Vile caregivers accused of using millionaire, 91, as a ‘piggy bank’ and leaving her in financial ruin

An elderly woman was secretly scammed out of millions by her home carers, her surviving relatives claim.

The allegations were exposed on Saturday in a piece by The San Francisco Chronicle in which four unnamed women are considered responsible and 91-year-old Geraldine Clark as their unsuspecting target.

Clark died in 2023, seven years after the alleged scam.

The group of caregivers found through an employment agency drained more than four million dollars from its finances within that period, relatives said.

The trustee appointed to oversee the San Francisco woman’s finances after her death then traced the money to an account controlled by Wells Fargo, where she found more than 1,000 canceled checks made out to health care providers.

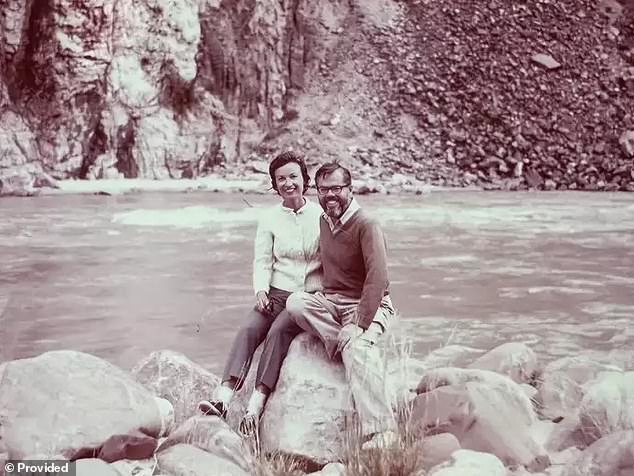

Geraldine Clark, now 91, seen here before her death with also late partner William Clement, lost more than $4 million over the course of seven years thanks to four defrauding live-in caregivers, her relatives claimed this week

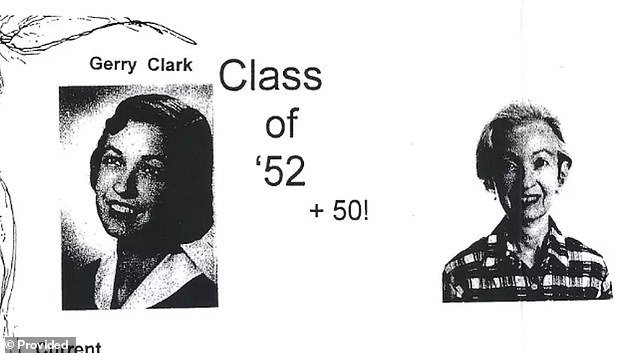

Clark, seen here in a 1952 yearbook photo and another photo 50 years later, died in 2023, seven years after the alleged scam. The group of caregivers found through an employment agency allegedly siphoned the money from her finances within that time

“There were months when (the caregivers) were raising $100,000, $200,000,” Clark’s 60-year-old cousin, David Stewart, told the local newspaper. “It looked like a piggy bank.”

“I was sitting with the manager of a bank until 8:30 at night, drawing all the checks and gathering everything to get a case,” added Heather Yarbrough, the trustee appointed to oversee her finances shortly after Clark’s death. to keep an eye on.

Yarbrough, a licensed private professional fiduciary and a nationally certified guardian, then proceeded to compare the cashed checks with a checkbook recovered from Clark’s apartment.

All the notes were written in the primary caregiver’s handwriting, she said, citing the fact that Clark was diagnosed with dementia in 2016.

She added that she made the discovery surrounding the checks four months after the matriarch’s death last year – just months after the unnamed caretaker called Clark’s cousin, David Stewart, to tell him that Clark’s piggy bank had run out.

The call had come after Clark had lived for years on half a million left by her partner, William Clement, and on an illustrious stock portfolio she had inherited from her family.

The arrangement allowed the woman to live comfortably in her rent-controlled apartment in the city’s financial district, even as her assets declined.

But by the time Clark was transferred to a nursing home the month after Clement died in November 2022, her brokerage account, which once held $5 million, was worth a paltry $185.

Clark, seen here in her youth, also suffered from dementia – a diagnosis the four women did not disclose to her living relatives

Now broke, Clark would die at the center months later, after which Yarbrough would deposit the missing millions into Wells Fargo’s account.

There, the fiduciary expert found checks written and cashed for thousands of dollars more than the corresponding checkbooks indicated, as well as documents showing how each of the caregivers was expected to earn $30 an hour.

But once she took the overpayments into account, the hourly rate skyrocketed to more than $416 per hour — compensation that amounts to more than $4 million, which Clark’s relatives now say was stolen between 2016 and 2022.

Yarbrough subsequently submitted her findings to both the San Francisco Police Department and the FBI in a police report filed last May, although both parties declined to take on the case.

As for an explanation as to why, Detective Sgt. Justin Woo told the Chronicle on Saturday that the case had been referred to the Public Prosecution Service [but] was rejected’

“Without testimony from the deceased victim, the prosecution will not be able to prove this case beyond a reasonable doubt.”

However, after contacting the district attorney’s office, the Chronicle found inconsistencies with that story, as prosecutors refuted Woo’s statement, claiming, “No arrest warrant or evidence has been submitted to our office for review on this matter” .

The trustee appointed to oversee the San Francisco woman’s finances, Heather Yarbrough (pictured), then traced the money to an account controlled by Wells Fargo, where she found more than 1,000 canceled checks made out to the healthcare providers.

The San Francisco District Attorney’s statement added: “If and when a case is presented to us by the San Francisco Police Department… [will] Please carefully review all facts and evidence gathered to see if we can pursue criminal charges.”

An FBI spokesperson, meanwhile, also stated that the FBI had decided not to take on the case, prompting some statements of disbelief from Yarbrough.

“I had no idea that they would do absolutely nothing here about a crime of this magnitude against an elderly person,” she said. emails showing that the main caregiver allegedly committed the theft amid correspondence with Clark’s financial managers.

Also failing to convince investigators were medical records that health care providers had not shared with Clark’s family, showing how serious her condition was and then worsened. dementia and years of monthly prescriptions for 150 pills of 5 mg hydrocodone, a powerful opioid that could worsen cognitive decline in older adults.

“Every time a prescription was written, it was at the request” of the primary caregiver, Kaira Stewart said, pointing to notes in her aunt’s medical file.

She and David live in Costa Mesa, more than 400 miles away from where this all happened, and both said they were never informed of the 2016 dementia diagnosis.

David’s sister, Elizabeth Bryant Stewart, lives even further away in France – and the family now say they believe there is little to be gained by suing the healthcare providers.

The newspaper did not name the four allegedly responsible for the plot due to the lack of any criminal charges, as the Stewarts struggle to pick up the pieces without a criminal case. In the photo Clark and her partner, who left half a million for his lover, who had millions in an inherited stock portfolio

After some digging into Kaira’s social media posts from the main caregiver, she told the paper that her mother-in-law’s money was probably long gone — and how posts from the caregiver and her family showed photos of vacations, new vehicles and even a new house.

She also recalled how the lead caregiver repeatedly contacted her and her husband after Clark was transferred to the nursing home and then asked for money after her death, which she said was for missed paychecks.

“I hate what happened to my Aunt No. 1,” David said, adding that he saw Clark as a second mother. “But I feel like there’s another family where this could happen again.”

John Hartog, a Bay Area attorney who specializes in probate law, blamed the structure of the city’s criminal justice system for the lack of charges. He told the Chronicle: ‘The criminal law will not punish these types of offenders nine times out of 10.’

The newspaper did not name the four allegedly responsible for the plot due to the lack of any criminal charges, as the Stewarts struggle to pick up the pieces without a criminal case.

The Chronicle, meanwhile, reported that it had contacted the primary caregiver for comment from the primary caregiver via emails, text messages and phone calls, but received no response.