Wade told his bank to stop a $50,000 transfer after scammers hacked his accounts… what happened next has sparked a two year battle

A business owner was left financially disabled after scammers stole $50,000 despite his warning to the bank to stop the money transfer.

Wade Brown received a frantic phone call on a Friday evening in 2022 after his staff noticed $50,000 had gone missing from the bank account of his company Pure Glass WA, based in Margaret River, south of Perth.

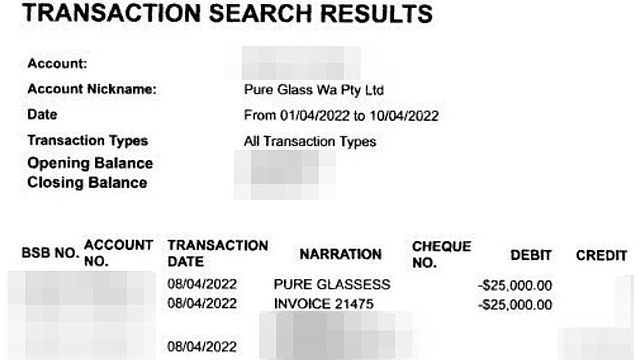

The money was transferred to a bank account at AMP with the name ‘Pure Glasses’ and the description ‘Invoice 21745’.

Mr Brown quickly called his bank, Bankwest, and froze his account, claiming that bank staff promised to alert AMP to the fraudulent transfer.

However, Mr Brown still felt uneasy and called AMP himself to ensure the money would not be released.

AMP is said to have informed him that the transfer would take until Monday.

Despite the reassurances from both banks, the $50,000 was successfully transferred to the AMP account and ended up in the hands of the scammer.

Mr Brown has been trying desperately to get his money back for the past two years, but to no avail.

Wade Brown (pictured) lost $50,000 in 2020 after a scammer defrauded an employee at his company, Pure Glass WA

Mr Brown quickly called his bank, Bankwest, and froze his account. He claimed that bank staff promised to alert AMP to the fraudulent transfer

“It almost paralyzed us. $50,000 is a lot for a small business,” he said. news.com.au.

The company owner claims that in 2022, Bankwest told him that his company, not the bank, was liable for the scam and refused to reimburse him.

Mr Brown subsequently filed a complaint with the Australian Financial Complaints Authority (AFCA).

AFCA also concluded that the fault lay with Pure Glass WA and that Bankwest was not responsible for compensating the company for the damage.

While Brown admits the scam “could have been a lot worse,” he feels the banks ripped him off.

He is still trying to figure out how the hackers were able to hack his Bankwest account.

Pure Glass reportedly experienced an internet outage the day before the scammer called.

The scammer then called, pretending to be a Telstra employee investigating problems with the company’s modem.

One of Pure Glass’s employees fell for the scam because the criminal was able to provide information about the company’s modem.

Mr Brown claimed the scammer should not have been allowed access to his bank account to make the two transfers (pictured)

According to Bankwest, the employee was then persuaded to download software onto the company’s computer, giving him remote access to Pure Glass’s systems.

Mr Brown claimed that even if the scammer had had access to Pure Glass’s computer, he would not have been able to access the banking processes because a code has to be entered before a transaction is approved.

The code is generated by a dongle that is kept in a locked room and changed every few minutes.

“I have tried to make two transactions without a security code, but it is impossible,” Mr Brown said.

According to Bankwest, the scammer was able to obtain the token code by sending it to a registered mobile number.

A Bankwest spokesman declined to comment directly on Brown’s case but said securing customers’ assets was “a priority.”

The company added that it is “accelerating” investment in its scam detection technology and claimed it is “doing everything we can to prevent or recover funds lost to scams.”

An AMP spokeswoman said “this appears to be a matter that would benefit from further investigation” and urged Mr Brown to get back in touch.

“AMP recognises the important role we play in working with regulators and other banks to protect the community from fraudulent activity. Like other organisations, we have enhanced our own systems and practices to protect consumers,” she said.

Daily Mail Australia has reached out to both banks for further comment.