Black Friday is almost here: how do you know if a deal is too good to be true?

Black Friday is almost here, and with it the promise of cheap online shopping deals – but are these deals all they’re cracked up to be, and how do you know?

Black Friday is a sales period that has become the unofficial start of the holiday shopping season.

The trend started in the US and has grown from a one-day sale to several weeks, with many major retailers participating. This year Black Friday falls on November 29.

While the Black Friday festival of consumerism can offer some real bargains, research has shown that most advertised ‘deals’ don’t offer shoppers meaningful savings that they can’t get at other times of the year.

Not only this, but the shopping period also brings a higher risk of fraud, overspending and debt.

Here’s everything you need to know about safely navigating the Black Friday sale – and how to tell a real bargain from a fake.

An arm and a leg?: Black Friday sales have been criticized by retail experts, who say they are often not the great deals consumers want to believe

Does Black Friday really have the best prices?

Most Black Friday deals seem too good to be true for a simple reason: they are.

According to research by consumer organization Which? nine out of ten Black Friday offers are the same price or cheaper at other times of the year.

While retailers rarely claim that Black Friday deals offer the biggest savings, which ones? said that ‘shoppers could be forgiven for believing this’ due to the heavy marketing around the sale period.

Which one? looked at deals on 227 products during last year’s Black Friday period between November 20 and December 1.

It found that 92 percent of these deals – all from major retailers – could be found for the same price or less at other times of the year.

Shocking: which one? also found 14 “deals” where the alleged “before” price of a discounted item had never been charged the previous year, meaning the offer wasn’t as good as advertised.

Even more shocking, many websites are staging ‘fake sales’ where prices are deliberately increased before Black Friday to make subsequent ‘discounts’ appear better, according to price monitoring website PriceSpy.

PriceSpy analyzed almost five million prices and found that since October 1, prices have increased by 33 percent (1.6 million). Sixteen percent of prices rose by more than 10 percent.

How do I know if a Black Friday discount is a good deal?

There are two ways to look at this question.

The simple way is to say that if you see an item you wanted anyway during a Black Friday sale, and you’re happy with the price, it’s a good deal.

The more frugal way is to ask yourself whether the advertised Black Friday sale price is the best possible price, and whether it’s worth buying the item now or waiting.

If you’re on the last stand and you shop online, your best friend should be price tracking tools that compare the cost of items over time.

If you shop on Amazon, the Camel Camel Camel website tells users when items are cheap, when prices have changed and by how much.

The websites Idealo, Pricechecker, Pricerunner and PriceSpy compare the costs of the same item at multiple retailers – and even in physical stores.

If you’re shopping in a physical store, you can use the Idealo app to scan a barcode for an item and see if it can be purchased cheaper elsewhere.

If you know exactly what you want and don’t need it right away, the Alertr website can track an item and give you updates on the best prices for it after 48 hours.

Beware of Black Friday scams

With so many Brits looking for a bargain on Black Friday, experts are urging shoppers to be wary of fraudsters trying to cheat them out of their money.

It is especially important to be careful when shopping online as you are much more likely to be scammed.

The Black Friday period is tailor-made for online scammers, especially as the time-sensitive nature of the sale period can encourage shoppers to purchase items without much reflection time.

Consumer expert Helen Dewdney and security professional James Bore say Black Friday is a ‘prime time’ for fraud.

Their tips for staying safe from fraud include:

1) Beware of cloned and fake shopping websites. A possible sign that a website is legitimate is that it has a secure padlock, especially on any page that involves payments, although this is no guarantee of security while shopping.

2) Check feedback and reviews about online stores you haven’t used before.

3) Consider using a credit card for online purchases as they offer more consumer protections than debit cards. Section 75 protection means that if a consumer buys something with a credit card worth between £100 and £30,000, the lender and the seller are equally liable to fix the problem if something goes wrong.

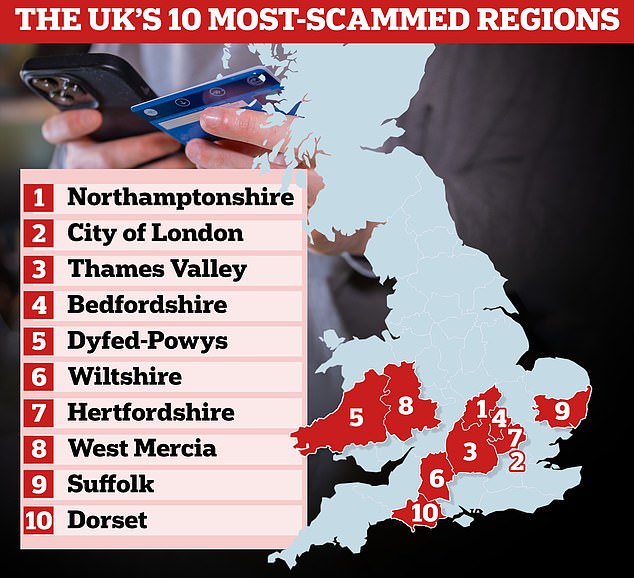

At risk: Northamptonshire residents are the most ripped off in Britain, says Idealo

4) If it seems too good to be true, it probably is. Dewdney says: ‘Companies will not offer discounts of 50 to 80 per cent on products that are in high demand.

“Fraudsters will use these offers to create excitement and an emotional response, which limits critical thinking and makes people more likely to buy something before thinking about it.”

Northamptonshire residents are most at risk of online shopping scams, according to Idealo.

Even after you have successfully purchased an item, you may still need to consider the risk of it being stolen before you receive it.

Dan Smith, security specialist at Checkatrade’s Smith & Greens Security, said ‘porch pirates’ can easily steal packages left unattended by delivery drivers.

Smith advised homes to install a key box where packages can be left safely, and to consider home improvements such as lighting, doorbell cameras and gravel driveways.

Stay within your spending limits

Despite Black Friday being ostensibly about bargains, the range of discounts can leave customers worse off financially if they overspend.

Chris Henderson, director of savings and payments at Tesco Bank, said: ‘With new discounts and offers every day in the run-up to Black Friday and Cyber Monday, it can be tempting to spend, spend, spend again. .

‘And while shopping the sales can yield savings, especially when it comes to holiday shopping, it’s important to take a step back and check whether you’re sticking to your budget and what feels affordable.’

Effective ways to stay on top of this are common sense, but can be easy to forget when faced with a high-pressure, time-sensitive sales situation.

These include avoiding impulse purchases, only shopping for things you really need, shopping around and comparing prices to make sure you’re really getting a good deal.

The only thing financially worse than spending too much is also getting into debt.

This is a particular risk when purchasing items with credit cards.

While credit cards provide a degree of financial protection for purchases, they also come with the risk of defaulting on repayments, which also causes interest to accumulate.

Moneyfacts financial expert Rachel Springall said: ‘Consumers waiting to make expensive purchases will no doubt be keeping an eye on the Black Friday and Cyber Monday sales.

‘However, it is essential to take a step back to ensure they can easily pay for all purchases or that they have a sensible repayment plan to cover the costs, especially if they are buying electronics.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.