This could be the perfect time to make your portfolio a home for homebuilders

The government’s plans to deliver 1.5 million homes, combined with lower mortgage rates and more optimistic economic data, should be the best news for housebuilders.

These companies have suffered from lower sales and low profit margins since the 2022 Liz Truss mini-Budget.

But the ‘rebuild Britain’ policy should renew their fortunes.

Other sources of relief include the latest figures from the Office for National Statistics (ONS), which show six consecutive months of rising property values.

There is also the prospect of deeper rate cuts after inflation fell to 1.7 percent this week. As Russ Mold of estate agent AJ Bell puts it, ‘the stars are finally aligning for the residential construction sector’.

Building Back: If you’re considering investing in homebuilder stocks, prepare to take a gamble and be patient

However, if you’re considering investing in homebuilder stocks, prepare to take a gamble and be patient. This will be a long-term gamble on Britain’s ongoing love affair with home ownership.

The government’s chances of re-election in 2029 depend on whether more young people can realize the dream of owning their own home. To achieve this goal, it seems likely that ministers will aim to overcome resistance to development – and this assumption has sent stocks soaring.

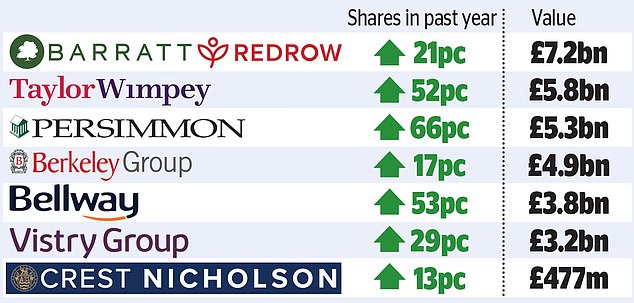

The price of Persimmon has risen more than 60 per cent in the past year to 1659.5p and Taylor Wimpey has risen 52 per cent to 163p. In the same period, Barratt is up 21 percent to 488p. The £7.2bn FTSE 100 group is number one in the sector, thanks to the acquisition of Redrow in August.

But housebuilders appear to be doubting the government’s rhetoric, which is hardly encouraging. On Monday, Sir Keir Starmer made major pledges on cutting red tape, signaling a major shake-up in planning, with the reintroduction of local housing targets and development on sloppy stretches of the green belt dubbed the ‘grey belt’. .

But on Tuesday, Bellway, Britain’s fifth-largest housebuilder, accused ministers of ‘talking down’ the property market to curb customer enthusiasm.

Oliver Creasey, property analyst at asset manager Quilter Cheviot, says: ‘Housebuilders may have the land and money needed to build houses, but they also need a motivated customer base.’

Bellway cited talk of tax increases in Chancellor Rachel Reeves’ first budget, which may not be accompanied by incentives. It seems almost certain that stamp duty will end in April next year.

This means the starting rate for this tax will return from £250,000 to £125,000.

The entry fee for first-time buyers will be reduced from £450,000 to £300,000.

Overhaul: Deputy Prime Minister Angela Rayner

It is also unlikely that there will be a replacement for Help to Buy. This controversial scheme has helped thousands of people who could not rely on a grant from the Bank of Mum and Dad. But as Creasey notes, Help to Buy has also been a boon to housebuilder bosses and shareholders.

Possible tax increases aren’t the only obstacles the industry faces. Other challenges include the shortage of skilled construction workers and poorly staffed planning departments.

The fallout from the 2017 Grenfell Tower fire is another factor. In the wake of the report into the tragedy, Deputy Prime Minister Angela Rayner appears set to give housebuilders an 18-month deadline to repair defective cladding on blocks. Companies have set aside money for such expenses, but acceleration will be costly because there are too few specialized firefighters.

In August, Bellway was poised to buy Crest Nicholson for £720 million. But the meeting was halted, apparently because of the size of Crest’s recovery bill. Crest is also dealing with outages on some of its older sites.

There’s more. Vistry, the number two in the housing competition, should be able to make the most of the fight for affordable housing, which is her specialty. But this FTSE 100 company could be distracted by a cost-estimation blunder at its southern division, sending its previously best-performing shares into a tailspin. The price has fallen by 29 percent this month.

The Competition and Markets Authority (CMA) is also investigating evidence of price fixing at the eight largest companies. But despite these factors, investors remain optimistic, even if their optimism is tempered by caution.

Alan Dobbie, manager of the Rathbone Income Fund, in which Persimmon and Taylor Wimpey operate, said: ‘Changing the planning system will not be quick or easy. Nimbyist objections will persist and Starmer may conclude that disrupting small but vocal groups of voters is less attractive in reality than in the abstract.’

The Aurora Investment Trust owns Bellway and Barratt. Gary Channon, the trust’s manager, is also optimistic about the prospects, but not very confident. He warns: ‘We do not think (the government) will be able to come close to the target of 1.5 million new homes within the five-year parliamentary term.’

Against this backdrop, it seems worth sitting still if you already own shares in homebuilders. Analysts have set an average price target of 581p for Barratt Redrow, with one analyst predicting a jump to 760p.

Analysts have lowered their price target for Vistry shares. JP Morgan’s target was 1550p. It is now 970p, up from the current 968.5p. Crest Nicholson is listed at 185.7p, but the average analyst price target is 227p.

If you’re looking to add to your portfolio, Bellway is rated a ‘buy’ by analysts.

Shares are up 53 per cent in the past year to 3222p, but Jefferies believes further gains are possible and has set a price target of 3646p.

Other top picks from Jefferies include Persimmon. The broker has set a target price of 1969p for these shares.

Like other analysts, this broker also likes Taylor Wimpey, which has a target of 191p, up from the current 162.95p.

Taking a stake in any of these companies is a bet on UK plc. But it’s also a waiting game. Barratt is partnering with Homes England and Lloyds to build and develop ‘garden villages’ on brownfield land.

But Anthony Codling, analyst at RBC, does not expect people to move into these homes “until 2028-2029 at the earliest.”

The government hopes that other housing projects will yield results somewhat sooner.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Receive €200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.