Devastated brothers shocked to learn St George bank loan taken out by their dead parents has quadrupled to $415,000: ‘This is an injustice’

Two brothers are shocked after they discover that a major Australian bank is still charging thousands of dollars in interest on a loan their late parents took out.

Mark*, 61, says his parents borrowed $85,000 in a St George reverse mortgage loan 20 years ago, with interest rates currently at 6.32 per cent.

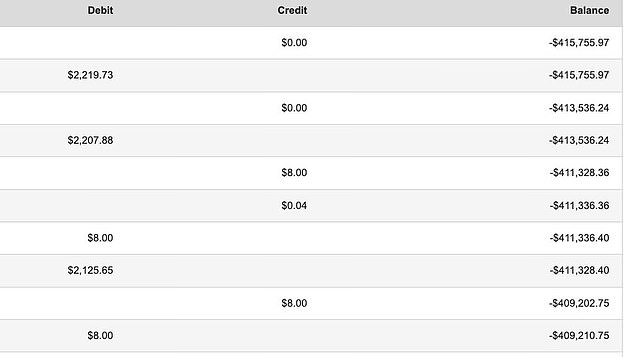

Documents show the loan has now quadrupled to $415,000, with monthly interest of $2,500, after their 92-year-old father died in May.

The brothers lost their mother several years before their father.

“When Dad passed away, it was $401,000 – so it’s gone up almost $15,000 since Dad passed away,” the teacher said. news.com.au.

He said neither he nor his brother have the capacity to borrow enough to cover the loan, meaning their only option is to sell the property.

“It’s just ridiculous that these types of loans are allowed at all and they can’t put a stop to them,” he said.

‘I hate injustice, and this is injustice. It just burns me – not just that it burns me financially.

St. George’s reverse mortgage loan started at $85,000 and has quadrupled to $415,000

He said his parents took out the loan simply to pay for a car and do some chores around the house.

“(But) they could now have bought a Ferrari with the amount borrowed,” he said.

“The kind of loan they don’t offer anymore because they know it’s predatory.”

St George confirmed to Daily Mail Australia that it is no longer offering reverse mortgage loans.

The bank said it has stopped offering reverse mortgages, which allow homeowners to borrow against a portion of their equity, after a 2017 review of its products.

A spokesperson for St. George did not say why these types of loans were canceled.

‘We are always sad to hear of the death of a client and we have a team of specialists on hand to support families through the estate management process,’ the spokesperson said.

‘Our teams work closely with surviving family members or executors to help them understand the financial position of the estate and what is needed to move forward.’

St George has confirmed to Daily Mail Australia that it will no longer offer reverse mortgage loans following a review of its products in 2017 (pictured, a St George ATM in Brisbane)

Interest on a loan from Mark’s deceased parents continues to pile up (photo)

Mark said he accepted the loan had to be paid out but could not understand why St George refused to stop charging interest on a deceased person’s account.

“The smallest goal would be to stop all interest from the date of dad’s death and that way it would get back to about $400,000 and then we know we don’t have to rush the property,” he said.

‘Because the longer it takes to sell the property, the more impact it has on my brother and me. It actually hurts me.”

Mark said there were delays in the sale of the house, which was built by his grandfather 100 years ago, as the family was still waiting for probate to be granted.

St George merged with Westpac in December 2008. Westpac Banking Corporation’s cash profit in the first half of its 2024 financial year was a whopping $3.5 billion.

*Name has been changed for privacy reasons.