A matchmaking company charged dementia-stricken 80-year-old man $8.5K for dates he can’t go on

A matchmaking company charged an 80-year-old man with dementia almost $8,500 so he could go on dates – despite the fact he couldn’t go out because of his illness, the man’s son claimed.

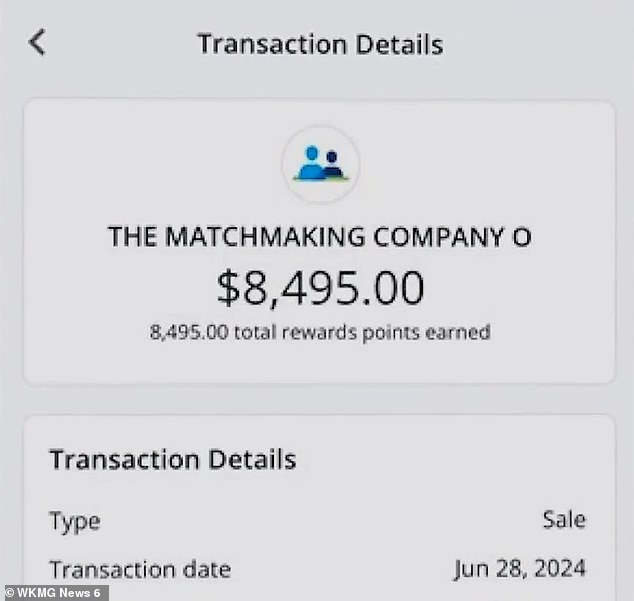

Blake Mooney, who manages his father’s finances due to his condition, discovered that his father had paid $8,495 to the Matchmaking Company on June 28.

His father, who remains unidentified, lives in an assisted living facility in Lake County, Florida, while Mooney lives hundreds of miles away in North Carolina.

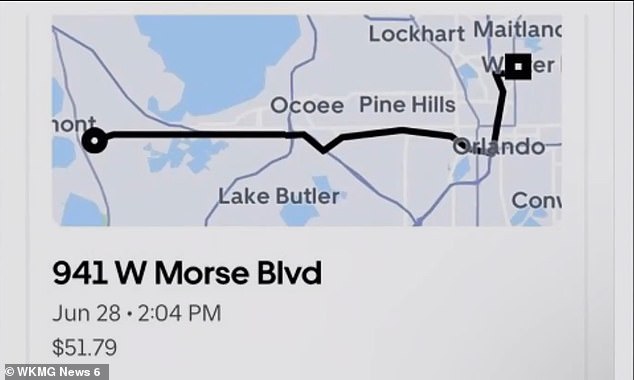

Mooney learned that his widower father managed to take an Uber to the Matchmaking Company’s Winter Park office, where he reportedly signed a contract that would entitle him to twelve “introductions,” or dates, with women. That’s also when he considered the staggering four-figure sum.

‘He doesn’t go on dates. He can’t go on a date. He has dementia,” Mooney said News 6. “Unfortunately, he doesn’t remember everything when I try to talk to him about it.”

Blake Mooney, left, is pictured with his 80-year-old father, who paid almost $8,500 to The Matchmaking Company in hopes of meeting twelve different women

Pictured: the credit card charges Mooney’s father incurred for the dating service

Pictured: The receipt showing exactly where Mooney’s father traveled to sign the contract with The Matchmaking Company

Mooney believes his father may have stumbled upon the company’s website, which promises to “create long-lasting, authentic and loving relationships” for its customers.

He added that while his father’s memory loss may not be immediately noticeable to people who first meet him, spending extended periods of time with him will reveal his mental issues.

‘Once [the conversation] When it comes to financial situations, numbers and dates, he would have no idea,” Mooney said. “You could call him right now and ask him what the date is, but he wouldn’t be able to remember it for you.”

According to application paperwork Mooney’s father submitted to the Oklahoma-based dating service, he listed his birth year as 1922, which would have made him 102 years old.

Once Mooney realized what had happened, he began calling every Matchmaking Company number in a desperate attempt to explain the situation.

“I lost count when I got 51 calls in the first two days,” Mooney said.

Sometimes he was hit by an automated voicemail system and other times he actually contacted company representatives.

Mooney claimed that when he called The Matchmaking Company, he was met with resistance and asked if he wanted to sign up too

Pictured: The Matchmaking Company office in Winter Park, Florida. This is where Mooney’s father signed the contract

Although, according to him, they were not very interested in paying back the money.

“There’s no one to talk to,” Mooney explained. ‘There is no one who can help you in any other way than [asking] “Do you want to sign up? Do you want to have matchmaking done for you?”

After Mooney contacted News 6 for help, reporter Mike DeForest visited the company’s Winter Park office — the same place where Mooney’s father signed the contract — to hopefully get some answers.

DeForest’s questions were not answered by staff, but shortly after his visit, Mooney was contacted by Chase Overstreet, the company’s general counsel.

Overstreet reportedly refused to void his father’s contract.

“He said, ‘Well, I called your dad and he says he doesn’t have dementia,’” Mooney said.

Because Mooney is his father’s power of attorney, giving him the right to make legal and financial decisions for him, Mooney was able to continue his battle with the matchmaker.

After Mooney sent the power of attorney documents to the company, he received the contract his father had signed.

Under that contract, his father had three days to cancel and receive a full refund.

The saving grace in the document was the fact that it could be canceled “if, under doctor’s orders, you cannot physically receive the services.”

Mooney, pictured, had his father’s doctor write a letter to The Matchmaking Company confirming his patient’s dementia

Orlando-based attorney Raymond Traendly advises families to check in with their elderly relatives to ensure they are still of sound mind. If doubts arise, it may be time to explore obtaining a power of attorney to mitigate situations like the one Mooney found himself in

“It’s ridiculous, the hoops they make us jump through,” Mooney said.

Mooney contacted his father’s doctor, who wrote a letter stating that his patient had “been diagnosed with dementia” and is experiencing “significant cognitive impairment that affects memory, reasoning, and judgment.”

“After extensive evaluation and clinical assessments, it is my opinion that he is unable to make sound decisions regarding the use of Match (sic) Company’s services,” the doctor concluded.

After the Matchmaking Company received the letter, it paid a refund of $5,953, which is almost $2,500 less than what Mooney’s father actually paid.

DailyMail.com reached out to the company but did not immediately respond to a request for comment on why it still has a hefty chunk of the payment.

“This would have cost him his life financially,” Mooney said, arguing his father should have been entitled to full reimbursement. ‘It would have been bad if we hadn’t noticed. It would have been really bad.”

Attorney Raymond Traendly of TK Law in Orlando told News 6 that family members with elderly relatives should check in regularly to see if their decision-making is still sound.

If not, it may be time to obtain a power of attorney, just in case they start using a credit card indiscriminately.

“You want to have conversations with your loved ones early and often,” Traendly said. ‘The best time to make a power of attorney is before a discussion arises about a lack of capacity.’