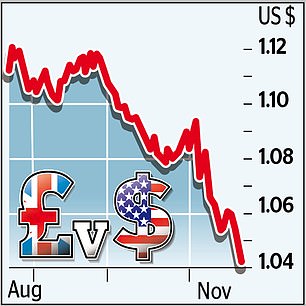

The euro falls to a two-year low

- The purchasing managers index stood at 48.1 in November, compared to 50 in September

The euro fell to a two-year low against the dollar yesterday as political unrest in Germany and France pushed the common currency zone’s economy into recession.

A closely watched monthly survey of business activity fell unexpectedly to 48.1 in November, down from 50 in September – on an index where 50 marks the line between growth and contraction.

Purchasing Managers’ Index (PMI) data saw the euro fall to just above $1.03 against the US currency, its lowest level since November 2022.

Eurozone government bond yields also fell as investors bet on faster rate cuts. The European Central Bank has cut interest rates three times this year to 3.25 percent, amid growing concerns about lackluster growth.

Markets expect another quarter-point cut next month, followed by further cuts that will bring interest rates to 1.75 percent at the end of 2025.

Jane Foley, senior FX strategist at Rabobank, said the euro has moved “one step closer to parity” with the dollar.

Struggle: Purchasing Managers’ Index data sent the euro falling to just above $1.03 against the US currency, its lowest level since November 2022

However, little changed against the pound after PMI figures for Britain also turned bleak as Labour’s fiscal attack on employers in the budget took its toll. The pound sterling was trading at just over €1.20.

Eurozone PMI figures showed that the services sector turned around for the first time in ten months and that the decline in the manufacturing sector deepened.

Germany, Europe’s largest economy, is in limbo after its coalition government collapsed this month – with elections not scheduled until February. Meanwhile, yesterday’s revised figures cut third-quarter growth from 0.2 percent to 0.1 percent.

The country, once a manufacturing power, is in crisis as demand from China slumps and its vast auto industry struggles with the transition to electric vehicles.

Bosch yesterday became the latest industrial giant to be hit, announcing 3,500 job cuts, impacting the part of the company that develops vehicle technology.

US carmaker Ford is also cutting thousands of jobs in Germany, while Volkswagen, Europe’s largest carmaker, is expected to close as many as three factories.

In France, hard-right lawmakers are threatening to topple Prime Minister Michel Barnier’s fragile coalition in a dispute over the 2025 budget.

Adding to the gloom is the fear that Donald Trump’s threatened trade tariffs will hurt the European economy.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, which compiled the PMI figures, said: “It could hardly have been much worse. The manufacturing sector is sinking deeper into recession, and now the services sector is starting to struggle after two months of marginal growth.

‘That is no surprise, given the political mess of late in the eurozone’s largest economies.

‘The French government is on shaky ground and Germany is heading for early elections. Add to that the election of Donald Trump and it is no wonder that the economy is facing challenges.’

Bert Colijn, chief economist at ING Bank, said: ‘November’s PMI is yet another wake-up call for eurozone policymakers that the economy continues to show signs of weakness.

“New production in manufacturing and services is weakening again, with export orders in particular falling sharply, as the eurozone economy faces weak demand from abroad.”

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.