Car insurers use new ‘Vehicle Risk Rating’ system to calculate the price of premiums – here’s why EV owners could be stung

Car insurers have switched to a new Vehicle Risk Rating (VRR) system to determine the premium price for drivers based on the car they drive.

It has replaced the insurance group’s rating system – rising from group 1 to 50 – which previously determined the risk level of vehicles based on the car’s original value, the cost of replacement parts and its performance, including power, acceleration time and top speed.

The body that created VRR says this new system should provide a “more comprehensive and dynamic framework” to allow insurers to calculate fairer premiums based on risk, because by taking into account factors such as the number of advanced safety systems installed in models, durability of repair and theft trends.

However, experts have told This is Money that the new system could massively increase the cost of EV cover…

Auto insurers have started using a new Vehicle Risk Rating system to calculate premium costs based on the car you drive. Here’s how it works and why EV owners might be annoyed by the new format

What is the Vehicle Risk Assessment System?

The new VRR system has been launched by automotive risk information specialist Thatcham Research and is funded by the insurance industry.

It says it will ‘improve the accuracy of vehicle insurability assessments’ by taking into account a greater depth of model information, especially around advances in safety technology installed in the latest cars.

Thatcham told us: ‘The new Vehicle Risk Rating system uses market performance data, collected in partnership with car insurers, to take into account dynamic factors such as technological advances, an increased focus on sustainable repair and emerging theft trends.

“This provides insurers with more detailed insight into vehicle risks while supporting Thatcham Research’s mission to improve safe, secure and sustainable mobility.”

How does it calculate the risk of your car?

The new rating system assesses risk based on five different parameters:

1. Performance

The first elements to take into account are the performance of your vehicle. This includes evaluating the top speed of the vehicle, its acceleration from 0 to 100 km/h and the technological level of the engine itself.

2. Damageability

Each vehicle is assessed to see how its design, materials and construction affect repair costs and severity of damage.

3. Repairability

This focuses on the ease and cost of repairs, encouraging repair-friendly vehicle designs. Of the five parameters, this is given the highest weight by insurers.

4. Safety

Analyzes active and passive safety systems, including collision avoidance functions.

5. Security

Examines physical and digital security measures, drawing on Thatcham Research’s expertise in New Vehicle Security Assessment.

Each model is given a scale score from 1 to 99 for the five different risk parameters. These are: performance; damageability; repairability; safety; and safety

In total, approximately 1,300 different data points are assessed for each model.

The five rating parameters are scored on a scale of 1 to 99 to give insurers a “more detailed understanding” of vehicle risk and enable “more accurate, individualized insurance premiums for consumers.”

Jonathan Hewett, CEO of Thatcham Research, told This is Money: ‘New technology is challenging the existing car insurance model, leading to an unprecedented shift in the balance of risk from the driver to the vehicle.

‘In response, we have worked closely with insurers, using advanced data analytics to create a rating system that provides a more accurate and detailed assessment of vehicle risk.’

He added: ‘VRR will not only help insurers set premiums more accurately, but also encourage manufacturers to consider insurance outcomes when designing vehicles and implementing technologies.’

Will it retroactively score older models?

The company says it has been working on the formula to power VRR for 18 months with a dedicated team.

However, so far the company has only rated a total of nine vehicles and it will not retroactively provide VRR scores for older models.

Any vehicle sold before August 1 will instead retain the original group rating (1-50) and the risk assessed by insurers based on this rating. The group rating system dates back to the 1970s.

It means that motorists only benefit from this fairer system if they buy a brand new motorcycle.

When will insurers start using this new Vehicle Risk Rating system?

VRR was officially launched on September 24.

However, for the first 18 months, insurers will use it in addition to the existing Group Rating System to calculate premiums.

This is intended to give both car insurers and car manufacturers the opportunity to adapt before VRR becomes the sole reference for assessing vehicle risk.

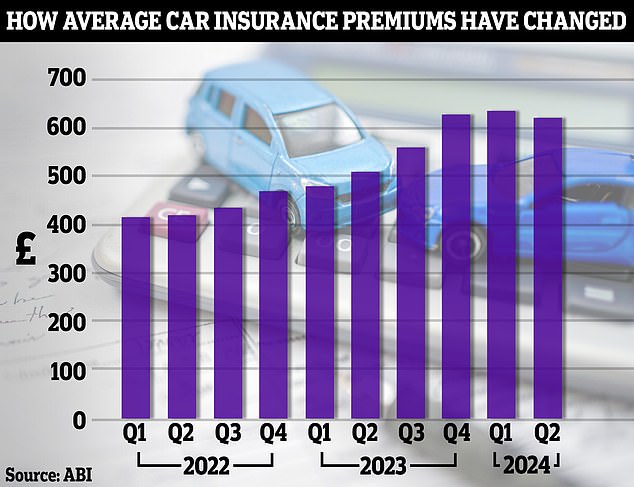

The latest data from the ABI shows that car premiums have started to fall after reaching a record high at the end of last year. However, average coverage costs have still increased by 48% in two years

Experts warn that VRR will be bad news for EV owners

Of the five parameters assessed to measure the risk to each vehicle, ‘repairability’ is the most important as it will be weighted most highly by insurers.

This is because repair costs for insurers have risen by 28 percent in the past year alone and is the driving force behind why premiums have reached record highs over the past twelve months.

According to the Association of British Insurers (ABI), providers paid out £2.9 billion in car insurance claims in the second quarter of 2024. This is 18 percent higher than the £2.5 billion paid out between April and June in 2023.

“Repairability is becoming increasingly important,” says Hewett.

‘Without a sharp focus on sustainable recovery at the design and launch stages of vehicles, the industry’s environmental efforts risk being undermined by vehicles that become disposable too early in their use phase.’

However, this is particularly bad news for EV owners.

The high cost of repairing electric cars could work against electric car owners as insurers are expected to rate repairability highly when calculating premium prices, Auto Express told us.

Thatcham Research said last year that electric vehicles are around 25 percent more expensive to repair than their petrol equivalents and take 14 percent longer to repair.

Chris Rosamond, current affairs and articles editor at Auto Expressexclusively told This is Money: ‘Previously car insurance was based on the more generic 1-50 group rating system, but factors such as an influx of Chinese EVs with insufficient spare parts and a lack of critical repair information, or the introduction of expensive-to-repair technology, such as LED headlights or driver assistance systems, made it increasingly difficult for insurers to accurately assess risks.

‘As a result, premiums have skyrocketed – and we are all paying for this knowledge gap.’

But while the new system promises greater transparency, it will inevitably lead to relatively higher insurance premiums for vehicles with high damage or poor repairability scores.

“VRR could negatively impact EVs if the difficulty of repairing EV batteries increases scores, as we see higher premiums for affected models,” Rosamond added.

He says that in the short term this may create a new barrier for motorists wanting to make the switch to an electric car, but that the new focus on repairability will inevitably force car manufacturers to improve.

“VRR is a more comprehensive – and much fairer – assessment of vehicles, which is great news for consumers,” he continued.

‘It highlights weaknesses in a way the industry has not seen before and will force manufacturers – including new brands from China or elsewhere looking to launch products here – to take better account of repairability when designing new cars for the UK roads.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.