Aussies to be left hundreds of dollars out of pocket as ‘tax by stealth’ hits Victoria

Grieving Victorian families will soon have to pay a sevenfold increase in death charges – on top of heavy taxes to fund Melbourne’s Covid lockdowns.

Victoria formally abolished all inheritance taxes in 1981.

But those grieving the death of a loved one still have to pay a filing fee to the Supreme Court to cover the administrative costs of transferring or distributing a deceased estate to surviving family and friends.

The costs of dealing with legal claims through a lawyer have so far been modest in Victoria for the relatives of a deceased loved one who left a typical suburban home.

But now estate costs for a small apartment complex will run into the hundreds, rising into the thousands for an average Melbourne home, and into the tens of thousands for homes sold in more expensive areas.

Fees are scheduled to increase on July 1 each year, but Victorian probate office fees will now increase for just four months in the 2024-2025 financial year.

Shadow Attorney General Michael O’Brien described the increases as a ‘stealth tax’.

From November 18, estates worth less than $500,000 will incur an inheritance tax of $514.40 – an expense that will be 7.5 times more expensive than the existing fee of $68.60.

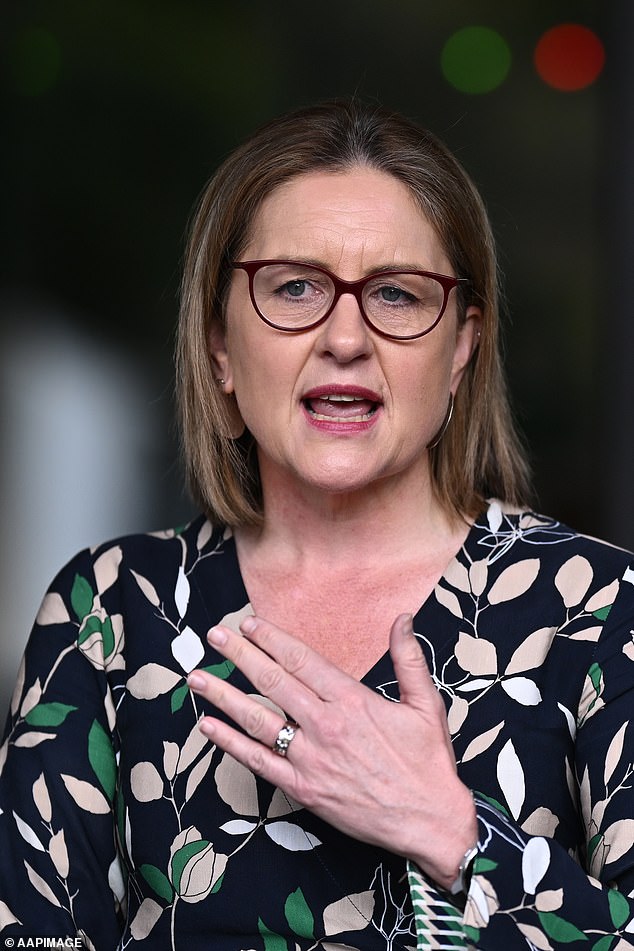

Grieving Victorians will soon have to pay a sevenfold increase in death costs to fund Melbourne’s Covid lockdowns (photo is a stock photo)

Estates valued between $500,000 and $1 million will be charged a surcharge of $1,028.80 – almost triple the existing level of $367.40.

That kind of cost increase would affect a family selling a median-priced Melbourne home worth $928,808 or a median-priced apartment of $613,638, based on data from CoreLogic.

For estates worth $1 million to $2 million, the fee is $2,400.50 – an increase from $685.90.

The compensation for estates worth more than $2 million but less than $3 million is $4,801.00 – an increase from $1,502.40.

For estates worth $3 million to less than $5 million, the fee increases to $7,185.20 – a threefold increase from $2,318.90.

Acting Attorney General Enver Erdogan also announced new allowances for the ultra-rich on Monday.

“For the very small percentage of Victorians dealing with multi-million dollar estates, fees will be lifted to cover the level of administration and dispute resolution that these complex applications often require in court,” he said.

That means estates valued at $5 million to $7 million will be charged a fee of $12,002.60, rising to $16,803.60 for estates valued at more than $7 million.

Mr O’Brien, a former Liberal leader, said the increases reflect poorly on Prime Minister Jacinta Allan as her state faces a $2.2 billion budget deficit in 2024-25.

“For the Allan Labor government to resort to taxing dead Victorians and their grieving families, and to announce this on the eve of the Melbourne Cup, shows how bankrupt this government is – financially and morally,” he said.

Victoria’s Labor government introduced a series of taxes on businesses and property investors last year in a bid to raise $31.5 billion over 10 years to pay for Melbourne becoming the most locked down city in the world during Covid-19 world is.

The opposition said the increases reflected poorly on Prime Minister Jacinta Allan as her state will face a $2.2 billion budget deficit in 2024-25.

This included a $975 land tax for property investors.

The federal government abolished inheritance tax in 1979, following Queensland’s lead.

Other states followed suit in subsequent years, with all states eliminating estate taxes in 1982 in an effort to deter the elderly and wealthy from moving between states.

Each state levies estate taxes, with amounts varying depending on the size of an estate.

While probate fee increases in Victoria are steep, other states are charging even more.

New South Wales charges $1,873 for estates worth $500,000 to $1 million and $2,494 for estates worth $1 million to $2 million.

South Australia charges $1,914 for estates worth $200,000 to $500,000, $2,549 for estates worth $500,000 to $1 million and $3,826 for estates worth more than $1 million.

Tasmania charges $1,024.76 in fees for estates worth $250,000 to $500,000, $1,290.30 for estates worth $500,000 to $1 million and $1,634.38 for estates worth $1 million to $2 million.

Queensland has a flat filing fee of $793, while in Western Australia it is $408.