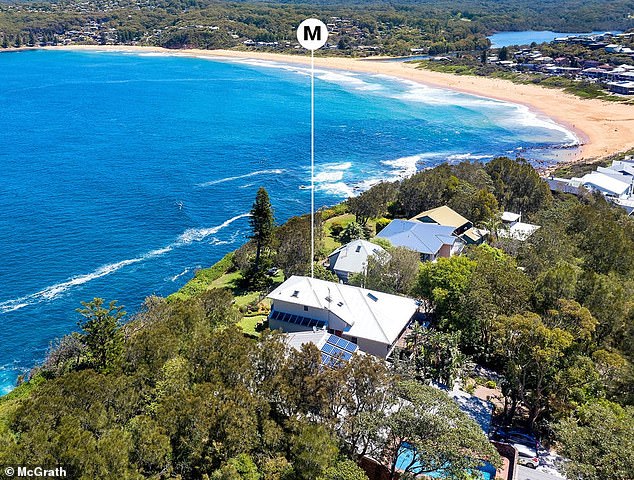

The exemption from Labour’s super tax hike, for MPs elected before 2004, would benefit Mr Albanese once he retires from politics and moves into his new $4.3 million Copacabana home with his fiancée Jodie Haydon a cliff, on the central coast of NSW, would take up residence.

This would benefit Mr Albanese once he retires from politics and moves into his $4.3 million Copacabana clifftop home on the NSW central coast with his fiancée Jodie Haydon.