Florida housing crisis escalates in five major cities as sales plummet

Home sales in five major Florida cities have plummeted as the southern state’s real estate crisis snowballs.

Natural disasters, rising homeowners association (HOA) costs, rising insurance costs and new condo regulations have sapped demand from a market that was booming just four years ago during the COVID-19 pandemic.

Fort Lauderdale, a city on Florida’s east coast, saw pending sales drop 15.2 percent year over year for a four-week period ending Nov. 10, according to a Redfin Analysis.

The next worst cities were Miami and West Palm Beach, with annual declines of about 14 percent each.

And rounding out the bottom five were Jacksonville and Tampa, which saw declines of 9.5 percent and 7.2 percent, respectively.

Nationally, current turnover even increased by 4.7 percent in the same period.

Florida real estate has been in a downward spiral for months, with some condo owners offering their properties for 40 percent less than they are worth just to offload them.

A combination of factors causes this phenomenon.

Fort Lauderdale, pictured, saw the sharpest decline in pending home sales last year

Perhaps the most obvious is what turned out to be a record year of natural disasters.

“The recent hurricanes have caused a major disruption in existing or pending sales, even for unaffected homes,” said Phil Crescenzo Jr., vice president of the Southeast Division at Nation One Mortgage Corporation.

Three major hurricanes – Debby, Helene and Milton – tore through the Sunshine State this year, killing hundreds of people and destroying thousands of homes and businesses.

Florida native and former real estate agent Ro Barber told DailyMail.com that home, mortgage and insurance prices have risen in response.

“Every time after a storm like this, we push out the middle class,” Barber said. “It’s not because of the storms that people are moving away; it’s the real estate trends that come next…all the rents are going sky high and people are just being priced out.”

Many lifelong Florida residents are considering moving out of state for the first time to avoid this boom-bust cycle the state is experiencing.

Foreigners seem equally reluctant to commit to Florida.

“First-time buyers in the market are especially skittish,” said Lindsay Garcia, a Redfin real estate agent based in Fort Lauderdale. ‘There is still some demand for holiday homes, but overall the market is very slow. Buyers are faced with persistently high housing costs and uncertainty surrounding the elections.’

Miami, Florida’s second-most populous city, saw the second-largest decline in pending home sales. West Palm Beach was close behind

Three major hurricanes – Debby, Helene and Milton – tore through the Sunshine State this year, killing hundreds of people and destroying thousands of homes and businesses (photo: Port St. Lucie homes razed during Hurricane Milton were made)

Pictured: The aftermath of an apartment building collapse in Surfside, Florida. The disaster has prompted state lawmakers to more heavily regulate condos, having a devastating effect on the market

Apartments are more vulnerable than any other market, as they are susceptible to natural disasters and new regulatory pressures to keep high-rise buildings safe.

Florida’s state government has passed a new law cracking down on older apartments after the Champlain Tower South in the Miami suburb of Surfside collapsed in 2021.

The disaster killed 98 people and left hundreds of others without homes and all their belongings destroyed.

Now all apartment buildings 30 years or older and three stories or higher must undergo an inspection by a qualified architect or engineer.

If ‘significant structural deterioration‘ is found, the apartment owner will have to make the repairs and raise significant amounts of money to repair his property within a year.

Thousands of remaining owners are trying to avoid the fast-approaching December 31 deadline for these inspections by selling their properties.

Homeowner associations are also raising their rates to pay for these new repairs, another reason some are fleeing.

Garcia said many condos have been on the market for more than a year waiting to be sold.

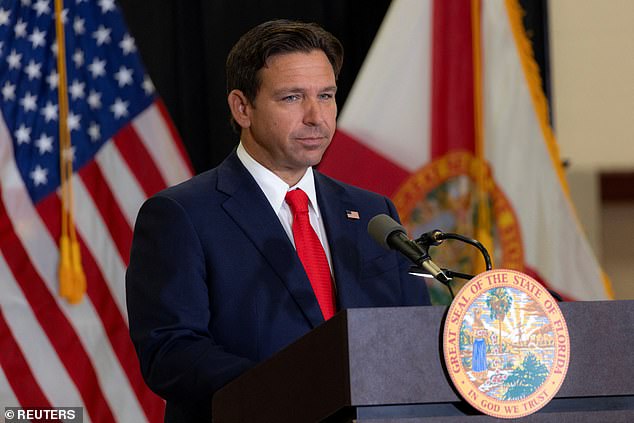

Governor Ron DeSantis is at the forefront of state leaders seeking to ease the condo crisis

Governor Ron DeSantis has urged the state Legislature to address this glaring issue before the end of the year.

His idea to stop panic selling is to offer low or no interest loans to people saddled with high repair costs.

The state legislature met Tuesday in preparation for the 2025 session, which begins on March 4.

The meeting would focus mainly on procedural issues and subsequently on setting the legislative agenda for the next two years.

It’s unclear whether lawmakers and DeSantis will come up with a solution to the housing crisis before the end of the year.