MARKET REPORT: Stock hunt trapped by falling energy prices

Shares of British energy services company Hunting fell to a seven-month low as it warned that the fall in oil and natural gas prices would hit profits.

The FTSE 250 group, which makes equipment for the energy sector as well as aerospace and defense, said “the recent drop in oil prices and the new drop in US natural gas prices” have taken their toll.

It expects a profit of between £95m and £97m for this year, after previously estimating £103m to £106m.

Slump: Hunting, which makes equipment for the energy, aerospace and defense industries, has been hit by a drop in oil and gas prices

The warning overshadowed a 16 percent rise in third-quarter profits to £67 million, as shares fell 16.5 percent (or 61.5p) to 311.5p, hitting their lowest level since March.

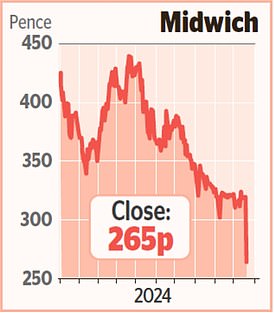

Yacht shares were on a roll earlier this year, rising 55 percent to a peak of 459 pence in early August.

But they have since fallen sharply, wiping out much of this year’s gains after oil prices fell from more than $90 a barrel in April to less than $76 now.

Among mid-cap stocks, construction and regeneration group Morgan Sindall moved in the other direction as it said full-year profits would beat its previous expectations.

The company says its Fit Out division, which carries out office and school renovations and offers interior design services, is booming.

Shares rose 20 percent, or 650p, to a record high of 3900p. Since the beginning of last year, the stock has more than doubled.

But there was little to cheer about in the broader market, with the FTSE 100 index falling for a third day in a row, falling 0.14 percent, or 11.7 points, to 8,306.54. However, the FTSE 250 rose 0.21 percent, or 43.05 points, to 20,949.65.

Holiday Inn owner InterContinental Hotels Group fell lower as weak demand for rooms in China offset a more solid performance elsewhere.

The company said revenues per room in continental Europe rose 7.1 percent, while in East Asia and the Pacific they rose 6.5 percent, in Britain 2.2 percent and in the US 1 .7 percent. But in China they fell 10.3 per cent, sending shares down 1.7 per cent, or 148p, to 8714p.

Airlines fared better, with Easyjet up 1.3 per cent, or 6.4p, to 514p, and British Airways owner IAG up 0.6 per cent, or 1.3p, to 215.4p, the highest level since 2021.

Gold and silver miner Fresnillo posted further gains, adding 2.9 percent, or 21.5p, to 769p after the recent rally in precious metals prices.

Gold was hovering close to the previous session’s all-time high of $2,740 an ounce, while silver was trading above $34 an ounce after hitting that level for the first time in 12 years on Monday.

Pinewood Technologies – previously called Pendragon before the sale of its car dealers such as Stratstone and Evans Halshaw earlier this year – jumped higher after winning a contract with dealer group Marshall Motor.

Shares in Pinewood, which specializes in software for car dealers, rose 14 percent, or 40.5p, to 330.5p.

Semiconductor company Alphawave IP was also on the rise, rising 20.8 percent, or 20 cents, to 116.4 cents as investors welcomed a rise in quarterly bookings.

DIY INVESTMENT PLATFORMS

A.J. Bell

A.J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.