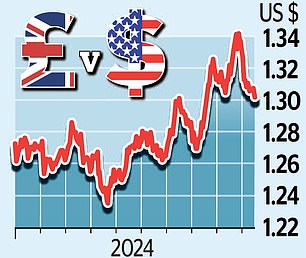

Pound falls below $1.30 as traders bet on rate cuts after inflation hits lowest level in more than three years

The pound yesterday fell to its lowest level against the dollar since August after a sharp fall in inflation, leaving markets betting that interest rates will be cut to 4.5 percent by Christmas.

Sterling fell below $1.30 to $1.2979 and also fell against the euro to €1.1934.

Yields on 10-year British bonds – which represent the interest charged by investors to lend to the government – fell to 4.055 percent after hitting 4.25 percent just two days earlier.

Take note? Bank of England Governor Andrew Bailey has been called on to accelerate the pace of austerity

A similar story was true for two-year bonds, which fell to within a fraction of 4 percent.

Markets reacted after the Office for National Statistics (ONS) said inflation fell to 1.7 percent in September, down from 2.2 percent the month before.

It was the lowest level since April 2021 and fell below economists’ forecast of 1.9 percent.

Experts say this increases the chances of a rate cut in November, after it was cut from 5.25 percent to 5 percent in August.

Traders see a 90 percent chance of a cut in November and a 75 percent chance of a further cut in December.

Matthew Ryan, head of market strategy at financial services firm Ebury, said the inflation data “effectively guarantees another rate cut by the Monetary Policy Committee at its next meeting in November.”

He added: ‘Indeed, we now see an increased possibility that both the vote is unanimous, and that the bank takes a more forgiving tone in its communications hinting at faster cuts.

‘Markets are already preparing for such a possibility and now see a three in four chance of successive rate cuts in November and December.

‘Either scenario would be clearly bearish for sterling, which we believe could have further negative consequences in the short term, especially if the Labor government also unveils broad tax increases in the October budget.’

Economists noted a particularly sharp fall in services sector inflation to 4.9 percent, a measure that is worrying rate setters at the Bank of England, who fear it could prove persistent.

James Smith, developed markets economist at ING Bank, said this was a “significant undershoot” compared to what the Bank had expected.

“In other words, this last fall looks real, and the BoE will take note,” he said. ‘If we are right, we think the Bank of England can increase the pace of cuts after November.

“We expect a cut in December and at every meeting until rates reach 3.25 percent next summer.”

Other experts were more cautious about the likely pace of cuts, especially given the potential impact of conflict in the Middle East on fuel prices.

“There are questions about whether falling oil prices, and therefore fuel prices, will continue into the future,” said Investec economist Ellie Henderson.

Henderson also noted that volatile airfares played a major role in the latest figures and that when this inflation was taken out of the equation, inflation for services appeared more persistent.

“This reminded us why the Bank of England cannot yet overcome inflation,” she said.

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.