Mortgage rates continue to fall: HSBC, Barclays and NatWest to cut mortgage costs tomorrow

Mortgage rates will fall again from tomorrow, after three major banks announced that they will lower mortgage rates.

This morning HSBC, NatWest and Barclays all confirmed a raft of interest rate cuts that will benefit homebuyers, first-time homebuyers and those looking to remortgage.

NatWest, which was the first to announce cuts, said it will cut mortgage rates by up to 0.19 percentage points on selected two- and five-year fixed products.

Most notably, it is cutting the lowest rate for a five-year fixed rate from 3.89 per cent to 3.77 per cent, with a product fee of £1,495.

HSBC is also cutting interest rates on its five- and two-year fixed loans, but specific details of this will not be announced until tomorrow.

> When will interest rates fall?

Price war: NatWest, HSBC and Barclays started the month with a wave of mortgage rate cuts as banks battle it out for customers

Meanwhile, Barclays has announced a number of interest rate cuts, including a rate cut of less than 4 percent for people refinancing their mortgages and a rate cut of 3.95 percent for home buyers with a 25 percent deposit.

Craig Fish, director at Lodestone Mortgages & Protection, told the Newspage news agency: ‘It’s only the first working day of the month but lenders are busy.

‘Significant cuts have already been implemented by several lenders this morning, and it is likely that more lenders will follow suit.

“As the nights get darker, this is a positive sign that the housing market is poised to recover by the fall.”

What does this mean for borrowers?

From tomorrow, NatWest’s lowest five-year interest rate for someone buying with a 40 per cent deposit is 3.77 per cent with a product fee of £1,495.

On a £200,000 mortgage paid off over 25 years, that works out at £1,033 a month.

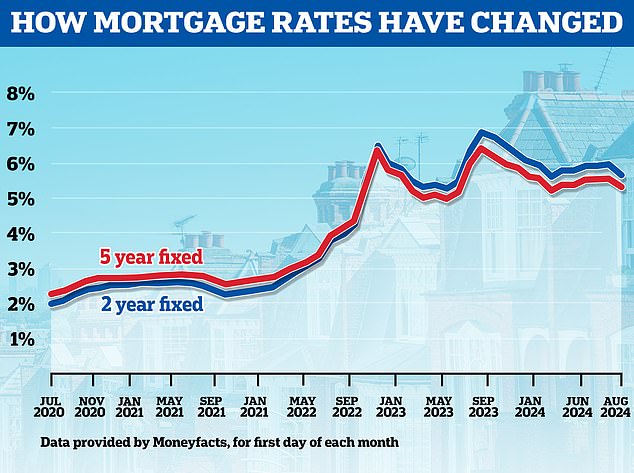

To put that into context, according to interest rate inspector Moneyfacts, the average five-year fixed-rate period across the market is currently 5.2 percent.

Someone who locked in the average interest rate on a £200,000 mortgage with a 25-year term would pay £1,193 per month.

NatWest’s lowest two-year fix aimed at home buyers will fall to 4.14 per cent tomorrow. It comes with a product fee of £1,495.

This industry-leading rate is available to people moving with a 40 percent deposit and is well above the market average of 5.56 percent for the past two years.

Ranald Mitchell, director at Charwin Mortgages, believes NatWest’s latest wave of rate cuts will breathe new life into the housing market.

“NatWest’s latest rate cut is a clear signal that mortgage lenders are doing everything they can to revive the housing market,” Mitchell said.

‘Lenders are competing fiercely to offer the most attractive deals and there is real momentum now.

“This series of rate cuts is a positive step toward finding the sweet spot at which consumer confidence recovers and the housing market gets back on track.

‘It’s an exciting time for potential buyers, affordability is improving and the possibilities are open.’

From tomorrow, NatWest and Barclays will also offer fixed-rate mortgage refinancing of less than 4 per cent for five years, for those with the largest resources.

NatWest’s lowest five-year fix is 3.92 per cent with a fee of £1,495, while Barclays charges 3.93 per cent with a fee of £999.

Barclays also offers an interest rate of 4.07 percent to people who refinance their mortgage and have at least 25 percent equity in their home.

Home buyers with a 15 percent down payment can take out a 4.45 percent interest rate starting tomorrow, without any fees.

Rohit Kohli, director at The Mortgage Stop, told news agency Newspage: ‘The good news continues as Barclays continues to cut interest rates, particularly in the 85 per cent loan-to-value band.

‘The mood among lenders is clear that these rates are here to stay for some time and that, unless there are shocks to inflation next week, borrowers need to take swift action.

‘These continued cuts are quickly creating a seller’s market and prices could rise rapidly.’

What is the future for mortgage rates?

Mortgage rates are falling because interest rate cuts are expected.

Since the beginning of July, the lowest five-year fixed mortgage rate has fallen from 4.28 percent to 3.77 percent.

Meanwhile, the lowest fixation rate of the past two years has fallen from 4.68 percent to 4.12 percent.

Nicholas Mendes, mortgage technical manager at broker John Charcol, said: ‘Until today, there has been a slight decline in competition between lenders as they try to manage their pipelines better and strike a balance between winning business and maintaining service levels.

The Bank of England is likely to leave interest rates unchanged this month, even as the Federal Reserve is expected to make a cut.

Given that inflation is expected to remain slightly above their comfort level, the committee is likely to adopt a wait-and-see approach, realising that the impact of the previous cut on inflation will not be felt immediately.

‘While rates are expected to fall to around 4.75 percent later this year, a larger cut to 4 percent may not occur until 2025.

‘Despite the likely slowdown this month, we can expect continued adjustments and a reduction in fixed interest rates between purchase and refinance deals.

‘In addition, building societies and smaller lenders may lower their interest rates as larger lenders have relaxed their competitive behaviour in recent weeks.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.