Barefoot Investor’s ultimatum for a bride-to-be after she discovered her fiance’s $9,000 secret

- The woman said he was ‘blinded by love’

- She asked if she should call off the wedding

- READ MORE: Australia has turned into a country of debt slaves

The Barefoot Investor has issued stern advice after a bride-to-be revealed she considered breaking up with her fiancé after discovering his secret debt.

Renata wrote to financial guru Scott Pape that she was “blinded by love” before discovering her fiancé had racked up a hefty $9,000 debt in two years by spending money on Afterpay and Uber Eats. Herald Sun reported.

“He consolidated this debt into a loan (at 17.5% interest) and I only found out when I opened a piece of mail from a bank we neither use (or so I thought),” she said.

‘I’m not sure what to do. I’m not going through with the wedding now, so we’ve probably lost $10,000 in deposits.

The woman added that the couple has only $14,000 in savings and lives in a mansion she owns and doesn’t know whether to make it work or “cut my losses and run.”

But the Barefoot Investor said that while the bride-to-be sounded financially savvy, he didn’t know what “type” of person her fiancé was.

He said he was “willing to cut him some slack,” but encouraged the bride-to-be to make sure their finances were in line before making her decision.

“Afterall, maybe he incurred Afterpay and Uber Eats debt by eating and drinking with you?” he wrote.

The bride-to-be wrote a letter to the Barefoot Investor asking whether she should cut her losses ‘and run’ after discovering her fiancé’s hidden debts (photo a stock photo of a bride)

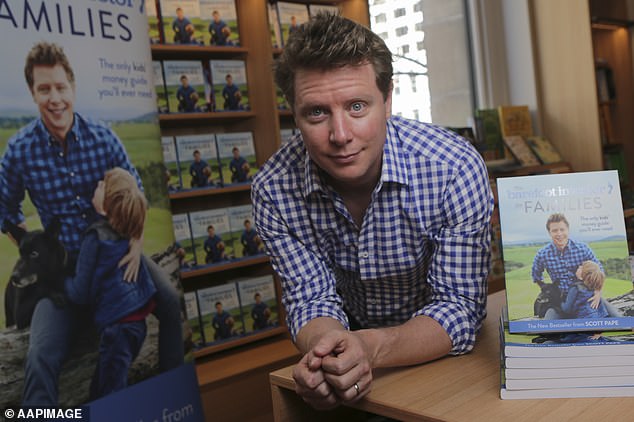

Scott Pape, the Barefoot Investor, (pictured) asked the woman to ‘give love a chance’

Mr Pape said Renata’s fiancée may also have been “blinded by love” but had “no idea” about finances, like many Australians.

‘My view? Let’s give love a chance,” he wrote.

The Barefoot Investor instead suggested that the bride-to-be should tell her fiancé what she sees in her financial future.

“Go into all the scary details: a paid-off house, a million-dollar super fund, private schools for the kids,” he wrote.

“And then smash him with the next sentence: ‘I don’t want to marry you if we’re not on the same page financially.'”

The financial whiz claimed she had to show her fiancé his investment and savings book and based on his reaction she could decide whether a wedding was worth her time.

“When he takes it to heart, hosts the Barefoot Date Nights and aggressively starts paying off his debt, you know your financial values are aligned,” he wrote.

The woman’s fiance racked up $9,000 in debt after spending money on Uber Eats and Afterpay over a two-year period and took out a high-interest loan to consolidate his debt (Uber Eats app stock photo )

But the Barefoot Investor said if the woman’s fiancée doesn’t take action, she’ll know what he values.

“And you can both move on and find people who are your type,” he wrote.