Now that he’s 94, it STILL feels good to follow Warren Buffett’s unique approach

Sage: Warren Buffett, with our badge, is the world’s most successful investor and the eighth richest man

When Warren Buffett is about to sell one of his most successful investments, the rest of us need to pay attention. And since that company is Apple Inc., we absolutely need to be on full alert.

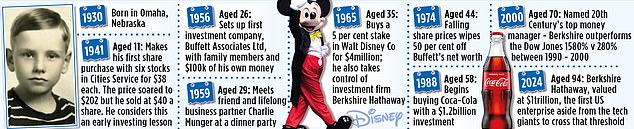

On Wednesday morning, his investment company, Berkshire Hathaway, was valued at $1 trillion (£750 billion), the first company in America outside of the tech giants to cross that threshold. Its value has risen 31 percent this year. Two days later, he celebrated his 94th birthday.

Buffett’s status as the world’s most successful investor is partly due to his longevity: He’s run Berkshire Hathaway since 1965. It’s his wealth, of course: At $146 billion, he ranks eighth on the Bloomberg Billionaires Index. It’s also his genius for finding a way to express investing truths in clear terms. One of my favorites is, “Be fearful when others are greedy. Be greedy when others are fearful.”

But above all, he is revered as a champion of the small investor. He has based his company in Omaha, Nebraska, not New York, and is known for his frugality. He lives in the same house he bought in 1958, eats hamburgers at McDonald’s and drinks Cherry Coke. And he has made thousands of once-small investors very rich.

Given that the annual return on Berkshire Hathaway stock from 1965 to 2023 is the equivalent of 19.8 percent compound interest, it’s easy to see why. It’s a classic case of “get rich slow.”

That’s the message that draws some 40,000 shareholders to the company’s annual meeting each May at the CHI Health Center in Omaha. This year was the first time he hosted solo, following the death of his longtime business partner and vice chairman, Charlie Munger, just before his 100th birthday.

Let’s try to unravel the recipe for success by looking at some of Buffett’s most famous aphorisms.

First, the “be afraid” quote above. He sold nearly half of his Apple stake, even though the tech company is still Berkshire Hathaway’s most valuable holding—and he’s made a series of sales of Bank of America shares, his second-largest holding, even though he remains the bank’s largest shareholder.

This is not a sign of fear, but it does show some scepticism about stock values in America. It has been a stunning bull run, with the S&P 500 nearly doubling in the past five years. Apple shares have more than quadrupled. But all bull phases come to an end, and taking profits before the peak is a good way to deal with the uncertain timing of market cycles.

The Apple stock echoes another statement of his, the origin of which he attributes to Munger: “It’s much better to buy a great company at a fair price than a fair company at a great price.”

Apple was and is a great company. So why sell half of the shares? The answer may lie in the valuation, but also in the weakening of the competitive advantage.

In Buffett’s own words: ‘The key to investing is not in estimating the impact an industry will have on society, or how much it will grow, but in determining the competitive advantage a particular company has and, above all, the sustainability of that advantage.’

Apple has the advantage of an astonishingly loyal customer base, but that is largely a function of the beauty and effectiveness of its products. It is not yet clear whether this advantage will continue into the next technological revolution – the application and development of artificial intelligence.

Then take a long-term view. “Our favorite holding period is forever,” as Buffett puts it, or “The stock market is a machine for transferring money from the impatient to the patient.” And “If you’re not willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

This must be tempered with the discipline to accept that you have made a mistake and need to change direction. Buffett famously quotes, “The most important thing to do when you are in a hole is to stop digging.”

He is candid about his mistakes, including not buying shares in Google. He didn’t know enough about technology and didn’t spend enough time analyzing it to appreciate its potential.

A final element of Buffett’s status is this: ‘Rule number one is never lose money. Rule number two is never forget rule number one.’

Inevitably, there have been years when Berkshire Hathaway’s value has fallen, but it eked out a small gain in 2022 as the S&P 500 fell 18 percent, silencing some critics who had suggested Buffett had lost his edge.

Behind it all lies the power of compound interest over a long period. It helps to be old. Warren Buffett himself says that he earned most of his money after he was 65.

That’s certainly a message for everyone, not just Berkshire Hathaway shareholders like me. It’s a powerful argument for saving within some kind of tax envelope, so that dividends and capital gains can be plowed back and reinvested without deductions.

Right now, it feels good to follow Buffett. For those fortunate enough to make profits in high-tech holdings, the option is to build some cash or move into lower-rated sectors. A number of other notable investors, including George Soros and Stanley Druckenmiller, have reduced their holdings in the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) in recent weeks.

But it is not, and never has been, a time to stop investing. Or, a final quote, this time from the late Charlie Munger: ‘The big money is not in the buying and selling, it’s in the waiting.’

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.